Bitcoin Faces a Reality Check as Small Business Optimism Crashes

Bitcoin price is trading around 103,000 after another day of choppy price action. The broader market tone is cautious as risk assets respond to softening economic signals from the U.S. Small business optimism dropped to its lowest level since April, according to the National Federation of Independent Business (NFIB), with hiring and sales both weakening. This comes amid prolonged government shutdown worries that have stalled economic momentum. The question now is whether Bitcoin can stay resilient—or whether fading U.S. growth expectations will weigh on crypto markets too.

Economic Backdrop: A Warning Signal for Bitcoin Price

The NFIB survey paints a picture of slowing U.S. business activity, declining profits, and hiring shortages. Historically, when business confidence weakens, liquidity-sensitive assets like equities—and by extension, Bitcoin price tend to struggle. A slowdown in small business activity usually leads to weaker payrolls, reduced capital investment, and softer consumer spending.

Markets are watching the U.S. Congress closely for a resolution to the government shutdown. If the shutdown persists, data collection delays and disrupted government services could further pressure investor confidence. Bitcoin, which thrives on liquidity and speculation, could see reduced buying interest if risk sentiment deteriorates.

However, the silver lining is that weaker business data may revive expectations of Federal Reserve rate cuts earlier than anticipated. Lower interest rates often translate to higher liquidity and renewed appetite for non-yielding assets like Bitcoin. This macro uncertainty sets the stage for volatile range trading in the weeks ahead.

Technical Analysis: Bitcoin Price Struggles Below Resistance

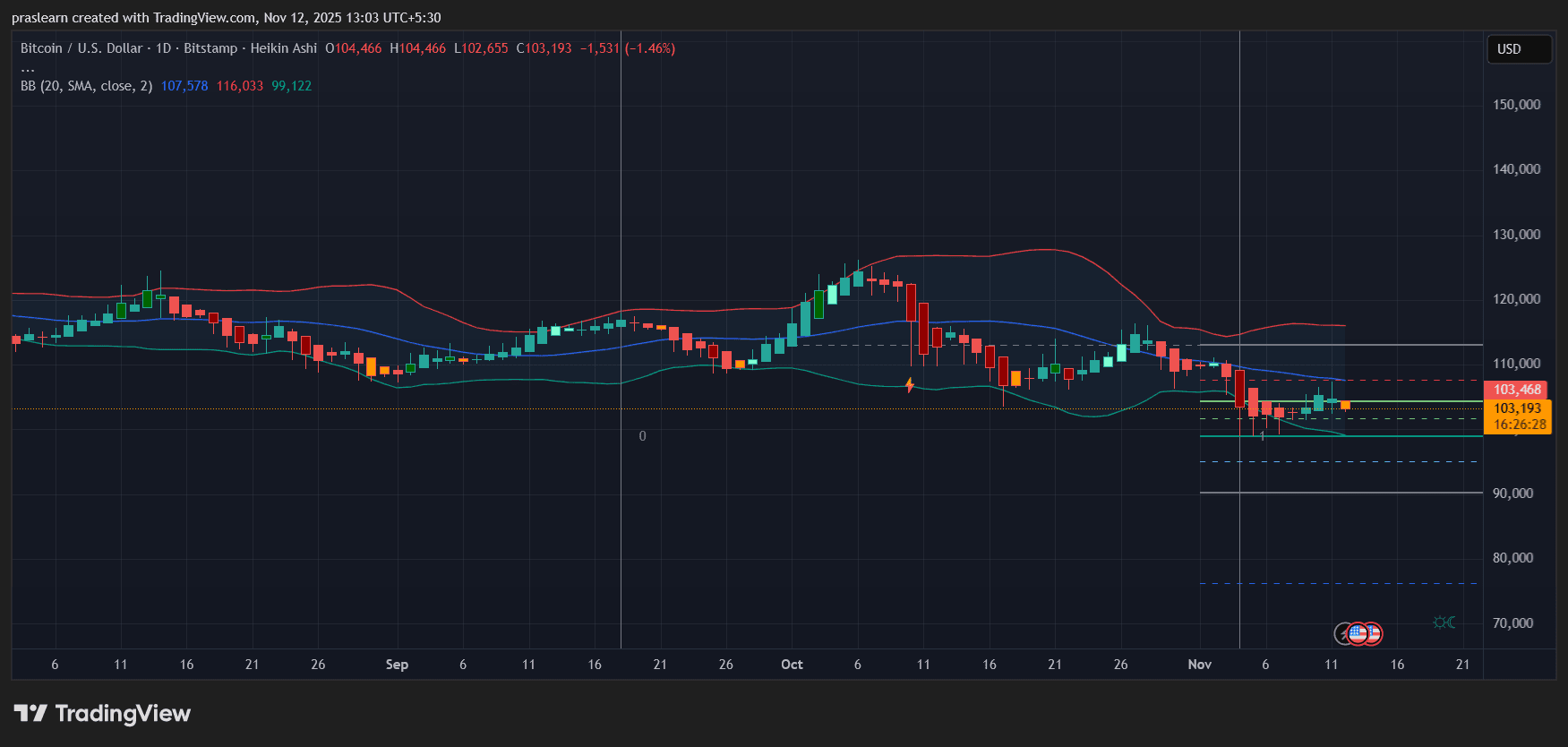

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

The daily chart shows Bitcoin price consolidating within a narrow range, with price sitting just below the midline of the Bollinger Bands (20-SMA near 107,500). The upper band at 116,000 serves as immediate resistance, while the lower band around 99,000 provides critical short-term support.

