Date: Thu, Nov 13, 2025 | 03:45 PM GMT

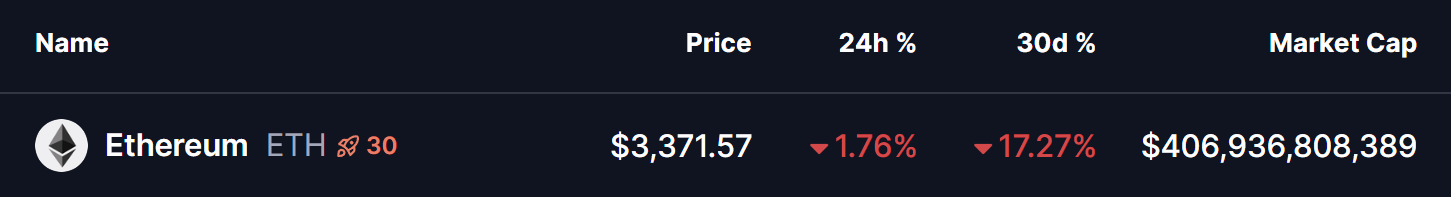

Ethereum (ETH) has managed to stage a notable recovery from its November 5th low of $3,061 to the current level of $3,388, showing a mild rebound after weeks of selling pressure. However, despite this short-term bounce, the broader trend remains cautious, as ETH is still down over 17% in the last 30 days.

Interestingly, ETH’s latest chart structure now appears to be forming a bullish fractal setup — one that mirrors the price action patterns that previously triggered major reversals in August and October.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Reversal

On the 4-hour timeframe, Ethereum’s price movement seems to be repeating a familiar cycle. In both August and October, ETH corrected sharply while forming descending broadening wedge patterns — a classic reversal formation that often signals exhaustion of selling pressure.

Each time, ETH bounced from the wedge’s lower boundary, then faced choppiness near the 50 moving average (MA) before breaking above the 100 MA, which confirmed a bullish reversal.

Ethereum (ETH) 4H Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) 4H Chart/Coinsprobe (Source: Tradingview)

Now, in November, ETH appears to be following the same playbook. The token has once again formed a descending broadening wedge, rebounded from its $3,061 low, and is currently hovering near $3,373, encountering volatility with the 50 MA. This setup mirrors the previous reversal fractals — hinting that a larger upside move could be developing if the structure holds.

What’s Next for ETH?

If this fractal continues to unfold as before, a successful reclaim of the 100 MA around $3,632 and a breakout above the descending resistance trendline near $3,660 would serve as a strong confirmation of bullish momentum. Such a move could potentially target the next key resistance at $4,250, marking a possible 24% upside from current levels.

However, if ETH dips below its recent local low of $3,232, it would weaken the bullish setup and potentially delay any reversal, leading to more consolidation in the short term.

For now, traders are advised to remain patient and watch for clear breakout confirmations before positioning for the next major move.