ETF Greenlight? Government Shutdown Deal Could Trigger Massive XRP Rally

DTCC lists nine spot XRP ETFs, with a November 2025 launch eyed. Price peaks at $2.45, but SEC approval and US Senate deal are critical factors.

The US Depository Trust & Clearing Corporation (DTCC) has listed nine spot XRP Exchange-Traded Funds (ETFs), intensifying expectations of a November launch pending US SEC approval.

With the potential US Senate deal to end the government shutdown, this could speed up SEC reviews and push XRP’s price to a high of $2.46.

DTCC Listing Expands XRP ETF Landscape

The list includes Bitwise XRP ETF and Franklin XRP ETF, among nine spot XRP ETFs—Canary XRP ETF (XRPC), Volatility Shares XRP ETF (XRPI), ETF Opportunities T-REX 2x Long XRP (XRPK), CoinShares XRP ETF (XRPL), Amplify XRP 3% Monthly ETF (XRPM), ETF Opportunities T-REX Osprey XRP (XRPR), Volatility Shares 2x XRP ETF (XRPT), and Franklin XRP ETF (XRPZ)—indicating market readiness.

🚨 BREAKING:Nine XRP Spot ETFs are now listed on the DTCC signaling readiness ahead of a possible launch this month. 👀🤯📊 Listed ETFs:↪️Bitwise XRP ETF (XRP)↪️Canary XRP ETF (XRPC)↪️Volatility Shares XRP ETF (XRPI)↪️ETF Opportunities T-REX 2x Long XRP (XRPK)… pic.twitter.com/00usToMVhX

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) November 10, 2025

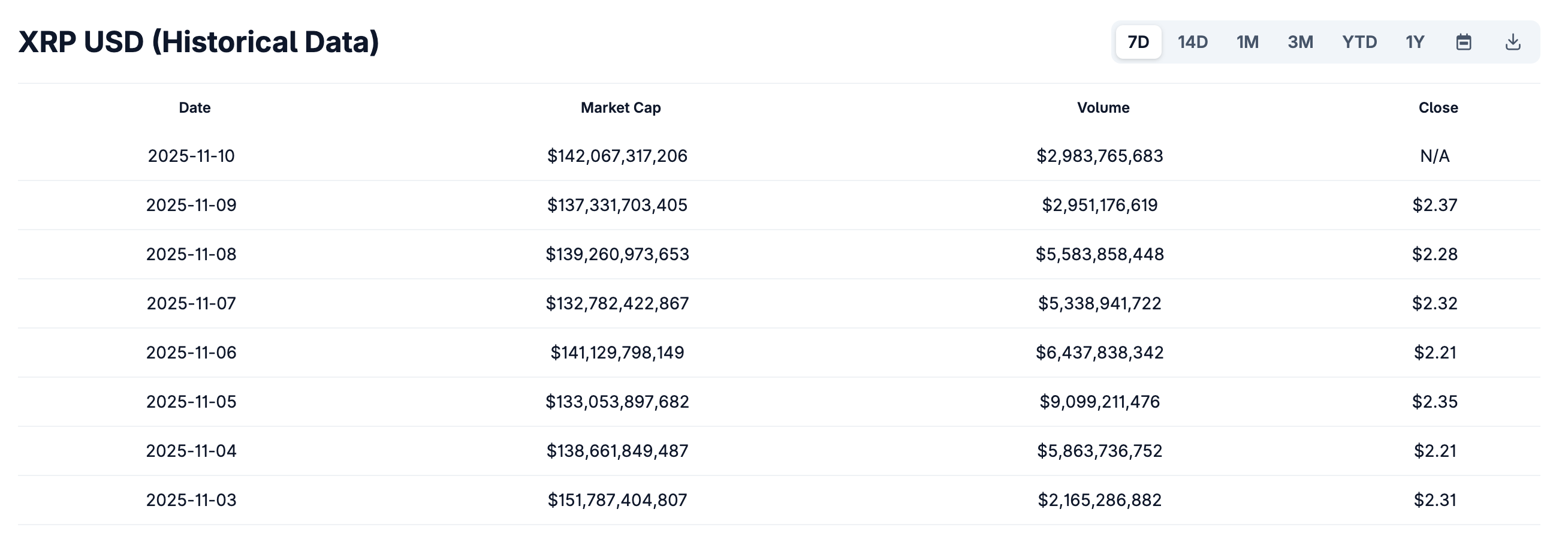

The Senate’s progress in halting a 40-day shutdown may restore SEC staffing, aiding approval. However, Ripple’s unresolved SEC litigation since 2020, with a year-end decision expected, poses risks. Over the past week, XRP’s trading volume increased to approximately $27.3 billion.

