Shiba Inu Price Might Rebound from its 1-Month Low...Here's why

The meme coin Shiba Inu ( $SHIB ) has had a tough month, dropping around 17% and currently trading near $0.0000099. As $Bitcoin tests the crucial $100K level, meme coins like SHIB are feeling the heat — yet the latest chart patterns hint that a short-term rebound might be coming.

Shiba Inu’s market cap stands at $5.87 billion, ranking #23 on CoinMarketCap , while trading volume has plunged nearly 48% in 24 hours to $148.5 million. The slowdown suggests traders are cautious, but SHIB’s community of 2.87 million holders remains strong — a key factor in potential recoveries.

Shiba Inu Price Analysis: A Breakout Could Be Near

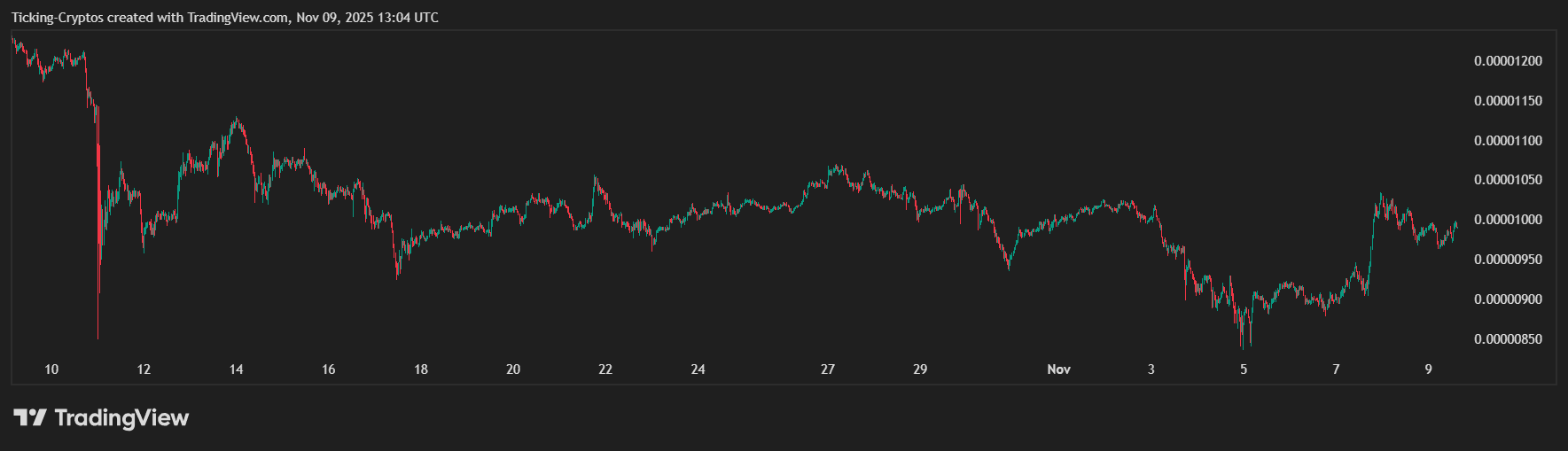

The 2-hour SHIB/USD chart shows a descending triangle formation, indicating consolidation before a potential breakout.

- Resistance: $0.00001022

- Immediate support: $0.00000963

- Major support: $0.00000868

SHIB/USD 2-hour chart - TradingView

Currently, SHIB is hovering just below its 200 SMA around $0.00000986, acting as dynamic resistance. A clean breakout above this line could push prices toward $0.0000102–$0.0000104.

Meanwhile, the Stochastic RSI is at 41.16, showing mild upward momentum after exiting oversold conditions. If the buying volume returns, SHIB could retest the upper resistance zone — but failure to break above $0.0000102 could lead to a pullback toward $0.0000086.

Bitcoin’s Influence on Meme Coins

With $BTC consolidating near $100K, most traders are reallocating funds toward Bitcoin and other large caps. Meme coins like SHIB and PEPE have seen liquidity outflows, but they often rebound quickly once Bitcoin stabilizes.

The volume-to-market-cap ratio of 2.52% suggests that speculation has cooled — yet this phase often precedes sharp moves when confidence returns.

Shiba Inu Price Prediction: Can SHIB Regain Momentum?

If Bitcoin remains steady above $100K and the upcoming U.S. inflation data brings positive sentiment, SHIB could aim for $0.0000104–$0.0000108 in the short term.

However, if Bitcoin dips below $98K, bears might push SHIB back down to the $0.0000086 support level — a zone to watch for accumulation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Update: Altcoin ETFs Move Closer to U.S. Approval After DTCC Surpasses Major Obstacle

- DTCC's approval of Bitwise's CLNK ETF marks a key step toward U.S. altcoin ETFs, with XRP-focused funds from 5 firms now listed. - XRP ETFs like Canary's XRPC and Grayscale's proposed offering highlight growing institutional demand for crypto exposure. - SEC resumes reviews post-government shutdown, accelerating approvals for pending applications including XRP Trust conversion. - Historical ETF inflows and CME's crypto derivatives success suggest regulatory clarity could drive significant capital into al

Bitcoin News Today: Whale Faces $190M Short Liquidation Risk as Bitcoin Approaches $104K

- Bitcoin nears $104K as a whale's $190M short position risks liquidation, potentially boosting prices to $105K. - Market volatility grows from $240M institutional selling and leveraged trading risks highlighted by Arkham Intelligence. - CME Group expands crypto products (XRP futures) amid regulatory scrutiny and record October trading volumes. - Whale liquidation could trigger cascading effects, testing Fibonacci resistance and accelerating BTC's bullish momentum. - CME's $7.3B 2028 revenue forecast contr

ZEC rises by 5.95% as whales reduce holdings and accumulation becomes evident

- ZEC surged 5.95% in 24 hours amid whale liquidation reducing its stake from $37M to $10.37M, triggering $960K realized losses. - Binance saw $33M ZEC accumulation via 2,200 coins/second trades, suggesting coordinated large-scale buying. - Grayscale’s Zcash Trust hit $151.6M AUM, reflecting institutional interest in ZEC’s hybrid privacy model aligned with U.S. regulatory clarity. - Whale position reversals and accumulation signals highlight ongoing bear-bull dynamics, with technical indicators like RSI di

DASH rises by 6.6% as quarterly results and recent strategic actions fuel near-term positive sentiment

- DASH surged 6.6% in 24 hours ahead of its Nov 12 earnings report, driven by strategic investments in autonomous delivery and a $5.1B acquisition. - The company’s 35.22% monthly gain and 88.68% annual rise reflect expanded partnerships with McDonald’s , Waymo, and Kroger , boosting order growth and market reach. - Analysts remain cautious due to high valuation risks and competition from Uber Eats and Instacart, despite DoorDash’s aggressive expansion into AI-driven commerce.