Zcash (ZEC) Drops Over 35% in November — Why Experts Remain Optimistic

Zcash’s sharp November decline hasn’t shaken investor confidence. Surging Shielded Pool activity and renewed interest in crypto privacy suggest a strong foundation for ZEC’s next major uptrend.

Zcash (ZEC) is facing its most volatile week of the year. From its recent high near $750, the coin has now fallen more than 35%. Despite the sharp correction, many experts remain bullish on ZEC.

What makes them believe this correction won’t derail a stronger upcoming bull run? Here are the key details.

Why Experts Are Optimistic About Zcash

With its focus on privacy, ZEC represents more than just a cryptocurrency. Many investors view it as a symbol of the growing demand for security and confidentiality in the crypto space.

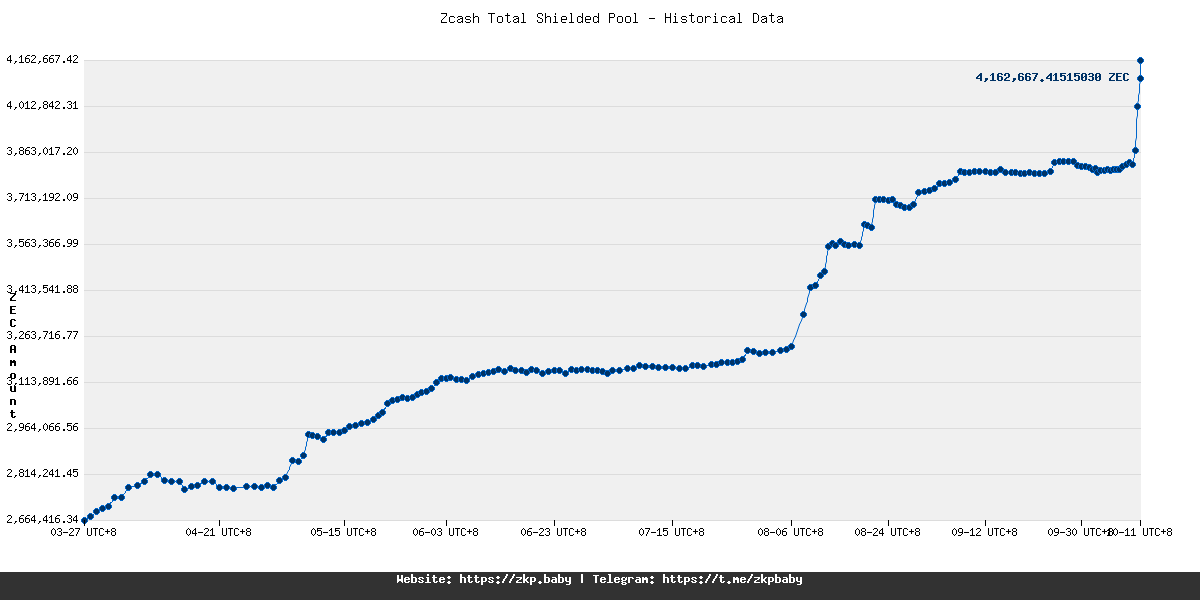

Although the price has dropped sharply, the amount of ZEC locked in the Zcash Shielded Pool — the network’s core privacy layer — has surged. This growth reflects a rising appetite for privacy-focused transactions.

Shielded Pools are mechanisms in Zcash that enable private and anonymous transactions.

Zcash Total Shielded Pool. Source: zkp.baby

Zcash Total Shielded Pool. Source: zkp.baby

Historical data from the Zcash Total Shielded Pool show that the number of ZEC locked in the pool rose from approximately 2.6 million at the end of March to more than 4.1 million by early November. The growth curve has turned almost vertical in recent months.

“The shielded pool on Zcash is literally vertical. The privacy properties are improving in real time. Speculation turning into stronger privacy properties in a reflexive loop is one of the most incredible things I’ve seen in crypto,” Mert, CEO of Helius Labs, said.

