Gold and Bitcoin Near Historic Valuation Relative to US Money Supply

Gold and Bitcoin near record valuation versus US M2 money supply as Fidelity’s Jurrien Timmer warns their inflation-fueled rally may be ending.

The combined value of gold and Bitcoin is approaching a historic level relative to the US M2 money supply.

A top market analyst now suggests the upside potential for using these assets as hedges against dollar devaluation and inflation may be nearing its limit. Jurrien Timmer, Director of Global Macro at Fidelity, shared his analysis on X (formerly Twitter) on Friday.

The End of the Easy Run?

Because of their limited supply, gold and Bitcoin are widely regarded as premier inflation hedges. Data from CoinGecko shows both assets have rallied strongly this year—gold is up 54.83%, while Bitcoin has gained 12.98%.

However, Timmer argues that this rally may be approaching its ceiling. He draws a comparison between current market conditions and those seen during the high-inflation peak of 1980.

Monetary Inflation. Source:

Jurrien Timmer’s X

Monetary Inflation. Source:

Jurrien Timmer’s X

Comparing Value Against US M2

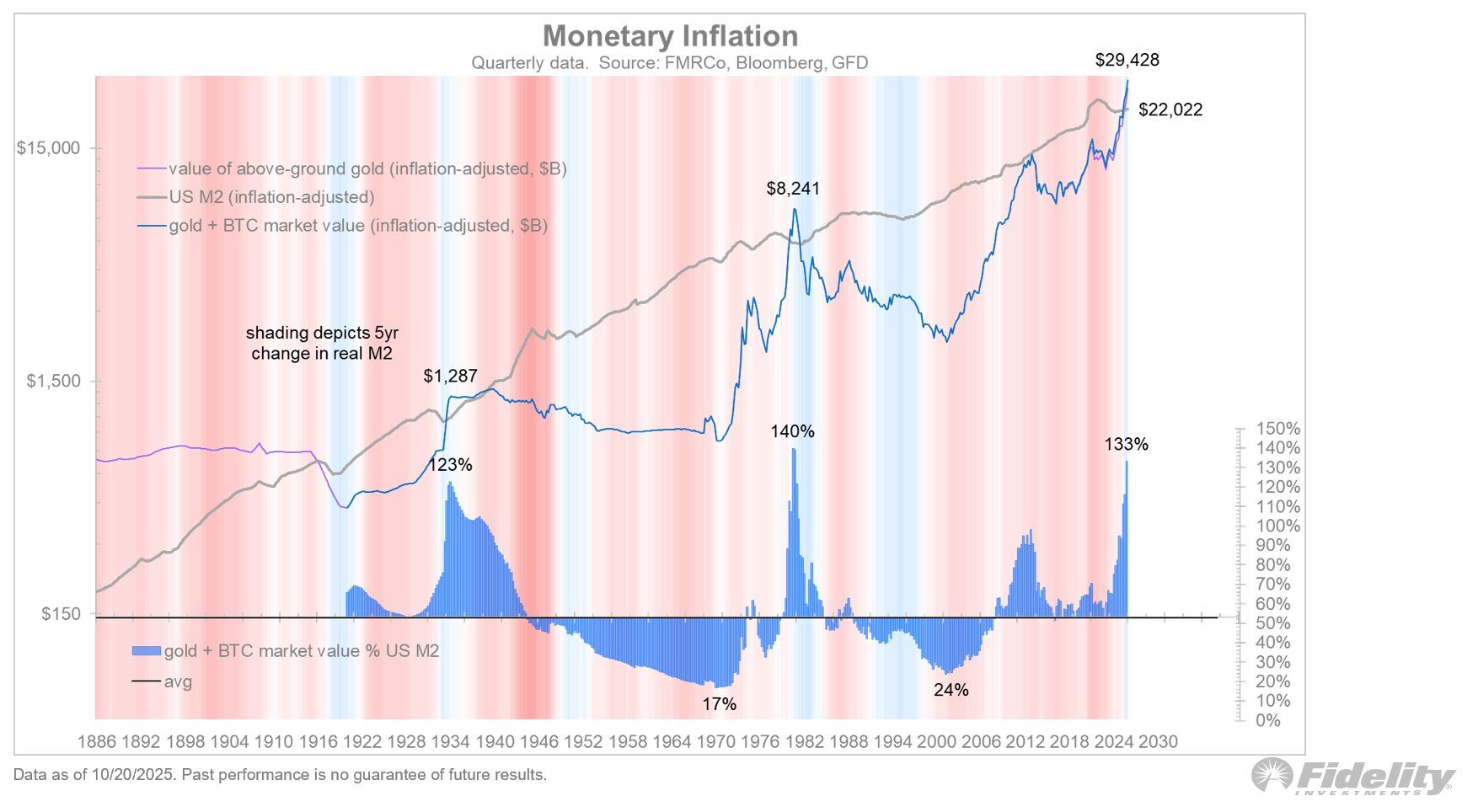

Timmer’s analysis aggregates the inflation-adjusted market value of gold and Bitcoin, then compares the total to the US M2 money supply—a broad measure of money in circulation.

Historically, sharp expansions in M2 (monetary inflation) have coincided with significant rises in the value of hard assets like gold. According to Timmer, both gold and Bitcoin act as key forms of “hard money,” offering protection against currency debasement.

The Historical Ceiling

Timmer highlights two notable moments in the past century when inflation caused gold’s value to surge—1933 and 1980. During those peaks, gold’s total market value reached 123% and 140% of the US M2 money supply, respectively.

Today, the combined value of gold and Bitcoin is about $29 trillion, equivalent to 133% of the M2 money supply. That figure surpasses the 1933 peak and sits just below the 1980 high.

Timmer called this valuation a “critical point” to consider following gold’s recent aggressive rally.

“One reason to contemplate ringing the golden bell is that if gold is a play on US fiscal dominance, one could argue that the run is now complete,” he concluded.

This suggests that the massive rallies in gold and Bitcoin—largely driven by concerns over monetary expansion—may be running out of steam. While both assets remain structurally sound as long-term hedges, Timmer warns that the “easy returns” fueled by inflation fears may already have been realized.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin Miners Bet on AI: Will Technological Advances Outpace Market Fluctuations?

