Did One Whale Steal aPriori’s Airdrop? 14,000 Wallets Raise Big Questions

A single entity claimed 60% of aPriori's APR airdrop, sparking debate on crypto fairness.

Liquid staking project aPriori, preparing to join the Monad, has raised $30 million from Tier-1 VCs. However, it now faces accusations that one entity used 14,000 connected addresses to claim more than 60% of its airdrop.

The revelations have rattled markets and raised fresh questions about airdrop design and on-chain verification.

On-Chain Picture Behind aPriori: What Happened?

aPriori (APR) announced the claim portal on October 23, with its public window and split-claim mechanic (early vs. wait) appearing to have been gamed by the clustered wallets.

Airdrop claim is live.Check eligibility and claim at .You have 21 days to choose:• Claim Early: smaller portion now• Wait for Monad Mainnet: unlock majority laterChoose carefully, your selection is final.

— aPriori ⌘ (@aPriori) October 23, 2025

Indeed, Bubblemaps, a visual analytics platform for on-chain trading and investigations, flagged an unusually tight cluster of new wallets that claimed aPriori’s October 23 airdrop.

According to Bubblemaps, the project raised $30 million from tier-1 VCs. However, 60% of its airdrop was claimed by one entity via 14,000 connected or clustered addresses.

Reportedly, the cluster’s behavior involved wallets that were freshly funded via the Binance exchange, with approximately 0.001 BNB, in short windows. They then routed APR to new addresses, suggesting an orchestrated claim-and-redistribute operation rather than an organic, distributed claiming process.

3/ However, 14,000 connected addresses claimed 60%+ of the $APR airdropThese addresses were:> Freshly funded via Binance> Received 0.001 BNB each in tight time windows> Sent $APR to fresh addresses, forming a second layer in the cluster

— Bubblemaps (@bubblemaps) November 11, 2025

Project Messaging and Timing

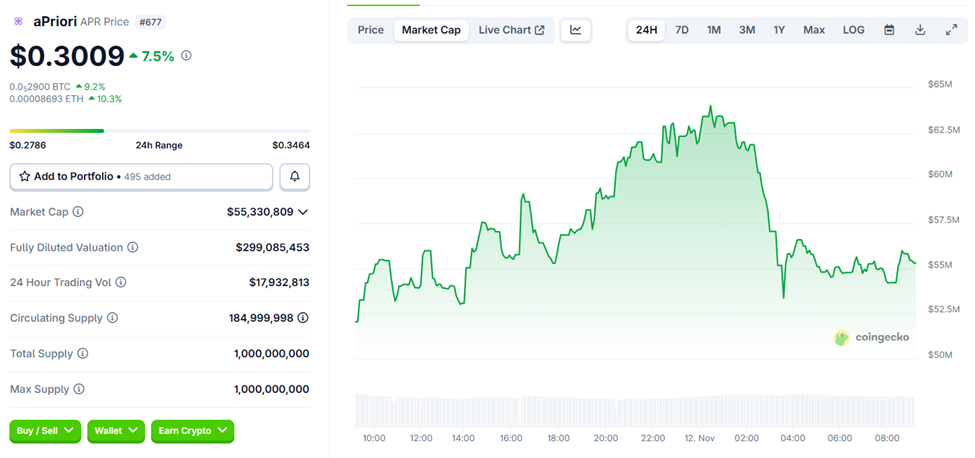

The fallout was immediate, with a sharp sell-off following the cluster activity. Likewise, there was a dramatic drop in the APR market cap soon after launch.

aPriori (APR) Price and Market Cap Performance. Source:

CoinGecko

aPriori (APR) Price and Market Cap Performance. Source:

CoinGecko

Concentrated airdrop claims, especially when claimers flip tokens quickly, can wipe out community trust and trigger steep repricing before a project reaches mainnet.

Why It Matters — Incentives, Verification, And Reputation

Crypto airdrops are meant to decentralize token ownership and bootstrap network effects. When a single actor captures the majority of distributed tokens, three problems arise:

- Incentive misalignment, where the token supply is effectively centralized

- Economic risk, where large concentrated holders can dump and destabilize the price, and

- Reputational damage, where partnerships and future fundraisers can be imperiled.

For aPriori, touted as “one of the biggest projects coming to Monad,” reputational risk now threatens its own rollout as well as associated ecosystem events.

Meanwhile, this scandal comes at a moment when Lighter is being celebrated as a model for institutional-grade DeFi growth. The Layer-2 DEX recently raised $68 million and surpassed $73 billion in weekly perpetual trading volume, emphasizing speed, scalability, and transparent on-chain execution.

Lighter is pursuing a zero-knowledge orderbook model to attract serious liquidity providers. By contrast, aPriori’s airdrop issues remind investors how easily tokenomics can be undermined by automation and poor verification.

Similarly, aPriori’s Sybil-attack-like airdrop highlights the fragility of token distribution mechanics still common in DeFi.

Bubblemaps says it reached out to the aPriori team but received no response; the project has not publicly disputed the cluster analysis.

As investigations continue and on-chain forensics deepen, aPriori’s path to the Monad mainnet and any associated MON sales will be closely monitored and evaluated based on on-chain evidence and, potentially, developer communication.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s Wall Street Fundraiser Sparks Renewed Debate Over Deregulation and Regulatory Oversight Following Trade Finance Crisis

- Trump dined with Wall Street leaders amid First Brands' $3B trade finance collapse, exposing non-bank lending risks and triggering calls for stricter oversight. - Jefferies faces scrutiny over $3B in tied debt as its stock fell 19%, while JPMorgan's Dimon warned of systemic gaps in non-bank lending oversight. - Trump's 50-year mortgage proposal sparked debate, with critics fearing "debt for life," while a 42-day government shutdown worsened market uncertainty. - The administration's deregulatory agenda c

Digital Identity, No Data Required: ZK Protocol Secures $9M to Champion a Privacy-Centric Tomorrow

- Self Labs raised $9M in seed funding led by Greenfield Capital and SoftBank, with participation from Web3 leaders like Sreeram Kannan and Sandeep Nailwal. - The ZK-based platform enables privacy-preserving identity verification using zero-knowledge proofs and supports 129 countries' biometric passports and India's Aadhaar system. - A points-based rewards program incentivizes on-chain verification, while integrations with Google, Aave , and Velodrome expand use cases like token distribution and age checks

Bitcoin’s Sharp Decline: Is This a Healthy Correction or an Ominous Signal?

- Bitcoin fell 10.5% in November 2025 amid a $19B derivatives crash, driven by Fed policy uncertainty and U.S.-China trade tensions. - Regulatory shifts and leveraged liquidations (1.6M traders impacted) exposed vulnerabilities in crypto's derivatives-heavy market structure. - Institutional demand persisted (e.g., JPMorgan's 64% ETF stake increase), suggesting long-term adoption despite short-term volatility. - Derivatives recovery may lag until 2026, hinging on Fed rate clarity and inflation trends, with

Bitcoin Leverage Liquidation Spike: Systemic Threats in Crypto Derivatives During Q4 2025 Market Turbulence

- Q4 2025 crypto derivatives saw $20B in liquidations as Bitcoin fell below $100,000, exposing systemic risks from extreme leverage (up to 1,001:1) and interconnected markets. - Platforms like Hyperliquid and Binance faced $500M+ losses in 24 hours due to cascading margin calls, with 78% of perpetual futures volume amplifying volatility through feedback loops. - Regulators scramble to address risks as unregulated leverage, macroeconomic pressures, and geopolitical tensions (e.g., U.S.-China trade wars) inc