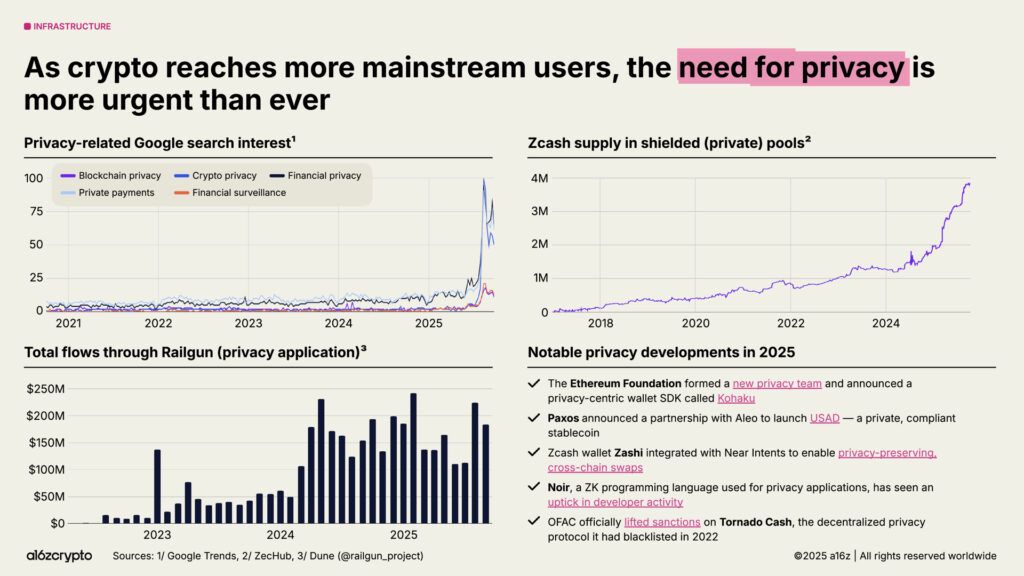

A new report from a16z Crypto, a leading venture fund in the blockchain industry, also emphasized that privacy concerns are becoming more urgent than ever as crypto adoption expands among mainstream users.

a16z Crypto’s Report on Privacy Narrative. Source:

a16z

a16z Crypto’s Report on Privacy Narrative. Source:

a16z

a16z highlighted several key factors:

- Google searches for keywords such as crypto privacy, blockchain privacy, and financial privacy have surged in 2025.

- The Railgun protocol, which hides transaction paths, has seen rapid growth in capital inflows over the past two years.

- The US Treasury Department lifted sanctions on Tornado Cash, signaling a softer regulatory stance toward privacy protocols.

Omid Malekan, a professor at Columbia Business School and crypto expert, expressed a similar view. He noted that while privacy has long been recognized as important, it has been neglected for too long in the industry.

“While on the subject of friends coming home, I think the Zcash surge is something every single person in crypto should be happy about, regardless of individual financial exposure or what the coin does going forward,” Omid Malekan said.

Arthur Hayes, co-founder of BitMEX, also urged holders to withdraw their ZEC from centralized exchanges and hold their assets in self-custody.

The optimism shared by these industry figures goes beyond short-term price performance. Their voices could influence retail investors, potentially helping ZEC recover.

Analysts’ Take on ZEC’s November Correction

Many analysts consider ZEC’s recent correction both natural and healthy rather than a sign of weakness.

Several experts still expect ZEC to reach a value of as high as $10,000 in the future. They argue that retracements like this are crucial for balancing market sentiment and sustaining a healthy bull market.

“Zcash will reach $10K, with some retracement phases, which is normal and healthy,” investor Yoshi said.

Zooming in on Shielded Pool data reveals a slight dip in recent days. However, this pullback is unsurprising, as many whales are sitting on gains exceeding 1,000%.

“Healthy movement, imo — many whales are sitting on more than 1,000% increased purchasing power, and it’s expected that they want to realize some of that or rotate part of it to other assets,” analyst Vini Barbosa explained.

