Polkadot Weekly Report | Polkadot Capital Group launches direct connection to Wall Street, W3F warns of risks from reduced inflation!

Polkadot

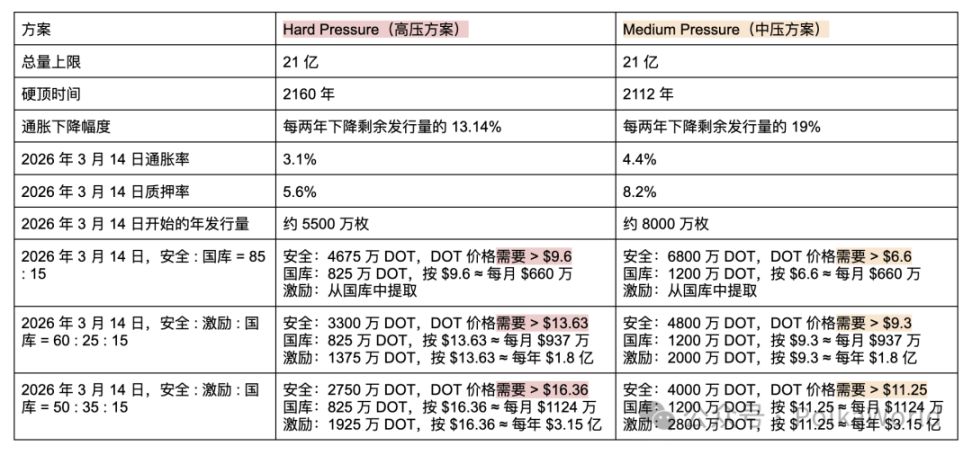

This week, the Growth Pressure plan was replaced by the Medium Pressure plan, which was re-proposed by Alice_und_bob and Jay after their meeting and is relatively less aggressive.

We have reorganized a comparison version, but it seems that Medium Pressure is no different from the previous Growth Pressure in terms of market cap pressure, except that it takes longer to reach the hard cap.

So, in the comparison between Hard Pressure and Medium Pressure, we can see:

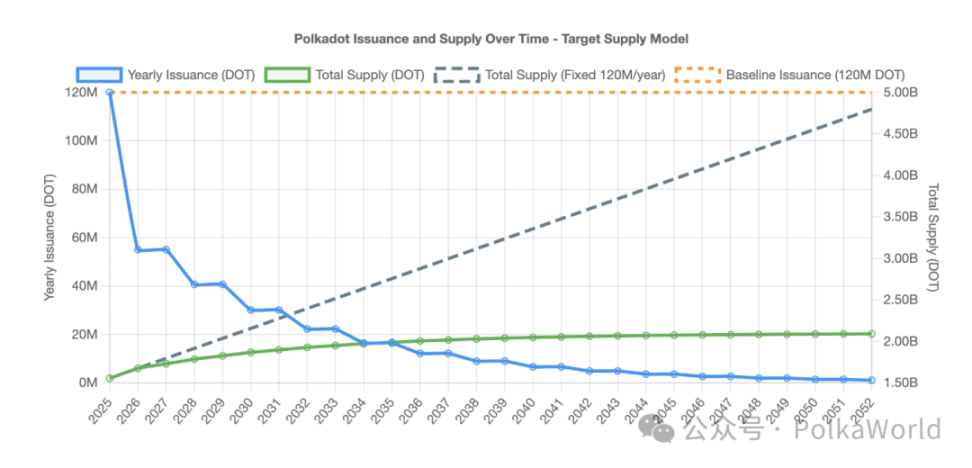

1. The annual issuance under Hard Pressure drops sharply at first (blue line below), and after 2052, that is, after 27 years, the annual new issuance will be less than 1 million DOT.