- Bitcoin miners adopt AI/HPC to offset bear market pressures, leveraging energy infrastructure for GPU workloads. - TeraWulf's $1.85M/MW/year AI hosting benchmark and CleanSpark's Texas campus highlight infrastructure diversification. - Grid constraints and GPU shortages challenge transitions, while Bitcoin ETF outflows ($558M) signal shifting investor sentiment. - Analysts warn of potential $100,000 price correction if $104,000 resistance fails, despite positive on-chain demand signals. - JPMorgan identi

Brazil Sets Sights on Crypto Regulation to Build Confidence and Strengthen Regional Leadership

- Brazil's central bank introduced Latin America's strictest crypto regulations, requiring VASPs to obtain authorization and comply with banking-level oversight by November 2026. - New rules mandate $2M+ capital requirements, classify stablecoin transactions as forex operations, and cap unapproved crypto transfers at $100,000 per transaction. - The framework aims to combat fraud and illicit finance by extending AML protocols to stablecoins, which account for 90% of Brazil's crypto activity, while enhancing

Argentina's LIBRA Controversy Exposes Connections Between Cryptocurrency and Politics Amid Worldwide Asset Freezes

- Argentina's federal court froze assets of LIBRA memecoin suspects, including U.S. founder Hayden Davis, over a $100M-$120M alleged pump-and-dump scheme linked to President Milei's endorsement. - Prosecutors allege Davis used Milei's influence to inflate the token's value, with $90M traced through exchanges like Bitget, including a $507,500 transfer 42 minutes after a presidential selfie. - The case highlights crypto-political ties, with texts suggesting Davis claimed control over Milei's decisions and pa

Ethereum News Update: BitMine's ETH Acquisition Echoes MicroStrategy While Institutional Holdings Fuel Supply Shortage

- Ethereum's circulating supply hits 12-month low as BitMine Immersion (BMNR) accumulates 2.9% of total ETH, becoming the largest institutional treasury. - SharpLink Gaming's staking activity and BitMine's aggressive buying drive supply contraction, with $13.2B in crypto holdings and $398M earmarked for further acquisitions. - Despite 15.94% weekly price decline, Ethereum sees $12.5M ETF inflow ending six-day outflow streak amid volatile on-chain activity and macroeconomic uncertainty. - SharpLink clarifie