Blockchain: Onchain revenues explode to nearly $20 billion in 2025

Web3, blockchain, and the crypto universe no longer play in the field of abstract promises. We are witnessing a clear turning point: projects are settling in the real world, usages are diversifying, and the numbers speak. Between the explosion of onchain fees and institutional adoption, the ecosystem proves its rise in power. Speculation decreases a notch, revenues take over. In short, blockchain is no longer a playground… it’s an industry.

In brief

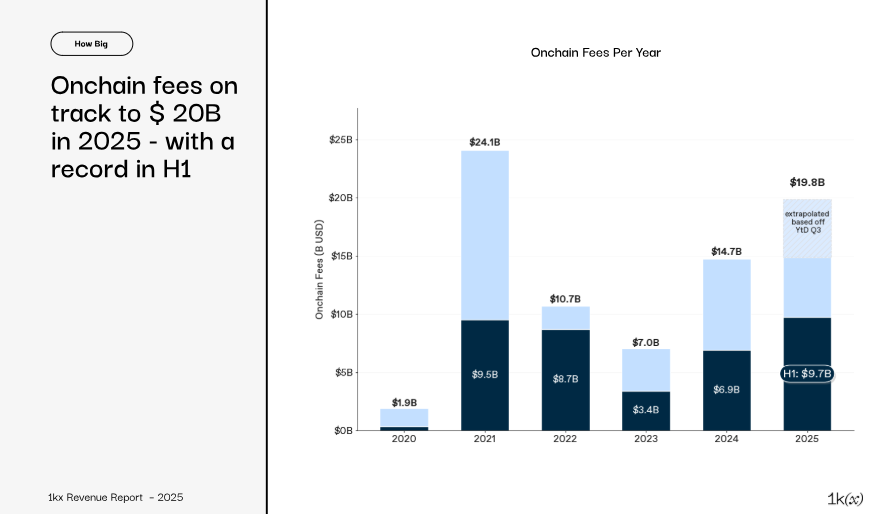

- Onchain revenues reach 19.8 billion $ in 2025, according to the 1kx report.

- The DeFi sector now dominates crypto with 63% of fees paid by users.

- Decentralized applications and stablecoins capture the majority of value at the expense of L1 blockchains.

- Some protocols like Pump.fun generate millions quickly, showing rapid leader rotation.

A strong signal: blockchain moves from gadget to economic lever

In 2025, onchain revenues from the blockchain should peak at 19.8 billion dollars, according to the 1kx report. Already 9.7 billion has been generated in the first half-year, a +41% year-on-year increase. The authors emphasize :

We consider fees paid as the best indicator because they reflect recurring utility for which users and businesses are willing to spend. As protocols mature and regulation progresses, the ability to generate and distribute regular fee-based revenues will distinguish sustainable networks from simple emerging experiments.

Crypto is therefore entering a new era. The time of blockchains as mere speculation platforms makes way for a more structured model based on real utility. Another signal: the number of protocols generating more than 1 million $ in annual revenue rose from 125 in 2021 to nearly 400 today. Profitability becomes a criterion, and recurring cash flows a standard.

In this logic, even the most popular blockchains — Ethereum , Solana, Tron — see their fees stagnate, but the economy shifts towards upper layers. The user pays for a service, not just to validate a transaction.

Onchain fees per year – Source: 1Kx Report

Onchain fees per year – Source: 1Kx Report

The crypto market reorganizes: the rush to apps finally pays off

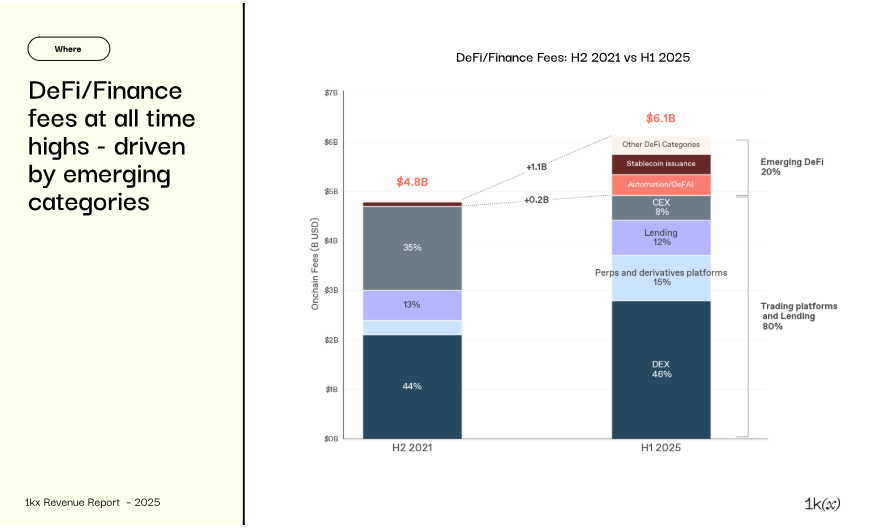

In the crypto industry, base blockchains are no longer the only ones generating revenue. Today, apps capture the attention… and the revenue. In 2025, 63% of onchain fees come from sectors related to DeFi and financial services. Blockchains themselves capture only 22%. A clear shift.