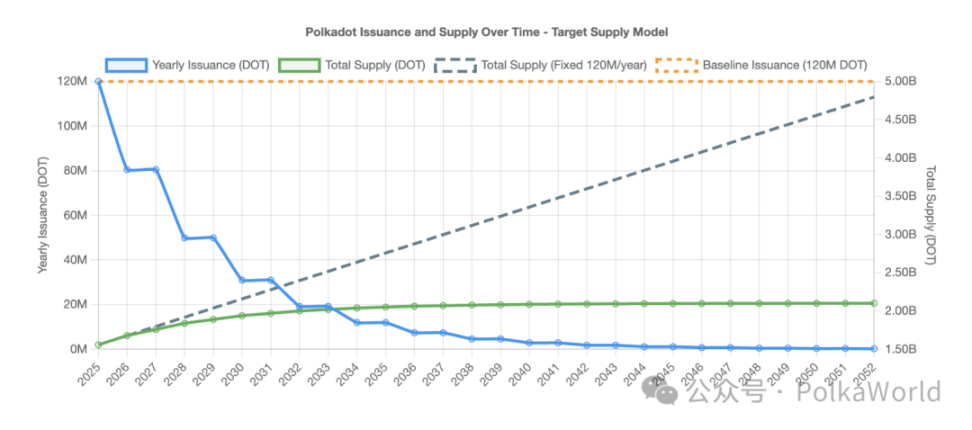

2. The annual issuance under Medium Pressure is overall more gradual (blue line below), and also after 2052, that is, after 27 years, the annual new issuance will be less than 1 million DOT.

3. Under the same allocation ratio, Hard Pressure exerts greater market cap pressure than Medium Pressure.

4. No matter which plan is chosen, in the future, after this proposal, we can adjust the parameters of the allocation ratio to regulate the market cap pressure and economic incentives for DOT.

In summary, regardless of the plan, we can adjust the "pressure" DOT's market cap faces through two types of "pressure":

- The first pressure comes from different degrees of inflation reduction

- The second pressure comes from the level of reduction in staker reward ratios

For specific data references, see the chart below.

You can also watch the replay of this week's PolkaWorld proposal livestream for a more detailed explanation.

Or read PolkaWorld's article for a comparison of all current DOT inflation proposals.

Regarding these proposals and discussions, Jonas Gehrlein, a research scientist at the Web3 Foundation, pointed out that a key issue is being overlooked: economic security. Jonas believes that Polkadot's security does not exist out of thin air, but is built on the staking of validators and nominators. Especially for those key validators at the "security lower bound," their security heavily depends on inflation rewards. If inflation is drastically reduced, Polkadot's economic resilience will almost decrease proportionally, and the network will become more vulnerable to economic attacks. In the worst-case scenario (bribing existing validators), the cost to attack Polkadot is only 14.71 million DOT, and if inflation is suddenly halved, this security lower bound will drop directly to 8.18 million DOT, greatly lowering the difficulty of attacking the system and sharply increasing the risk.

Jonas's policy recommendations:

1️⃣ Minimum commission & minimum self-stake

- Mandate validators to set a minimum commission (e.g., 10%) to ensure their long-term returns;

- Require validators to have a minimum self-stake amount (e.g., 10,000 DOT) to ensure they have "skin in the game".

2️⃣ Adjust issuance structure

- Currently, about 280,000 DOT are newly issued daily for staking rewards, and 50,000 DOT for the treasury;

- The overall inflation can be reduced by adjusting the ratio between the two, rather than simply cutting it. (Jonas here also confirms the importance of PolkaWorld's proposal to adjust ratios and parameters to influence inflation and market cap pressure.)

3️⃣ Relax nominator mechanism

- Remove nominator slashing and unbonding period to reduce participation risk and increase liquidity;

- Even if yields decline, users will still be willing to participate in staking, maintaining network security.

4️⃣ Inflation decay curve + total supply cap

- Design a continuously decreasing issuance model so that the total DOT supply gradually approaches a certain cap (e.g., π × 10⁹ DOT);

- Combine with coretime burn and transaction fee burn to make the economic model more sustainable.

Jonas's core view is clear: simply cutting inflation = reduced security; but cutting inflation + supporting policies = possible to achieve "low inflation + greater security".

See all his recommendations here.

