The MMT Token TGE and Its Impact on DeFi Market Trends

- Momentum (MMT) token's 2025 TGE secured $10M funding from Coinbase Ventures, OKX, and Jump Crypto, valuing it at $100M. - Binance allocated 0.75% genesis supply via HODLer Airdrop, while post-TGE price surged 1330% from liquidity incentives. - Divergent from traditional MFS Multimarket Income Trust (NYSE: MMT), the DeFi token faces volatility risks despite institutional interest. - Strategic entry points for institutions hinge on regulatory clarity, utility validation through RWA integrations, and liquid

Distinguishing MMTs: Traditional Finance vs. DeFi

The MFS Multimarket Income Trust (NYSE: MMT) is a closed-end fund specializing in fixed-income assets, with institutional investors such as 1607 Capital Partners LLC reportedly increasing their holdings by 84.7% in Q4 2024, according to

TGE Structure and Institutional Participation

Momentum’s TGE in June 2025 featured a $10 million fundraising round led by Coinbase Ventures, OKX Ventures, and Jump Crypto, giving the project a $100 million valuation, as reported by

The allocation breakdown for the token is as follows:

- Ecosystem growth: 38.5%

- Team and early investors: 27% + 19.7%

- Institutional and airdrop allocations: 0.75% (Binance) and 5 million tokens set aside for post-launch marketing, according to

Although the precise share allocated to institutions at TGE is not detailed, the swift uptake by venture capital and exchange partners demonstrates strong institutional interest. For example, 5 million tokens were earmarked for marketing after the initial listing, reflecting a staged approach to building liquidity and market presence, as reported by

Institutional Strategies for Entering the Market

Institutions evaluating the MMT token must balance its speculative appeal with its practical features. The vote-escrow (veMMT) mechanism, which requires token locking to participate in governance, aligns long-term interests with the protocol’s success, as outlined in the

Nonetheless, risks remain. The 224% price spike following the Binance listing highlights the token’s volatility, a stark contrast to the $6.1 billion that flowed into

Market Trends and Managing Risks

MMT’s TGE has had a notable impact on DeFi markets, attracting both liquidity and speculative capital. Blockchain data indicates $12 billion in decentralized exchange volume over 30 days and $265 million in total value locked (TVL) by November 2025, according to

For institutional investors, successful entry depends on three main considerations:

1. Regulatory certainty: Projects with strong compliance, like MMT’s veMMT model, are more appealing.

2. Utility assessment: Forthcoming RWA integrations and DEX launches need thorough evaluation for practical adoption.

3. Liquidity oversight: Monitoring post-TGE marketing and airdrop activities is essential to understand their effects on token distribution and price steadiness.

Summary

The TGE for the MMT token highlights the ongoing balance between speculative excitement and utility-focused progress in DeFi. While institutional investors are attracted by its partnerships and liquidity programs, they must remain mindful of the risks tied to volatility and speculation. For those prepared to manage these uncertainties, MMT offers a potentially high-reward opportunity in a rapidly evolving token landscape—assuming its roadmap delivers on its promises of real-world value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