The Heikin Ashi candles reflect a gradual loss of bullish momentum since late October’s rally. Consecutive red candles with small bodies indicate indecision rather than a deep correction. Volume has thinned out, suggesting traders are waiting for a macro trigger—perhaps the government funding vote—to determine direction.

So far, 103,000 is acting as a weak pivot zone. A break below 102,000 could open the door to the 99,000–97,000 support cluster, while a daily close above 107,500 might trigger a short-term bullish breakout toward 110,000.

Momentum Indicators: Neutral-to-Bearish Bias

The Bollinger Band squeeze pattern also signals potential volatility ahead. Historically, when BTC price volatility compresses to this degree, a strong directional move tends to follow—often within 5–10 trading days. Given the current structure, that move could go either way depending on macro cues.

Bitcoin Price Prediction: Key Levels to Watch

- Resistance: 107,500 (20-day SMA), followed by 110,000 and 116,000

- Support: 102,000 (short-term), 99,000 (lower Bollinger Band), and 97,000 (October swing low)

- Invalidation: A daily close below 97,000 would confirm a deeper correction toward 90,000

If Bitcoin price closes above 107,500 with rising volume, a rebound toward 110,000 becomes probable. However, failure to hold 102,000 would suggest a continuation of the descending channel that began in mid-October.

Macro and On-Chain Crosscurrents

Despite the soft U.S. data, Bitcoin’s on-chain health remains stable. Exchange reserves continue to trend lower, suggesting that long-term holders are not panic-selling. Meanwhile, stablecoin inflows have plateaued, implying that traders are waiting on macro clarity before re-entering the market.

The next few days will be critical as the U.S. House of Representatives votes on the spending bill. If the shutdown officially ends, we could see a short-term relief rally across equities and Bitcoin alike. But if political deadlock persists, a dip below 100,000 wouldn’t surprise.

30-Day Bitcoin Price Prediction: Choppy, Then Directional

In the near term, BTC price is likely to oscillate between 99,000 and 110,000 until a macro catalyst breaks the range. A confirmed end to the government shutdown could lift sentiment and push BTC toward 115,000–118,000. Conversely, continued fiscal gridlock or disappointing economic data could send prices to retest 95,000 or even 90,000 by early December.

Bitcoin’s current setup reflects a market in wait-and-see mode. The technical picture favors consolidation, while macro signals—like weakening small business confidence—tilt sentiment cautiously bearish. Yet, the underlying resilience of $BTC holder base and cooling inflation may provide a safety net.

For now, traders should watch 102,000 and 107,500 closely. A break of either side will likely define Bitcoin’s direction heading into year-end. Until then, volatility compression suggests patience might pay off more than prediction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar News Today: C3.ai Faces AI Challenges While Stellar's Blockchain Thrives: Changing Currents in Technology

- C3.ai faces leadership turmoil, 54% stock drop, and legal claims over misleading growth statements amid $116.8M Q1 2026 net loss. - Stellar (XLM) gains traction with BRL stablecoin partnerships, tokenized energy projects, and 1B+ Q3 2025 transactions boosting institutional adoption. - Stellar's ecosystem expands via 37% developer growth, $562M RWA market, and IBM's integration of its security protocols for tokenized infrastructure. - Contrasting trajectories highlight shifting tech priorities: speculativ

Algorand Moves to Passwordless Security to Address Quantum Risks and Meet Regulatory Requirements

- Algorand launches passwordless login via Pera Wallet using FIDO2 standards to combat quantum threats and regulatory demands. - Industry trends show firms like AMI adopting post-quantum cryptography while Prisma AI develops AI-specific security tools. - Ledger explores NY IPO amid rising crypto storage demand, while BIO-key expands passwordless solutions in Middle East/Africa. - NIST/NCSC urge quantum-resistant algorithm migration, positioning passwordless tech as critical for financial/healthcare complia

Ethereum News Update: Connecting Crypto Enthusiasts and Card Game Fans: Funtico's EV2 Presale Transforms Web3 Entry

- Funtico launches EV2 presale, allocating 40% tokens to early buyers via crypto and credit cards. - EV2 blends sci-fi shooter mechanics with progression-driven gameplay, featuring five character classes and high-fidelity visuals. - Token deployed on Ethereum to leverage DeFi infrastructure, offering TICO bonuses for presale participants. - Flexible payments include ETH, USDT, BTC, and credit cards, incentivizing early adoption. - Phased rollout aims to build community engagement through tournaments and NF

XRP News Update: XRP ETF Approaches Debut While Profit-Taking Challenges $2.35 Support Level

- XRP's price surged 10% to $2.43 amid anticipation for its first spot ETF, with Canary's SEC filing signaling a potential Thursday launch. - Profit-taking by long-term holders spiked 240% since September, pushing daily realizations to $220M as prices retreated to $2.30. - Ripple's $125M SEC settlement and XRP Ledger's 99.999% uptime bolstered fundamentals, while a partnership with Mastercard/Gemini expands cross-border payment integration. - Competition from AI/meme tokens and liquidity shifts threaten XR