Duan Yongping Rarely Speaks Out: The "Iron Retail Investors" of the AI Era, the Faith in Moutai, and the Underlying Logic of Not Buying General Electric

In an interview, Duan Yongping shared his investment philosophy, views on corporate culture, management principles, and insights on children's education, emphasizing the importance of long-termism, rational investing, and corporate culture. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

This is a rare video interview with Duan Yongping, more than 20 years after his "retirement" from BBK.

In the first episode of the third season of the professional dialogue program "Strategy" produced by Snowball yesterday, Snowball founder Fang Sanwen and Duan Yongping engaged in a rare intellectual exchange around investment philosophy, corporate culture, and long-termism.

In the two-hour-long interview, Duan Yongping shared his views on investment, corporate culture, business management, companies, and children's education, among other topics. The following is an excerpt from the full text, highlighting 50 key points for your reading.

On Investment

1. Cheap things can get even cheaper.

2. Staying rational is a very difficult thing.

3. If you really know how to invest, you don't need any advice. You just need to buy the companies you think are good and hold on to them.

4. People care about what we've done, but a big reason we become who we are is because of the things we choose not to do.

5. Investing is interesting; not understanding doesn't mean you can't make money.

6. If you can't withstand a 50% drop in a stock, you shouldn't buy it.

7. In the era of AI investing, if you try to make money by reading charts and lines, you are definitely the "chives" (slang for easily exploited retail investors).

8. The probability of making mistakes is about the same for everyone; the difference is that some people don't persist in their mistakes to the end.

9. Buffett's margin of safety doesn't mean cheapness; it means how well you understand the company.

10. The saying "buying stocks is buying companies"—if even 1% of people truly understand this, it's remarkable; actually doing it is even harder.

11. Why is investing simple but not easy? It's simple because you must look at the company, understand the business, and also understand future cash flows; it's hard because it's difficult to actually do this, as most companies are not easy to understand.

12. It's very hard to make money trading stocks. Most retail investors lose money in both bull and bear markets—about 80%—so don't think you're the special one.

13. I come from a business background, so it's relatively easy for me to understand other people's businesses, but I can't understand too many businesses either.

14. Why can you hold for so long and not sell even after making so much money? The thing is, that money isn't actually that much.

15. Is copying homework (following others' trades) a sustainable investment method? It's difficult, because when you copy, you're always behind.

On Corporate Culture

16. Corporate culture is closely related to the founder; you need to find people who agree with you, who share your culture.

17. Much of our culture has evolved during our growth, constantly improving. Even our "do-not-do list" was added item by item; knowing what not to do often comes from painful lessons.

18. "Doing the right thing and doing things right"—this immediately brings out the distinction between right and wrong... If something feels wrong, we stop easily; if you only consider whether you can make money, things get complicated.

19. What we say is what we do, so everyone feels at ease and there is a high level of trust... The dividends employees receive are what they deserve. When we give out bonuses, some say "thank you, boss," but I say that's not appropriate, because the bonus is given according to the contract; you don't need to thank me.

20. We have two types of people: like-minded people and fellow travelers. If someone agrees with you, even if they don't fully understand, they'll do as you ask.

21. The best thing about a good culture is that it ultimately leads you back to the right path, like a guiding star. It's not just about business; if you only discuss business, it's easy to make mistakes.

On Business Management

22. Jobs told Tim Cook, "As CEO, you make the decisions; don't think about what I, Jobs, would do." That's the right approach.

23. (On partners) I trust them a lot, and I think that's very important. I'm also not afraid of them making mistakes.

24. The president of Panasonic told me: When I'm making a decision, I imagine the old Panasonic elders standing behind me and wonder what they would think. That makes me nervous.

25. I have a habit: if I encounter something unsuitable, I leave immediately.

26. Your eyes should be on the users, while theirs are on the rearview mirror.

27. It's very hard for founders to leave their companies; not many people can do it. Why? Because they don't want to.

28. I don't think age is necessarily a barrier. Buffett is over 90 and still doing well. He just loves what he does and keeps doing it.