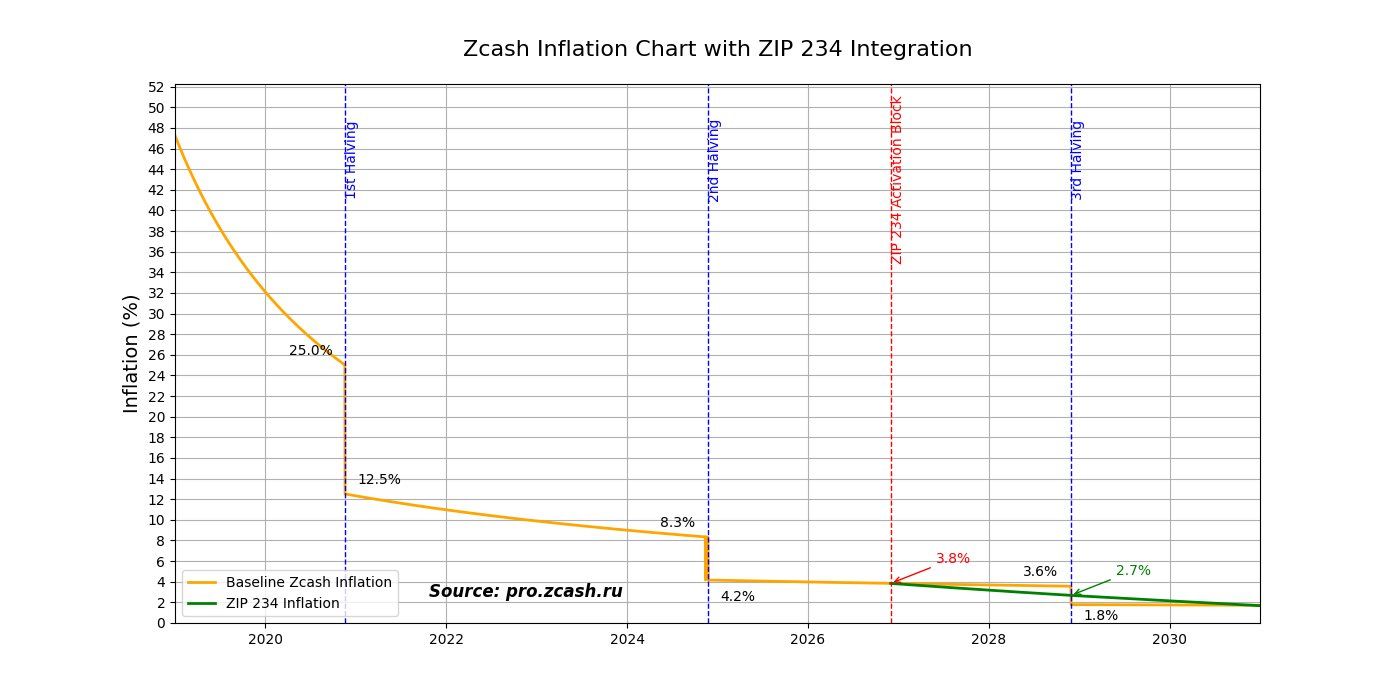

In addition, ZEC’s lower inflation rate — thanks to its Bitcoin-like halving mechanism — combined with growing awareness of privacy, forms a strong fundamental base. Analysts believe these factors position ZEC for a long-term uptrend.

Zcash Inflation. Source:

zooko

Zcash Inflation. Source:

zooko

ZEC’s bullish narrative is also inspiring a rally among smaller privacy-themed altcoins. Experts predict that privacy-focused altcoins could soon attract institutional attention. They may even be included in Digital Asset Trusts (DATs), which could act as “Trojan horses” bringing fresh capital into the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The PLG Dilemma: Why Sales Remains the Overlooked Key to Revenue

- Product-led growth (PLG) prioritizes product adoption but risks undervaluing structured sales strategies, creating a blind spot for non-technical leaders. - Non-technical operators must act as "Translator-in-Chiefs," aligning technical innovation with market demand through three pillars: product architecture understanding, systematized sales forecasting, and CFO-focused financial metrics. - By institutionalizing sales as a revenue blueprint rather than a cost center, PLG startups can transform innovation

Fed’s Internal Differences and Lagging Data Put Dollar at a Turning Point While Euro Strengthens

- EUR/USD climbed to 1.1590 as weak U.S. labor data and Fed policy splits fueled dollar weakness expectations. - Fed officials diverged on rate cuts: Moran favored 50-basis-point cut, Collins opposed, while Musalem noted inflation near 3%. - ECB's projected rate stability through 2027 contrasts with Fed's 125-basis-point easing by 2026, boosting euro despite global risks. - Market pricing for December Fed cuts dropped to 55% as delayed NFP data and mixed CPI components heighten uncertainty. - Technical ind

BCH drops 2.06% due to sluggish loan expansion and a decline in institutional ownership

- Banco de Chile's stock (BCH) has declined 5.24% in 24 hours, 9.81% in 30 days, due to weak loan growth and reduced institutional holdings. - Earnings slowdown stems from lower inflation-adjusted income and stagnant loan growth in core mortgage/consumer credit segments. - Analysts maintain neutral stance with $36.93 price target, but institutional ownership fell 3.53% amid bearish put/call ratio of 4.11. - Backtest hypothesis links institutional sell-offs and below-expected earnings to statistically signi

Bitcoin News Today: Bitcoin’s HODL barrier encounters a challenge reminiscent of FTX as liquidations reach $1.1 billion

- Bitcoin tests $95k HODL wall amid $1.1B liquidations, echoing 2022 FTX crash volatility with $44.29M largest single loss. - Technical indicators show oversold RSI and potential death cross rebound, with analysts predicting $95k-$145k range for near-term reversal. - ETF flows reveal $524M Bitcoin inflow vs $1.07B Ethereum outflow, highlighting shifting institutional sentiment amid macro uncertainty. - U.S. regulatory progress through GENIUS/CLARITY Acts aims to clarify SEC-CFTC oversight, potentially boos