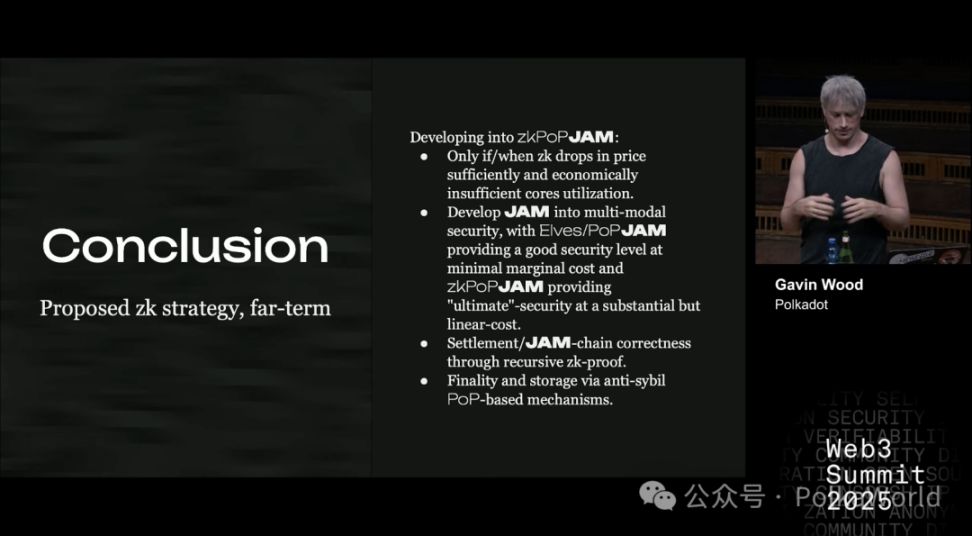

Check out the latest progress on the JAM protocol:

- Protocol audit expected to start by year-end: The 0.7 series is nearly complete, 0.8 will introduce gas modeling, and it is expected to advance to 0.9 and start the audit before the end of the year.

- Development toolchain is continuously improving: Parity and Gavin are building SDK & documentation, CoreVM functionality is being enhanced (audio/video output, data I/O, transaction-based service communication), and EVM support will be added in the future. More teams will also participate in building their own JAM SDKs.

- Cross-service messaging (JAM version XCM/XCMP) is under development and may directly use Hyperbridge for cross-chain implementation.

- Core collaborative scheduling (coreplay) is expected to be implemented within 12–24 months.

- Governance and standardization: The gray paper will be converted into technical specifications, an editorial committee will be established to ensure openness and transparency.

JAM is not only the core protocol of Polkadot, but may also become the unified infrastructure for Web3. For more details, see the latest PolkaWorld article.

According to PolkaWorld, Parity is building Polkadot Hub to become the main DeFi venue!

- Short term: Launch 100% EVM compatibility (REVM), allowing Ethereum applications to migrate with zero changes

- Long term: Develop PolkaVM based on RISC-V, supporting more complex and higher-performance applications

REVM allows developers, exchanges, and infrastructure providers to access with almost zero cost, and the Ethereum ecosystem can be seamlessly integrated. PolkaVM is the key to breaking through EVM limitations in the long term, bringing higher performance, multi-language support, and native extensibility.

This is Parity's dual-track strategy: short-term to accommodate Ethereum, long-term to reshape DeFi.

For an in-depth analysis, see the latest PolkaWorld article.

Breaking news! Polkadot has officially launched the Polkadot Capital Group, aiming to build a bridge between Wall Street and Web3 as US regulation becomes clearer.

The organization, led by David Sedacca, will closely connect asset management companies, banks, OTC desks, exchanges, and venture capital institutions with the Polkadot ecosystem. Key areas include: CEX + DEX infrastructure, real-world asset (RWA) tokenization, staking, and DeFi!

Sedacca stated: Polkadot Capital is establishing strategic partnerships with brokers, asset managers, and capital allocators to provide "clear, credible, and actionable resources." The goal is to help institutions truly understand and leverage Polkadot's unique value.

