- Chainlink (LINK) price dips 3.3% amid ETF delays and weak crypto sentiment.

- Bitwise’s Chainlink ETF appears on DTCC, signalling launch progress.

- Chainlink expands with Injective EVM integration for real-time data.

Bitwise’s proposed Chainlink ETF has appeared on the Depository Trust and Clearing Corporation (DTCC) registry, a move often seen as a key step toward an eventual launch.

The listing signals that the fund’s debut could be approaching, marking another milestone in the growing intersection between traditional finance and blockchain assets.

Despite this progress, Chainlink’s (LINK) price has edged lower, weighed down by a broader market pullback and persistent regulatory uncertainty.

Investors remain cautiously optimistic, viewing the ETF’s advancement as a potential long-term catalyst even as near-term sentiment stays subdued.

Bitwise Chainlink ETF nears launch

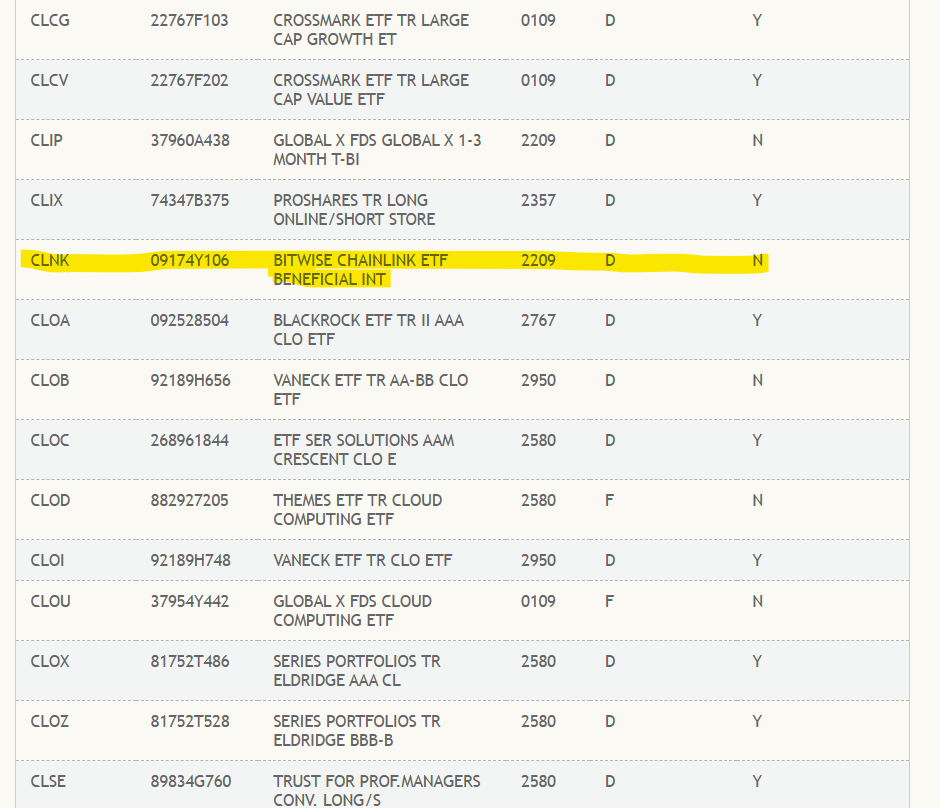

Bitwise’s Chainlink ETF has appeared on the DTCC’s eligibility list under the ticker CLNK, placing it in both the “active” and “pre-launch” categories.

DTCC ETF registry | Source: DTCC

DTCC ETF registry | Source: DTCC

Such a listing is typically one of the final steps before a new exchange-traded fund can officially begin trading on the market.

The listing reflects backend preparations for clearing and settlement, but it does not guarantee that the US Securities and Exchange Commission (SEC) will approve the fund.

The ETF aims to track the price of Chainlink (LINK), the token that powers the decentralised oracle network connecting smart contracts to real-world data.

Bitwise first filed its Form S-1 registration with the SEC in August and is still expected to submit Form 8-A, the last major document required before a security can be listed on an exchange.

The listing on DTCC suggests that this step may be imminent once the US government reopens after a prolonged government shutdown .

The 42-day US government shutdown has stalled SEC activity, creating a bottleneck for dozens of crypto-based ETFs, including Bitwise’s Chainlink product.

However, optimism has returned after the Senate passed a funding bill that could soon restore full SEC operations, clearing the backlog of pending applications.

Historically, ETFs that reach DTCC listing status tend to move toward approval once regulatory conditions normalise.

Analysts such as Bloomberg’s Eric Balchunas have noted that most funds that reach the DTCC stage eventually debut, underscoring growing confidence that a Chainlink ETF could soon join the expanding roster of crypto investment vehicles.

In addition, Coinbase Custody Trust Company has been named as custodian of the Bitwise Chainlink ETF, and the fund will allow in-kind creation and redemption, meaning investors can exchange shares directly for LINK tokens.

Analysts view this feature as a potential liquidity driver that could deepen institutional exposure to Chainlink’s network.

Meanwhile, other asset managers like Grayscale are also pursuing Chainlink-based products, though their proposals include staking components that could complicate approval.

Chainlink (LINK) price outlook

Despite the promising ETF progress, the Chainlink price has dropped by about 3.3% over the past 24 hours, diverging from its 7-day gain of roughly 5.5%.

The pullback reflects a combination of market-wide weakness and profit-taking after weeks of ETF-driven speculation.

Amid the pullback, the open interest in LINK derivatives has dropped 8%, suggesting that traders are scaling back exposure amid short-term uncertainty.

The broader crypto market has also slipped by about 1.7% in the same period, showing that sentiment remains fragile even as structural developments advance.

From a technical analysis standpoint, LINK has slipped below its 7-day simple moving average at $15.61 and now faces resistance near the 30-day SMA of $1693.

The relative strength index (RSI) has also weakened to around 43, indicating waning momentum.

If the token closes below the $15.22 support level, analysts warn of a potential retest of the October low near $13.87.

Chainlink (LINK) price chart | Source: CoinMarketCap

Chainlink (LINK) price chart | Source: CoinMarketCap

Nevertheless, the long-term fundamentals appear stronger.

Chainlink continues to expand its role in decentralised finance infrastructure, most recently through the integration of Chainlink Data Streams and DataLink into the Injective EVM Mainnet.

The integration , unveiled on November 11, enables real-time, low-latency price feeds that support next-generation DeFi applications.

This integration reinforces Chainlink’s dominance in the oracle sector and enhances its value proposition beyond speculative trading.

At the time of writing, Chainlink (LINK) is trading around $15.50 with a market capitalisation exceeding $10.8 billion.

While the Chainlink (LINK) price outlook remains mixed in the short term, institutional demand could provide a meaningful tailwind if the Chainlink ETF is granted approval to the ETF.