Crypto Sell-Off Shocks Market — Hidden Signal Suggests It’s Not Over

Bitcoin's recent drop was a "textbook shakeout of weak hands," analysts say, noting long-term conviction is intact. Unrealized losses remain minor, suggesting the bull cycle structure holds.

Bitcoin’s price has fallen for four consecutive days, a worrying pattern of sluggish reaction to positive news yet highly sensitive to negative catalysts.

This movement was intensified by the recent Federal Reserve meeting, which has spurred questions among market participants about whether the current bull run is concluding.

“Sell the News” Event Driven by Short-Term Traders

CryptoOnchain, an analyst at the on-chain data platform CryptoQuant, characterized the decline following the FOMC rate cut as a textbook “sell the news” event. The Federal Reserve hinted that it might not implement a rate cut in the December FOMC meeting. This served as the primary catalyst, prompting short-term traders to liquidate positions.

“On-chain data from Binance provides a definitive clue,” the analyst stated. Data showed that amidst the volatility spike on October 30, a large inflow of over 10,000 BTC hit Binance. Crucially, 10,009 BTC originated from addresses that had held the coins for less than 24 hours.

“This is the signature of ‘hot money’—short-term traders and speculators reacting instantly to the news,” CryptoOnchain noted. He added, “In stark contrast, the inflow from Long-Term Holders (coins aged 6+ months) was negligible.”

The analyst concluded: “This was a textbook shakeout of weak hands, not a loss of conviction from long-term players. The underlying structure remains strong.”

Unrealized Losses Remain Minor

Echoing this sentiment, Glassnode Senior Researcher ‘CryptoVizArt.₿’ highlighted the minor scale of overall market damage.

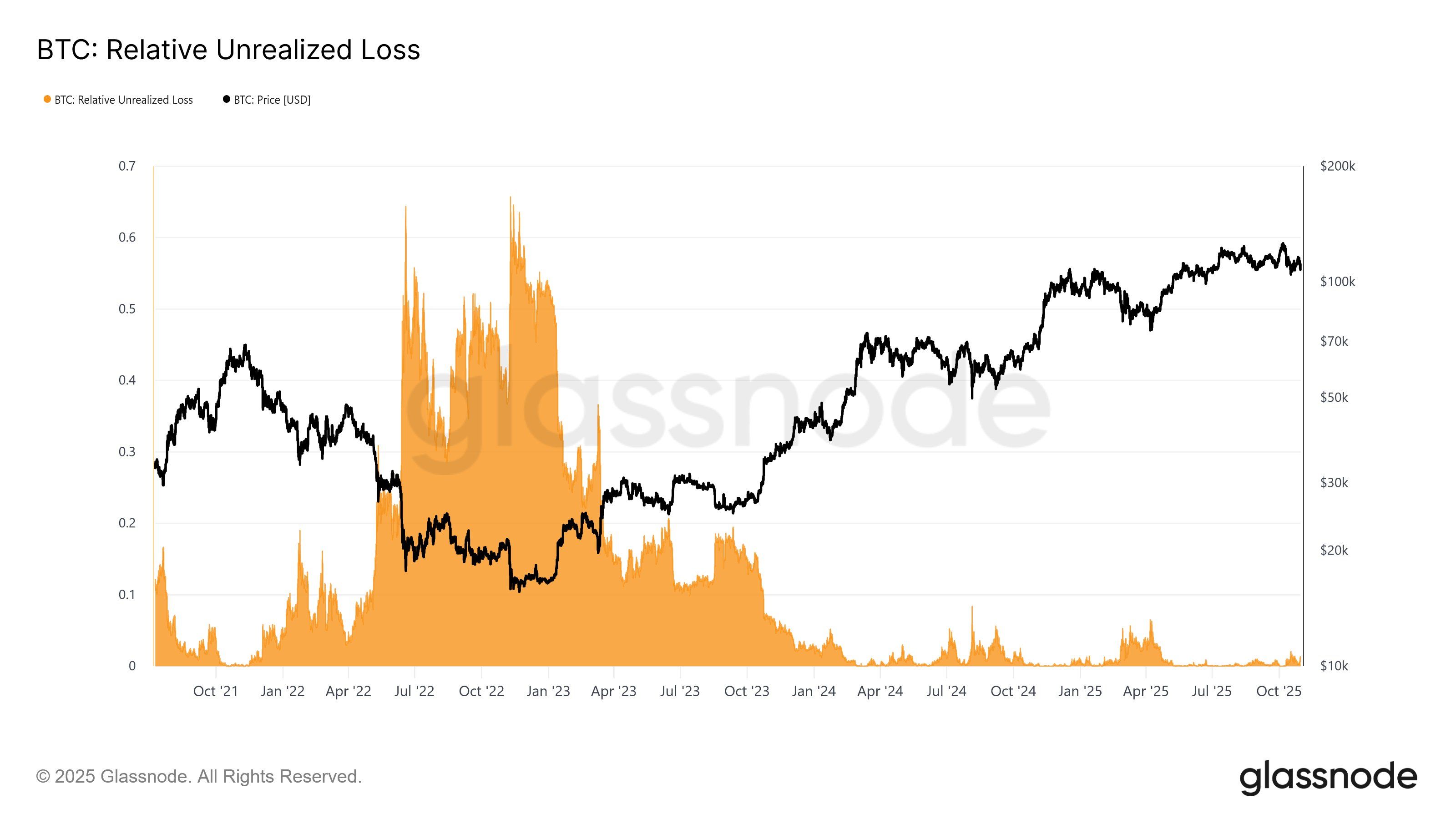

“Despite the bearish sentiment, Unrealized Loss at $107K is only equivalent to ~1.3% of Bitcoin’s market cap,” the researcher pointed out.

BTC: Relative Unrealized Loss. Source: Glassnode

BTC: Relative Unrealized Loss. Source: Glassnode

Typically, the start of a “crypto winter” is preceded by a significant surge in Bitcoin’s Unrealized Loss. For instance, the 2022 bear market only intensified after the Unrealized Loss reached approximately 20% of the total market capitalization. It was a signal of the season ender.

The researcher concluded, “In mild bear markets, this typically exceeds 5%, and in severe ones, it exceeds 50%.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Inflows Surge to $764M for WisdomTree, Q3 AUM Reaches Record $137.2B

Crypto Products Account for 34% of Total Inflows as WisdomTree's Assets Under Management Reach All-Time High

From On-Chain to Reality: The Proxy Economy is Awakening, and Machines Are Starting to Work for Humans

The article explores how the integration of robotics, crypto, and AI technologies is driving the development of the agent economy. It introduces the Virtuals ACP protocol, Butler trading assistant, Unicorn launch platform, and SeeSaw data collection system, showcasing future scenarios of collaboration among humans, AI, and machines. Summary generated by Mars AI. This summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

The Surge of ZK Coin Electrifies the Crypto Scene

In Brief ZK Coin starts November with a massive rise, breaking from the broader crypto downturn. The ZKsync Atlas upgrade enables 15,000 TPS, ensuring swift, secure transactions. Vitalik Buterin’s praises on ZKsync stir positive market sentiment for ZK Coin.

CryptoNewsLand Weekly Round Up: Crypto Regulations and Monetary Shifts Define Global Financial Space