XRP’s trading volume:

CoinGecko

XRP’s trading volume:

CoinGecko

Global Markets Monitor Regulatory Progress

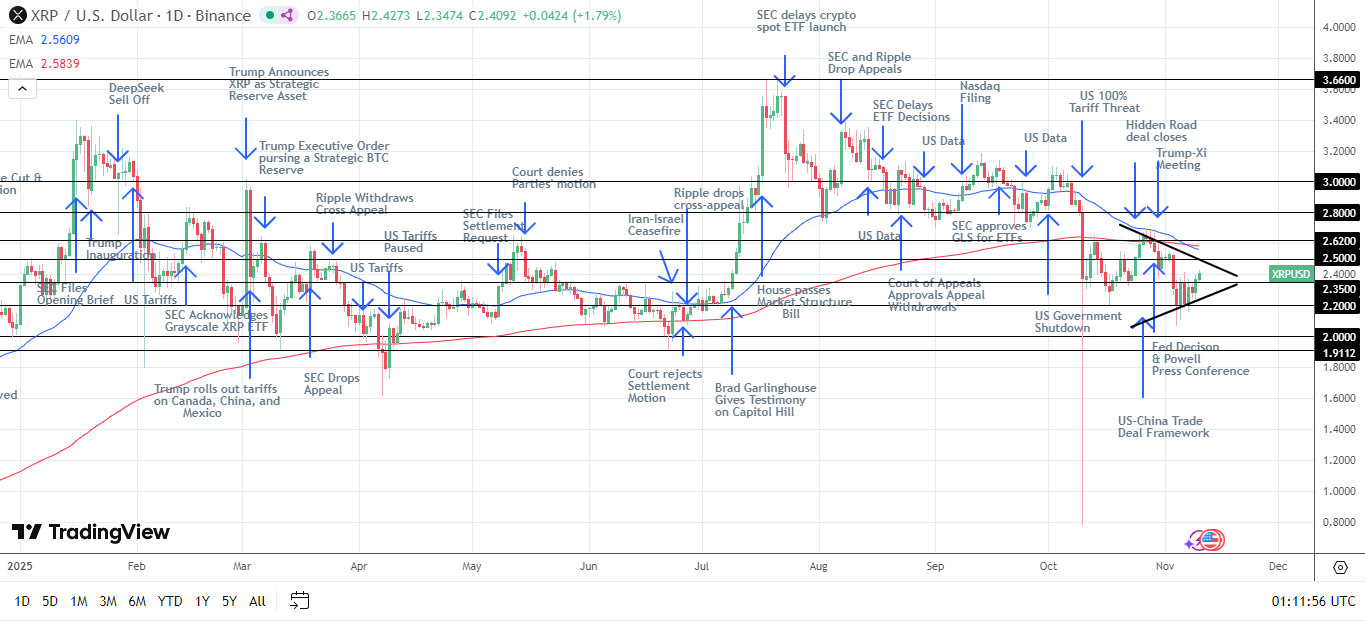

The XRP price surge to $2.45 follows a breakout above the 50-day moving average, with analysts targeting $3 by Q1 2026.

XRP price chart: BeInCrypto

XRP price chart: BeInCrypto

Technical analysis indicates that near-term support levels lie at $2.0 and $1.9, while key resistance lies at $2.5 and $2.62.

This movement occurs as XRP ETP success contrasts with Asia’s cautious stance. Asian exchanges like Bitget are awaiting clarity from US regulators. Analysts caution that a delay in the SEC’s regulatory approval could push prices down to $1.80.

the 50-day moving average, targeting $3 by Q1 2026 :

FXEmpire

the 50-day moving average, targeting $3 by Q1 2026 :

FXEmpire

JP Morgan estimates a launch could draw $3-5 billion in inflows, similar to Bitcoin ETFs, enhancing XRP’s institutional appeal. The Senate deal, if finalized, may accelerate this, though uncertainty persists. Europe’s success offers a global adoption model, but investors await clarity from the SEC and legislators.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Timeless Strategies for Investing in Today’s Market

- 2025 financial markets face AI-driven disruptions and volatility, yet timeless principles from R.W. McNeel and Warren Buffett remain relevant for navigating uncertainty. - Both emphasize intrinsic value (Buffett's "price vs. value" mantra) and emotional discipline, exemplified by Buffett's 2008 Goldman Sachs investment and 2025 AI-focused portfolio adjustments. - Their strategies prioritize compounding through retained earnings (e.g., Coca-Cola , Apple) and confidence in U.S. economic resilience, alignin

Investing in STEM and Digital Skills: Shaping the Future of Higher Education and Workforce Integration

- Global EdTech market grows at 20.5% CAGR to $790B by 2034, driven by STEM/digital literacy demand. - AI/cybersecurity programs surge as universities launch accelerated degrees to address talent shortages. - Investors target EdTech's growth potential despite challenges like unstable pricing models and uneven infrastructure. - Platforms like Coursera and Udacity leverage AI for personalized learning, aligning education with workforce needs.

Zcash (ZEC) Value Soars: The Intersection of Privacy Advancements and Mainstream Institutional Embrace in 2025

- Zcash (ZEC) surged in late 2025 due to privacy innovations, institutional adoption, and robust on-chain activity. - Grayscale's Zcash ETF filing and Cypherpunk/Reliance's strategic holdings highlight growing institutional confidence in privacy-centric crypto. - Orchard protocol adoption (30% of ZEC transactions) and Zerdinals inscriptions drove 1,300%+ transaction growth, outpacing Ethereum/Solana in fee production. - Zcash's hybrid privacy model (shielded/transparent transactions) addresses regulatory c

SOL Value Plummets by 150%: Uncovering the Causes of the Solana Turmoil

- Solana's 150% price drop in 2025 exposed structural risks in its centralized validator network and fragile DeFi infrastructure. - Validator concentration (Teraswitch/Latitude controlling 43% stake) and Jito's 88% node dominance created systemic vulnerabilities. - $3.1B in 2025 DeFi losses from smart contract exploits highlighted unresolved security flaws despite AI audits and Rust-based safeguards. - Governance failures and regulatory uncertainties prompted 72% of institutions to enhance crypto risk prot