Latest update! DOT fast unbonding (reduced from 28 days to 2 days) has been fully developed! All review comments have been addressed! The PR has now been handed over to the code owners (Polkadot Technical Fellowship), awaiting merging according to the SDK roadmap and version cycle, and is expected to be scheduled after the Asset Hub migration (November 4). Learn more in the PolkaWorld article.

After Kusama referendum #569 was successfully passed and ran smoothly for a week, RFC103 has been officially deployed on Kusama! This is a historic milestone worth celebrating for the entire Polkadot ecosystem. This upgrade means that elastic scaling is now fully live on the Kusama network, and Kusama's parachains can now safely utilize multiple cores for computation, bringing higher throughput, lower latency, and greater scalability. In addition, Parity expects this feature to go live on Polkadot in early September, with the exact date to be announced after the relevant referendum is submitted!

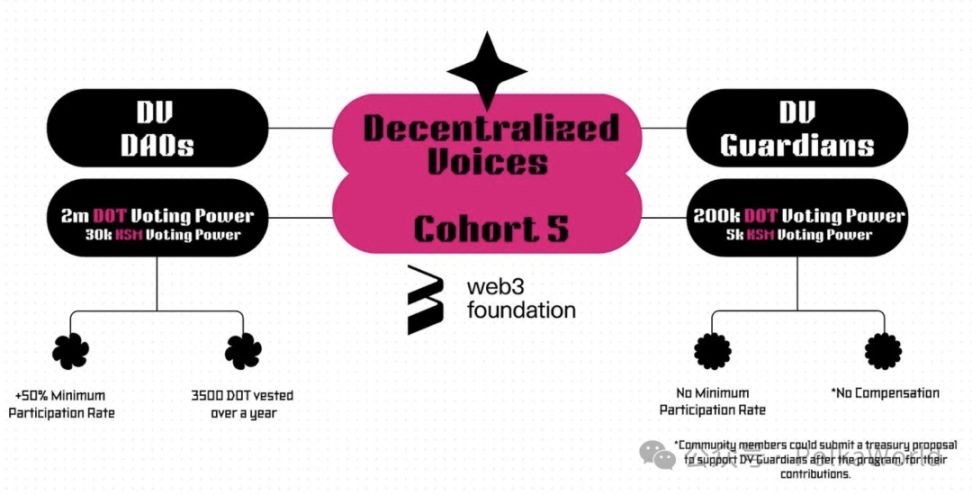

The Web3 Foundation announced the fifth batch of DV proxies this week! It includes 7 DV representatives and 5 DV-Light. Notably, the Foundation has introduced two AI Agents into DV-Light, marking the first time AI agents have been included in OpenGov. In addition, clearer rules have been set: one person can only join one DV entity, must avoid conflicts of interest, and will lose the Foundation's delegation after two violations.

We look forward to DV5 turning more voices into higher standards in the next four months, making OpenGov more resilient!

