CME Group and FanDuel to launch US prediction markets platform next month

CME Group and FanDuel announced today that they will launch a prediction markets platform in the U.S. in December through the new standalone app, FanDuel Predicts.

According to a press release , the upcoming prediction markets platform plans to offer sports event contracts, accessible for users who live in states where online sports betting is illegal. Beyond sports, the new platform said it will feature event contracts on prices of cryptocurrencies, oil, gas, stocks and other benchmark assets.

"Our new event contracts on benchmarks, economic indicators and now sports will appeal to a new generation of potential participants who are not active in these markets today," said CME Group Chairman and CEO Terry Duffy. "This launch will dramatically expand our distribution and reach, connecting directly with FanDuel's millions of registered U.S. users."

The collaboration between a major derivatives exchange and a U.S. online fantasy sports platform comes as prediction markets rapidly emerge as a legitimate new sector at the intersection of information and finance.

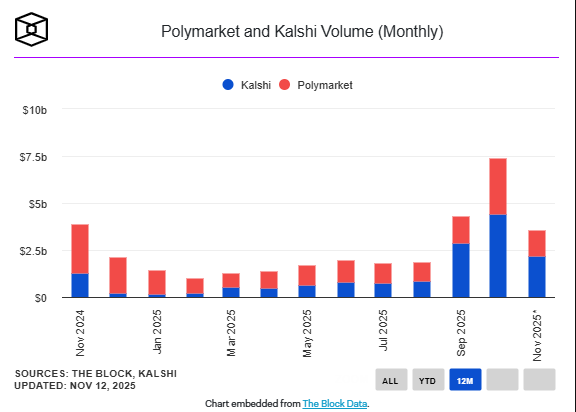

The prediction markets industry is currently dominated by two players — Kalshi and Polymarket. While Kalshi leveraged its U.S.-regulated status to achieve market leadership in volume, Polymarket may challenge Kalshi's position as it is reportedly relaunching in the U.S.

The two dominant players continue to expand their presence by adding key players in finance, sports and other industries. Robinhood picked Kalshi to offer event contracts on sports and policy on the platform, while Polymarket recently partnered exclusively with Yahoo Finance. Google and the National Hockey League chose to partner with both Kalshi and Polymarket.

Alongside CME and FanDuel, Winklevoss-led Gemini exchange is also racing to challenge the Kalshi-Polymarket dominance. The crypto exchange has already filed regulatory documents to operate a designated contract market, with plans to launch prediction market contracts "as soon as possible," according to a recent Bloomberg report .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Latest Speech by US SEC Chairman: Farewell to a Decade of Chaos, Crypto Regulation Enters an Era of Clarity

The US SEC Chairman further elaborated on the "Project Crypto" initiative, outlining new boundaries for token classification and regulation.

Grayscale, which once confronted the SEC, is about to be listed on the New York Stock Exchange

Since the launch of GBTC in 2013, Grayscale's assets under management have exceeded $35 billion.

Monad Ecosystem Guide: Everything You Can Do After Mainnet Launch

Enter the Monad Arena.

Comprehensive Data Analysis: BTC Falls Below the Critical $100,000 Level—Is the Bull Market Really Over?

Even if bitcoin is indeed in a bear market right now, this bear market may not last long.