Giants are bottom-fishing: A new wave of mergers and acquisitions sweeps the crypto industry

Author: Gu Yu, ChainCatcher

Original Title: Giants Are Bottom Fishing, M&A Wave Sweeps the Crypto Industry

The crypto world in 2025 is witnessing an unprecedented wave of mergers and acquisitions.

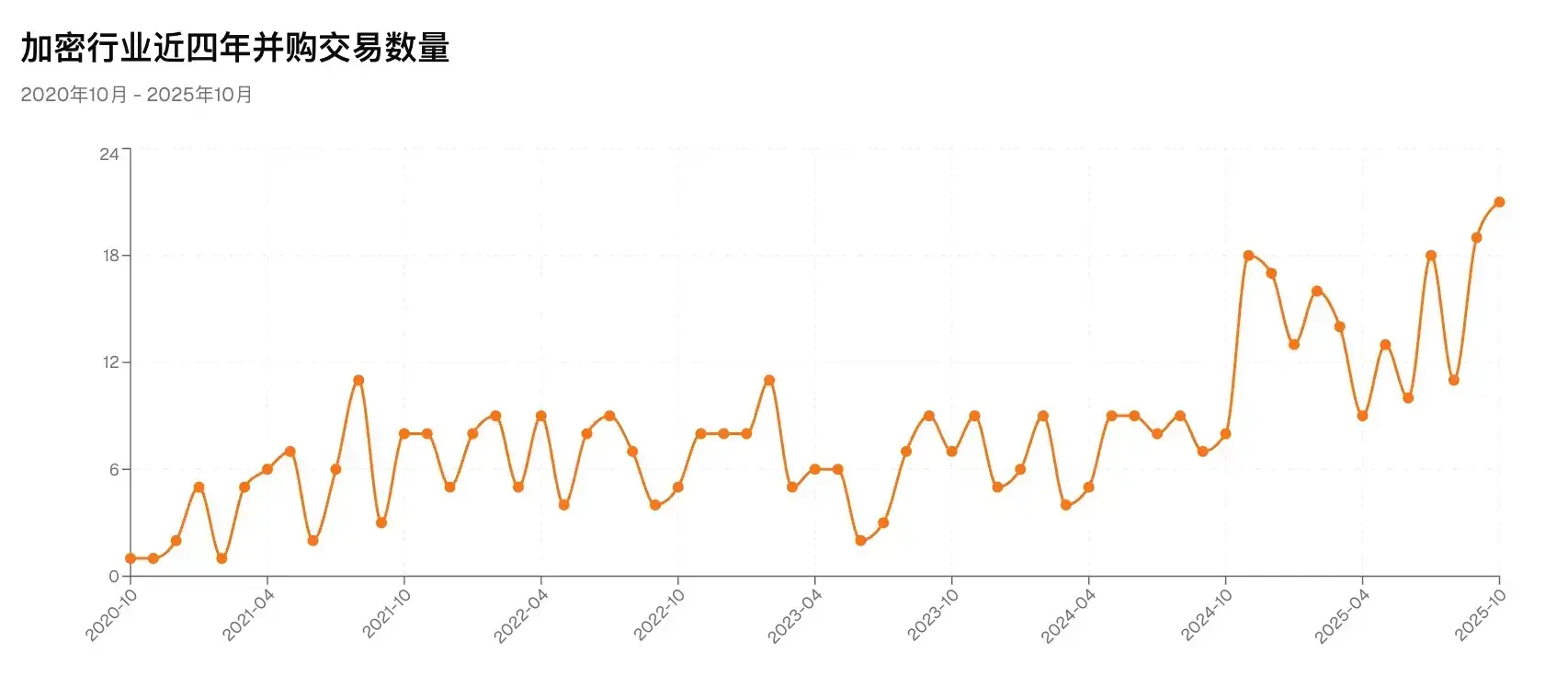

From DeFi protocols to asset management companies, from payment firms to infrastructure service providers, new M&A events are happening almost daily. Kraken swallowed futures trading platform NinjaTrader for $1.5 billion, while Coinbase recently made consecutive moves to acquire derivatives exchange Deribit and on-chain fundraising platform Echo. According to RootData, the number of crypto M&A deals in 2025 has reached 143 so far, not only setting a new historical record but also marking a 93% increase compared to the same period last year.

Why are giants so enthusiastic about M&A when the market is sluggish? What impact will the accumulation of M&A have on the market?

1. Giants Trade Capital for Time

M&A is the most direct way for giants to expand their territory and enhance their competitiveness.

In the past few years, giants represented by centralized exchanges have mostly done well relying on trading fees. But as the secondary market turned bearish and regulations tightened, simple trading income could no longer support growth, and external Web2 giants were eyeing the space. As a result, they began expanding their territory through acquisitions—either to fill ecosystem gaps or to acquire compliance resources.

Through M&A, giants can skip the long periods of independent R&D and market cultivation, quickly bringing competitors or complementary teams under their umbrella, thus rapidly expanding their product matrix—for example, from spot to derivatives, from trading to payment and custody—enhancing their full-stack product service capabilities.