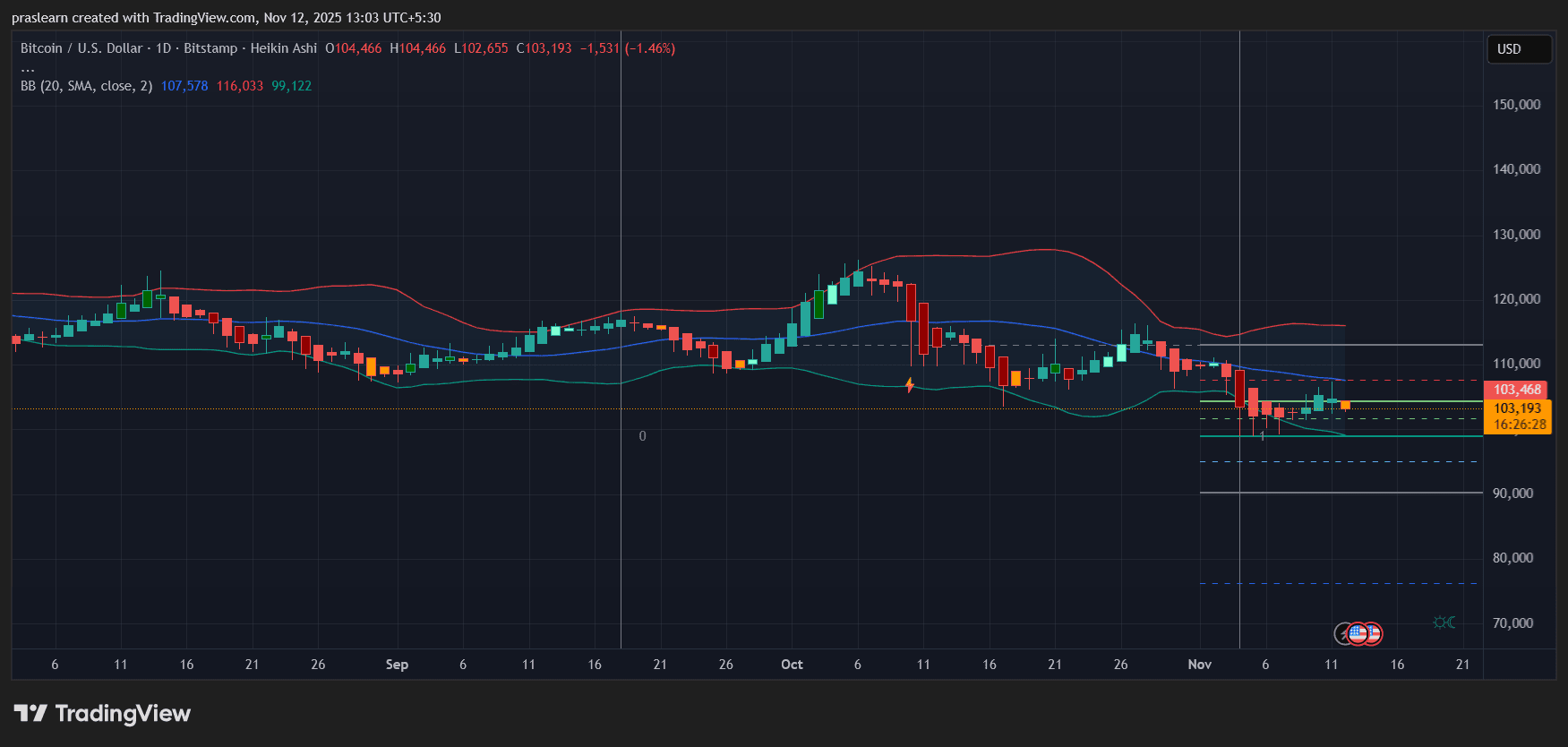

Bitcoin Faces a Reality Check as Small Business Optimism Crashes

Zcash Latest Updates: Privacy-Focused Funding: Cypherpunk Makes Major Investment in Zcash’s Secure Tomorrow

- Cypherpunk Technologies rebranded to Zcash-focused entity, acquiring $50M in ZEC via Winklevoss Capital-led funding. - The move positions it as a privacy-centric crypto treasury pioneer, contrasting with Bitcoin-centric corporate strategies. - Zcash's institutional adoption grows despite volatility, with 20–25% of tokens in shielded addresses and regulatory clarity emerging. - The firm balances biotech R&D with crypto operations, pending shareholder approval for its dual-track strategy on December 15, 20

Circle’s Rapid USDC Expansion Fails to Boost Struggling Shares Amid Rising Expenses and Divided Analyst Opinions

- Circle reported strong Q3 2025 results with $73.7B USDC growth but stock fell 5.4% premarket as costs rise and analysts split. - Revenue surged 66% to $740M while net income jumped 202% to $214M, yet RLDC margins dropped 270 bps to 39% amid expanding balances. - Arc blockchain's public testnet attracted 100+ institutional participants, with partnerships announced with Deutsche Börse and Visa to expand stablecoin adoption. - Analysts remain divided: J.P. Morgan "Sell" vs. Monness Crespi "Buy" at $150, whi

Bitcoin News Update: SoFi Integrates Cryptocurrency with Conventional Banking, Sets the Stage for a Decentralized Tomorrow

- SoFi becomes first FDIC-insured U.S. bank to launch integrated crypto trading via its app, offering BTC, ETH, and SOL alongside traditional services. - The 2025 relaunch follows regulatory clarity from the OCC enabling crypto custody and execution, addressing prior compliance uncertainties. - CEO Anthony Noto emphasizes blockchain's potential to reshape finance through faster, cheaper transactions, aligning with 60% member preference for bank-based crypto trading. - SoFi's platform combines FDIC-insured