On Children's Education and Growth

29. Everything parents do is to give their children a sense of security.

30. I don't require my child to do things I can't do myself.

31. Children will always have tempers, and at certain moments, they can express their emotions in their own words.

32. You need to tell them about boundaries—what they can't do. I think that's very important. It's not about scolding them every day.

33. For children, giving them a sense of security is very important. Without it, it's hard for people to be rational.

34. The most important thing you learn in college is how to learn, building confidence that you can learn things you don't understand.

35. Everything parents do for their children is actually teaching them how to behave. If you scold them, you're teaching them to scold; if you hit them, you're teaching them they can hit their own kids in the future; if you lose your temper, you're showing them it's okay to lose their temper; if you're good to them, you're showing them they should be good to others.

36. Doing exercises is indeed helpful, but not everyone will figure it out. You need to find methods, find reasons for your mistakes, and that's how you learn the whole logic.

On Understanding a Company

37. I usually tell everyone I only have three stocks: Apple, Tencent, and Moutai. That's pretty much true.

38. When Apple finds that a product can't provide enough value to users, they just don't do it. They won't do something just for business, and that's their culture.

39. What do you think of Apple's current price? It's not cheap, but will Apple continue to grow? I don't know. Where will AI finally land? Isn't it still on the phone? It's possible for Apple to double, triple, or more in the future, but I don't know.

40. I think Apple's corporate culture is very good. They care a lot about doing things well and about user experience.

41. Over a decade ago, everyone was saying Apple would launch a car, but I said they would never do an electric car. What can they really do, and do they have enough differentiation? That's where I understand Apple better than most.

42. I don't know how much AI will replace search. But overall, I still think Google is pretty good.

43. I've watched a lot of Jensen Huang's videos. I admire him. What he said more than ten years ago is the same as what he says today. He saw it early and has been working in that direction.

44. I actually knew about TSMC very early, but I didn't understand the industry. I thought they were very asset-heavy, but now I see that with the takeoff of semiconductor AI, no one can escape TSMC—they've outperformed everyone.

45. I think you should at least get involved in AI; don't miss out completely, or you'll regret it.

46. The electric vehicle business won't be very good; it's exhausting and the differentiation is small.

47. There are two types of baijiu: Moutai and others.

48. The most important thing for Moutai is whether it has a culture that can sustain it. The core is Moutai's unique flavor and whether its target consumers recognize this unique flavor.

49. When Moutai was at 2,600 or 2,700 yuan, I really wanted to sell. But after selling, what would I buy? Those who sold lost even more, because they bought something else.

50. With today's thinking, I wouldn't invest in General Electric. Their business model isn't good. I wasn't as knowledgeable back then as I am now.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SoFi Becomes First U.S. National Bank to Offer Crypto Trading Amid Regulatory Shift

JPMorgan Pilots JPMD Deposit Token on Base, Accelerating Institutional On-Chain Finance

Ethereum Price At Crossroads: $3,532 Support Or $3,326 Slide?

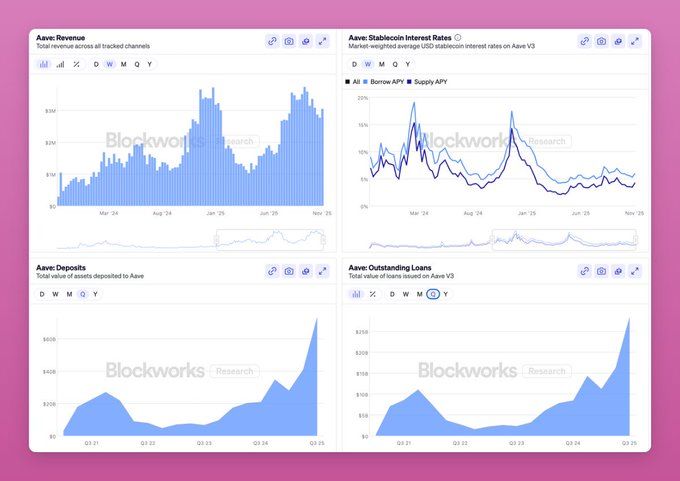

AAVE Price Prediction 2025: AAVE Eyes 2x Rally With Record On-Chain Growth