Uniswap Labs' "fee switch" activated: a mysterious move or the next narrative wave?

Author: Bruce

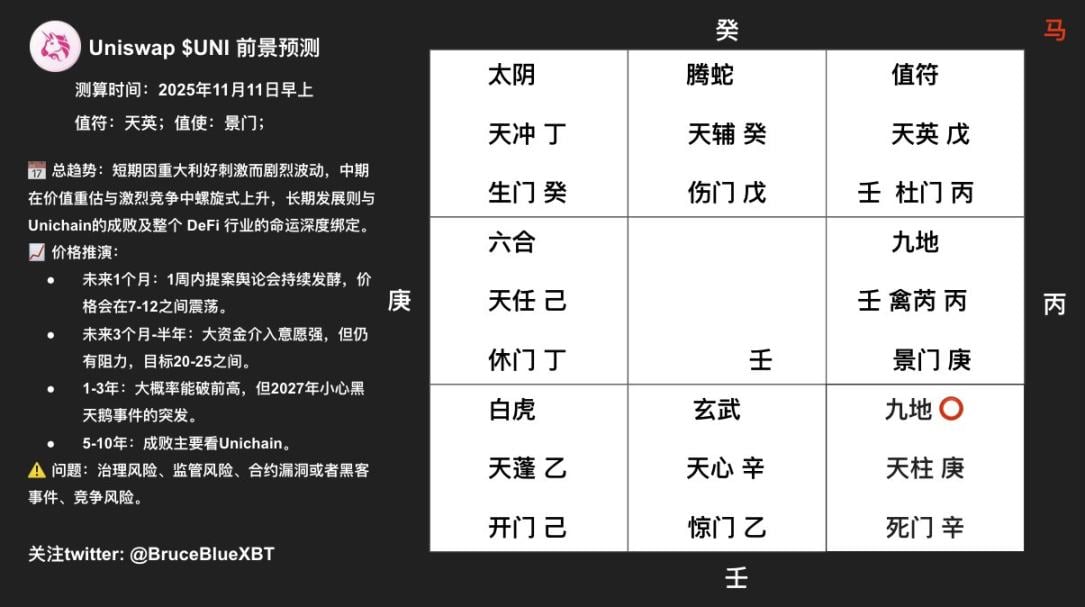

Original Title: Fee Switch, the Prospects and Opportunities of Uniswap Labs' Qimen Dunjia

Preface

The founder of Uniswap released the latest proposal in the early morning, which concerns the fee switch that has failed 7 times in the past 2 years. Here, borrowing the content from @Michael_Liu93, let’s explain this proposal and the concept of buyback:

-

Burned 100 million tokens, accounting for 10% of the total supply, about $950 million (to make up for previous burns that didn’t happen);

-

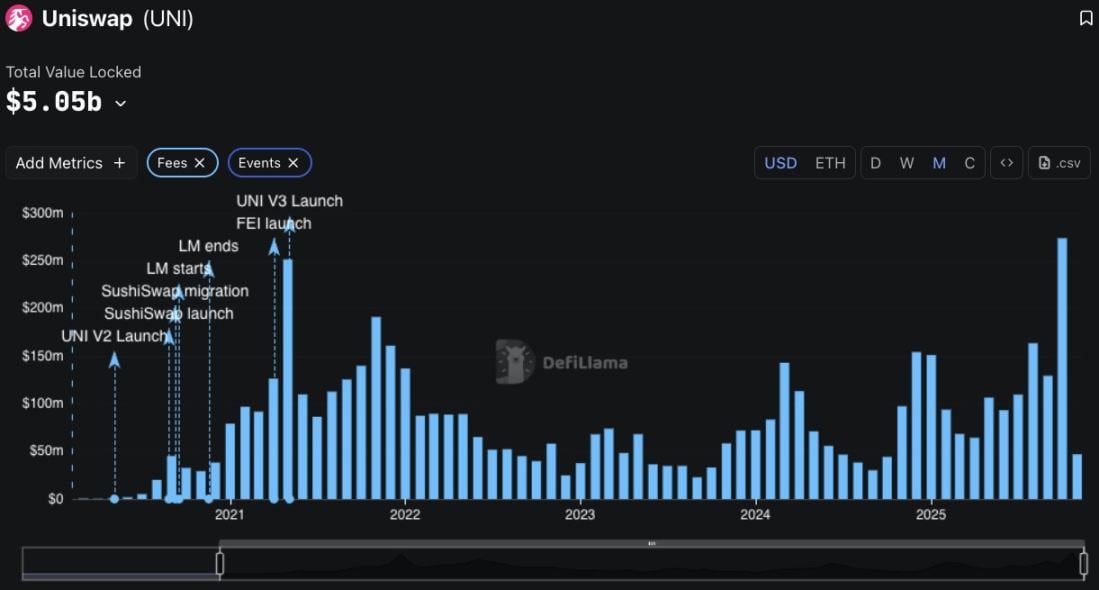

Use 1/6 of the fees for buyback and burn (5/6 goes to LPs). In the past 30 days, fee income was $230 million, annualized to $2.76 billion. 1/6 means $460 million per year is used to buy back and burn UNI on the market. At the current market cap, the annual deflation rate is just under 5% of the total token supply;

-

Calculating $UNI’s valuation multiples: $9.5 billion market cap, corresponding to a 21x P/E ratio, and a 3.5x P/S ratio;

-

Compared to hyperliquid: hyperliquid has a $42.1 billion FDV, annual income of $1.29 billion, annual buyback of $1.15 billion, P/E ratio of 37x, P/S ratio of 33x;

-

Compared to pump: pump has a $4.5 billion FDV, meme business income is highly volatile, fluctuating between $1-3 million in recent months. Assuming $1.5-2 million income per day, annualized income is $550-730 million (100% buyback), corresponding to a P/E and P/S ratio of about 6x-8x.