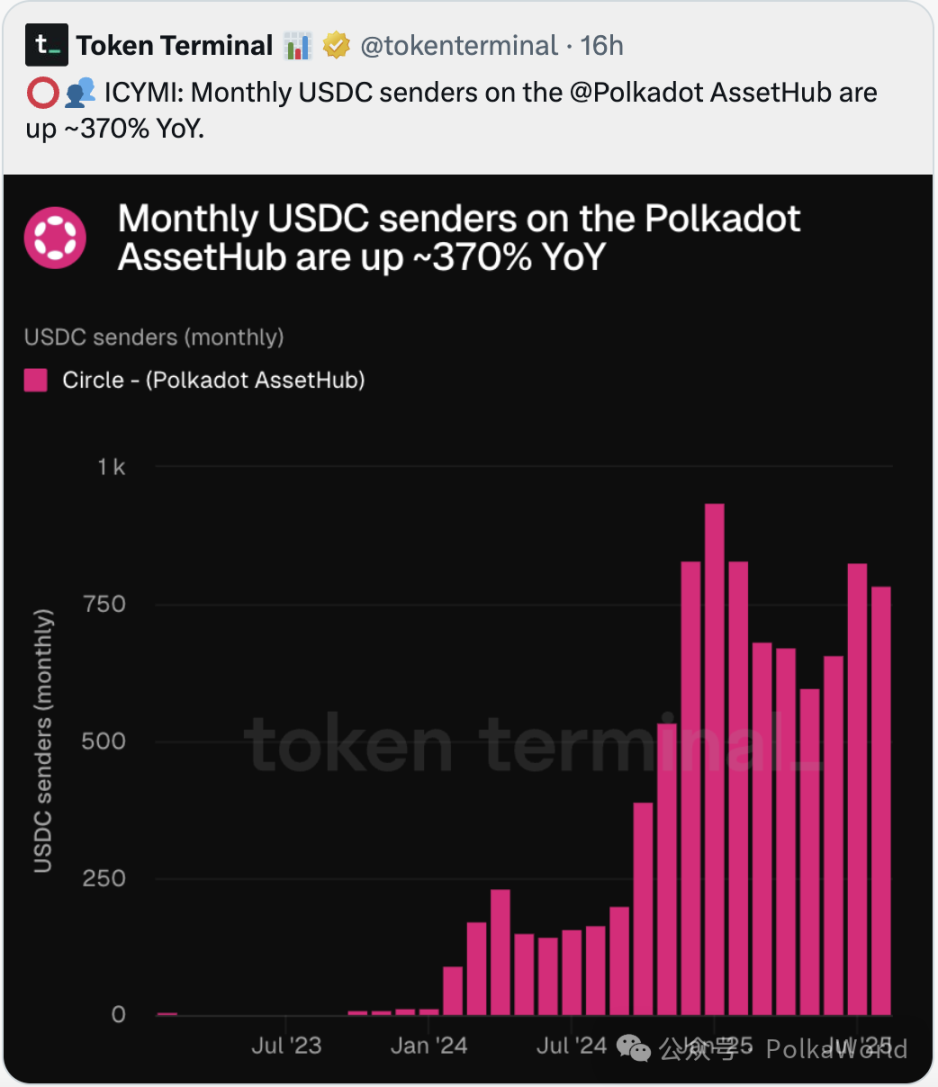

According to Token Terminal data, monthly USDC sending users on Polkadot AssetHub have increased by about 370% year-on-year! More and more users are sending and using USDC through Polkadot.

At Coinfest Asia 2025, the Polkadot booth became one of the most popular check-in spots, with a lively and energetic atmosphere that attracted a large number of developers and community members to participate. Polkadot's community in Southeast Asia is heating up, and the ecosystem is being recognized by more people in a more vibrant way. The event sneak peek has been released, and more exciting photos are coming soon!

Ecosystem Progress

Mythos launches ambassador program! Recruiting content creators to jointly promote the MYTH ecosystem. Possible content directions: educational content, news, tutorials, game videos, visual works, memes, etc.

- The top 3 monthly can win a legendary card + 500 MYTH

- Quarterly best ambassador reward: 1000 MYTH + rare card

- There are additional rewards during the event, with the top 10 each receiving 100 MYTH

How to apply: Contact community manager @MythosCharley to get the form.

At the 2025 Web3 Summit, Lollipop founder Qinwen_Wang proposed a brand new perspective for understanding the JAM protocol! Her insights are very interesting. In her view, JAM is not just a technical iteration, but an opportunity to redefine digital order! In PolkaWorld's latest video, starting from the perspective of "digital sovereignty" and global order, let's discuss the real-world value of the JAM protocol.

Bifrost product lead Tyrone put forward a viewpoint that hits the pain point: price determines the security level of the network.

He pointed out that if ETH staking APY reaches 10%+, almost no DeFi protocol would survive, as all liquidity would flow to ETH staking. This is the core dilemma facing Polkadot DeFi. He believes network security depends on token price, price depends on liquidity, and liquidity only flows where there are applications.