1kx data point to centralization:

The top 5 protocols (Tron, Ethereum, Solana, Jito, Flashbots) captured about 80% of blockchain fees in the first half of 2025. Although this number remains high, it is an improvement from 2021, when Ethereum alone represented 86% of blockchain fees.

However, outsiders stand out. Platforms like Pump.fun , Meteora, or Axiom have generated millions of dollars in revenue in record time.

DeFi/Finance fees: 1st semester 2021 vs 1st semester 2025 – Source: 1Kx Report

DeFi/Finance fees: 1st semester 2021 vs 1st semester 2025 – Source: 1Kx Report

The crypto market becomes more agile. Stablecoins , DEXs, launchpads, or DeFAI bots show impressive momentum. And democratization follows: an 86% drop in fees since 2021 makes apps accessible to hundreds of millions of wallets.

These new blockchain giants to watch

In the blockchain ecosystem, the surprise comes from ratios. Where historic blockchains like Solana or Ethereum show price-to-revenue (P/R) ratios exceeding 7,300x, some apps cap between 8x and 17x. A distortion indicating undervalued investment opportunities in crypto.

1kx analysts note that the top 20 protocols capture nearly 69% of onchain revenues. But this dominance is fluid. In 2024, a project like Meteora surpassed heavyweights in a few weeks. Crypto is a ground of ultra-fast disruption. It is also a showcase for regulation. The European framework (MiCA) and American ambitions (Genius Act) pave the way for an institutional influx that redefines the landscape.

Trends and numbers not to miss

- Nearly 400 protocols generate >1M$ ARR in 2025;

- Onchain revenues have increased by 60% per year since 2020;

- Tokenized assets exceed 35 billion $ in onchain value;

- DeFi captures more than 63% of blockchain revenues;

- The average cost per transaction has dropped by 86% in four years.

If the crypto industry breaks records and recovers more than 4,000 billion dollars , it is thanks to solid sub-sectors. DeFi and stablecoins offer blockchain what it lacked: massive, visible, measurable utility. Behind tokens, there are now uses. Behind promises, reality.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Global Authorities Rush to Address the Growing Wave of Crypto-Related Crime

- Global regulators and Europol intensify scrutiny of crypto crimes as illicit blockchain activities grow in sophistication, demanding international cooperation and standardized tools. - Chainalysis reports $40.9B in 2024 to illicit crypto addresses, while inconsistent analytics and training gaps hinder investigations, per BIPA experts. - Physical threats like "wrench attacks" and high-profile crypto frauds ($540M) highlight risks as law enforcement struggles to keep pace with tokenized asset crimes. - Ene

Hyperliquid News Today: "Whale’s XPL/HYPE Strategy Challenges Market Stability While Short Sellers Profit"

- Crypto whale 0x082 accumulates $8.22M in 5x leveraged XPL longs, incurring $1.14M unrealized losses while becoming Hyperliquid's largest XPL futures holder. - Contrast with Abraxas Capital's $14.1M profit from XPL shorts at $0.88 average price, highlighting polarized market sentiment and 1,000% returns versus whale's 70% losses. - Pre-Robinhood HYPE accumulation and high-leverage strategies raise insider trading suspicions, as regulators warn about sophisticated blockchain misuse and $40.9B 2024 illicit

BNB News Update: MoonBull's Mobunomics Blends Meme Culture with Organized Incentives to Take On Leading Crypto Players

- MoonBull ($MOBU) outperforms BNB/AVAX in 2025 presale with 95% APY staking and $500K Stage 5 milestone. - Meme-driven Mobunomics allocates 5% of transactions to liquidity/rewards, offering structured incentives vs. speculative meme coins. - 163% ROI for Stage 1 investors highlights potential, with 9,256% projected ROI if token lists at $0.00616. - 1,700+ holders benefit from 2-year locked liquidity, contrasting BNB/AVAX's slower growth forecasts and lack of viral adoption. - Ethereum-based transparency a

Solana News Update: Crypto Whale Faces $6.3M Loss on Bold Solana Move as Institutions Remain Confident

- A top crypto whale boosted Solana (SOL) longs despite $6.3M unrealized loss, defying market volatility. - Reliance Global Group added Solana to its digital portfolio, citing fast settlement and low fees for risk diversification. - Bitcoin whale activity, including $356M Kraken BTC accumulation, fueled bullish speculation amid consolidation phase. - Analysts warn crypto's volatility risks concentrated bets, as Solana lags Bitcoin amid macroeconomic and regulatory pressures.