More importantly, by acquiring entities that already have regulatory approval or well-established compliance frameworks, platforms can obtain the "ID" to enter certain markets (such as licenses, compliance processes, or clearing channels in specific jurisdictions) much faster than building a compliance team from scratch. This is especially important in the crypto world, where regulations are tightening and regional differences are significant.

Take Coinbase as an example. Since 2025, its M&A strategy has been almost "full-chain": from derivatives exchanges to on-chain fundraising platforms, and compliant custody companies, covering multiple segments such as trading, issuance, payments, and asset management. An industry insider close to Coinbase revealed: "What they want to build is a 'Goldman Sachs map' in crypto—not relying on coin prices, but on a service system."

Kraken's moves follow a similar logic. NinjaTrader is an old player in the traditional financial sector. By acquiring it, Kraken essentially bought a compliance channel recognized by US regulators, allowing it to bring traditional futures clients and tools into its ecosystem. In the future, Kraken will no longer have to take detours to provide more comprehensive derivatives and futures trading services.

In other words, while small projects are still struggling for the next round of financing and token listings, giants are already using cash to buy time and acquisitions to buy the future.

This trend is not limited to giants like Coinbase. Web2 giants such as Robinhood, Mastercard, Stripe, and SoftBank are also participating. This means that Web3 is no longer just a game for entrepreneurs and retail investors; it is attracting deep participation from traditional capital, financial institutions, and even publicly listed companies. M&A has become their bridge into Web3.

Moreover, the current market situation provides them with an important opportunity to increase their M&A investments. Now, the crypto primary market continues to slump, and the vast majority of crypto projects face challenges in financing and exit, putting them at a disadvantage in the capital market. Therefore, giants with ample cash or access to capital markets can leverage their capital advantage to dominate M&A pricing and structure design. For sellers, accepting equity swaps, partial cash plus stock, or strategic cooperation transaction structures is often more prudent than betting everything on issuing tokens in the open market. Thus, capital-strong players have a natural advantage in M&A negotiations, enabling them to acquire key technologies, users, and licenses at more favorable costs.

2. Has the Golden Era for Web3 Builders Arrived?

In the past, the main exit path for many Web3 projects was "token issuance—price surge—buyback/cash out," a path highly dependent on secondary market sentiment and easily hijacked by token price fluctuations. M&A offers project teams another, more stable path: being integrated by strategic buyers within or outside the ecosystem, receiving cash/equity, or being incorporated into the product lines of larger platforms for continued development. This provides teams and technologies with a smoother capitalization route, without having to pin all hopes on the "vampiric" process of token issuance and exchange listing.

M&A activities by Coinbase, Kraken, and others have, to some extent, broadened the ways Web3 projects and teams can realize value. In the current capital winter, this has also injected a shot of confidence into the crypto primary market equity sector, bringing more hope to crypto entrepreneurs.

The rise of M&A in the crypto industry is no accident, but the result of market maturation, capital structure reshuffling, and the joint push of regulation and user demand. M&A enables technology, users, and compliance capabilities to be reallocated more quickly within the crypto market. Leading companies use M&A to consolidate and expand their moats, while for small and medium-sized projects, M&A provides a relatively stable exit and development path.

In the long run, this wave of M&A is expected to motivate many crypto projects to evolve from tech communities or marketing companies into truly commercialized companies with clear user scenarios and solid technology, refocusing on product experience, compliance, and business implementation. Undoubtedly, this is beneficial for the long-term healthy development of the industry and will accelerate its mainstream adoption.

Of course, M&A is not a cure-all. Giants still face many uncertainties, such as integration—how to incorporate the strengths of the acquired party into the acquirer at the organizational, product, compliance, and customer levels. If integration fails, it often means "buying an empty shell." There may also be valuation bubbles, which could negatively impact the acquirer's cash flow and profitability.

In any case, this is a major boon for crypto entrepreneurs and the long-term crypto ecosystem. The market will provide a more favorable environment for projects that are diligently cultivating technology and use cases. Questions like "If you don't issue a token, how do we exit?" will gradually stop haunting entrepreneurs and builders—their golden era is about to arrive.

The crypto industry in 2025 is at such a turning point. Rather than calling it a capital game, it is better described as a necessary path for the crypto industry to mature.

In the coming years, we may see: exchanges no longer just as exchanges, but as one-stop financial supermarkets; wallets not just as wallets, but as users' on-chain financial gateways; stablecoins not just as stablecoins, but as the underlying currency for instant cross-border settlements.

And all of this is starting with this wave of "M&A fever."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From Queen’s Dream to Prison Gate: Zhi Min Qian and the Absurd Scam Involving 60,000 Bitcoins

The specific handling of this huge amount of Bitcoin will be decided early next year.

After zero commission, the new battleground is the "discovery and discussion layer"—whoever captures the talent there will be the new broker.

Social is becoming the underlying infrastructure of finance.

Analysis of Monad's 18-Page Sales Document: How Does 0.16% of Market Making Chips Support a 2.5 Billion FDV?

This document also systematically discloses a large number of important details such as legal pricing, token release schedule, market-making arrangements, and risk warnings.

Tom Lee: Recognize the eve of the crypto asset explosion, fasten your seatbelt!