The Ethereum example is straightforward: Ethena launched an event on Aave and attracted $1.5 billion in liquidity in just half a day. Speed is everything. So the question is: on Polkadot, can teams achieve the same deployment speed? Can Polkadot Hub's precompiles bring this agility? This is the positive cycle for Polkadot that we need to consider. What do you think?

vDOT yield strategy update! This week, Bifrost has compiled several different vDOT yield methods for everyone, making it easier to choose the most suitable plan based on your risk preference:

1️⃣ Hydration's GDOT

- Swap any token for GDOT in one click to directly participate in yield strategies

- You can also lend vDOT or borrow other assets in the Money Market

2️⃣ Bifrost LoopStake

- Self-developed staking reward amplification mechanism

- Up to 4x leverage

- No liquidation risk

3️⃣ DOT-vDOT LP on StellaSwap

- Customize LP based on liquidity range

- The smaller the range, the higher the yield

- Lock $STELLA to increase returns and participate in voting

4️⃣ Bifrost Farming

- Create DOT-vDOT LP and deposit into the Farming pool

- Returns include $BNC rewards + trading fees (distributed as $BLP0)

More tutorials are available.

Polkadot ecosystem stablecoin coming soon!

Hydration's decentralized stablecoin HOLLAR (Hydrated Dollar) launched its testnet this week. The Polkadot ecosystem stablecoin is coming soon! The emergence of a stablecoin not only completes the DeFi infrastructure, but also means Polkadot will enter a new stage in terms of liquidity, cross-chain payments, and asset pricing.

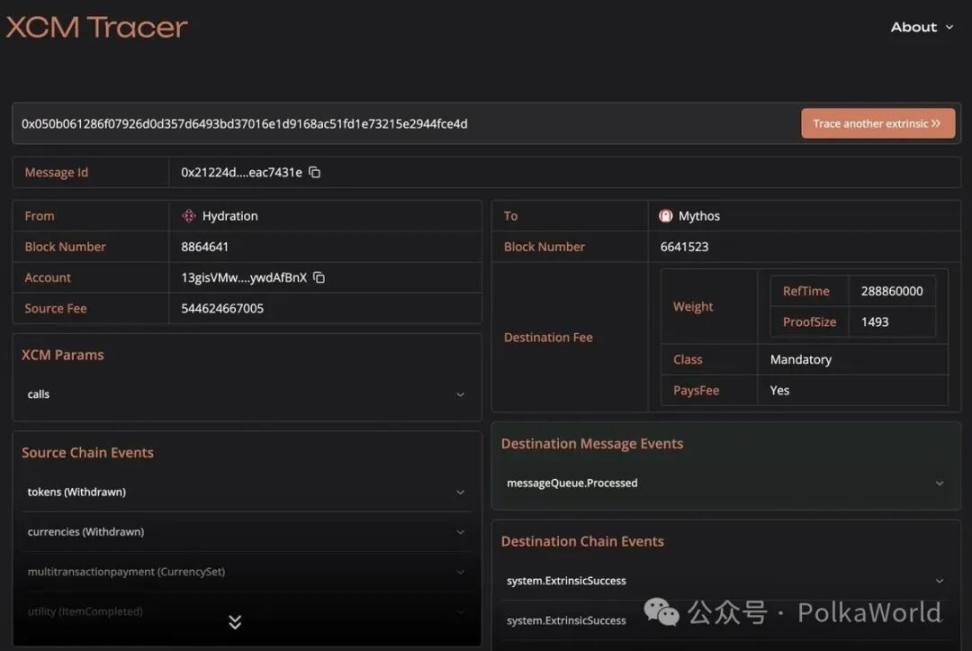

Are cross-chain messages always confusing? Written XCM but don't know where the message ended up? Try XCM Tracer developed by BlockDeep Labs!

Just enter the transaction hash and source chain to track the status and result of the message across multiple chains.

Visual interface, simple and intuitive, no more getting lost in block explorers. Supports any Substrate-based chain.

Handle the most complex cross-chain tracking in the easiest way.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polkadot Hub + PDP: Rewrite Rollup Deployment Rules to Accelerate Ecosystem Explosion!

A new paradigm beyond EVM chains: Polkadot smart contract platform to launch in October!