????♂️Follow me as I break down what the future holds for @Uniswap?

Will the proposal pass?

✅ Extremely high probability of passing (over 80%)

1️⃣ Core palace auspicious pattern dominates:

The Chief Deity falls in the Kun Palace, representing the highest decision-making body and final outcome. The pattern is the Azure Dragon Returning, a highly auspicious sign, indicating a trend that is bound to succeed. This pattern clearly points to the proposal ultimately passing.

Both the day stem and hour stem are blessed by auspicious deities and lucky stars, showing strong internal community momentum and that the proposal itself is of high quality and well-timed.

2️⃣ Opposition power transforms:

Key opposing roles (investors) have some power in the chart, but their palace pattern shows their stance has softened and shifted. Tianrui and Jiutian in the same palace indicate their concerns have shifted from "firm opposition" to "how to avoid risk in the process", with their energy now more focused on seeking solutions rather than direct obstruction.

⚠️ Core issues to be encountered in the process

Although passing is highly probable, the process will not be smooth sailing and will mainly face the following three major challenges, corresponding to three palaces in the Qimen chart:

1️⃣ Final confirmation of legal and tax risks (core obstacle)

Chart: Dui Palace with Tianrui + Jingmen + Jiutian, indicating a process that will require much debate and persuasion.

In reality: This is exactly what investment institutions like @a16z have always been concerned about. Before and after the vote, legal debates about securities classification and DAO tax liability will reach a climax. Additional legal opinions or minor adjustments to the proposal may be needed to fully dispel the doubts of large institutions. This is the most time-consuming part of the process.

2️⃣ Rebound and appeasement of the LP (liquidity provider) community

Chart: Zhen Palace with Liuhe + Xiumen + Tianren.

In reality: Some LPs will be dissatisfied because their income is being split, and may even threaten to move liquidity to competitors. Community governance needs to effectively communicate and explain the compensation mechanism (such as PFDA) and the rationale for phased implementation, to appease these emotions and maintain the foundation of the protocol.

3️⃣ Competitors seizing the opportunity to attack and public opinion interference

Chart: Li Palace with Tengshe + Shangmen + Tianfu Star.

In reality: Competitors will seize on the narrative that "UNI sacrifices LPs", creating negative public opinion on social media, attempting to shake community consensus and siphon off users and liquidity.

What are the prospects for development?

The overall trend can be summarized as: short-term violent fluctuations stimulated by major positive news, medium-term spiral upward amid value revaluation and fierce competition, and long-term development deeply tied to the success or failure of unichain and the fate of the entire DeFi industry. Its fortune is not a smooth road, but a process of gradually realizing its potential as a "DeFi blue-chip leader" after overcoming many obstacles.

???? Core trend evolution

1️⃣ Short-term trend (next 3 months): news-driven, volatile consolidation

Violent fluctuations: Bingqi falls in Dui Palace (Jingmen + Jiutian), representing a sudden surge triggered by the proposal news. However, after the price spikes, there will inevitably be pullbacks and volatility.

Key node: The 22-day voting period ahead is the core observation window. The Chief Deity at Jingmen in Dui Palace, $7 – $7.5 is the short-term lifeline. If it holds, there is hope for another rally after the proposal passes.

Market sentiment and voting progress will dominate the price, with wide fluctuations as the main trend, accumulating energy for the next directional move.

2️⃣ Medium-term trend (6 months - 2 years): value revaluation, upward trend

Pattern opens: Jiashen Geng falls in Kun Palace, with Chief Deity and Tianying. This pattern suggests that once the proposal passes, it will attract mainstream capital attention and start a round of value discovery.

6 months: Target price $15 – $25, corresponding to a market cap of $15 – $25 billion, achieving the baseline scenario.

1-2 years: If protocol revenue can be effectively captured and deflation stabilized, it is expected to challenge the historical high of $44.5 and move towards the $50 – $75 range. In 2026 (Bingwu year), Li Palace is filled, and policy and ecosystem positives may resonate.

3️⃣ Long-term trend (3-10 years): ecosystem as king, destiny fulfilled

Success path: If @Unichain can successfully build the ecosystem, combining protocol revenue with on-chain value capture, $UNI will no longer be just a trading protocol token, but will be upgraded to the core asset of Web3 financial infrastructure. The Qimen chart pattern of "Chief Deity guards Kun, Azure Dragon Returns" also supports its long-term leadership, with price targets of $100 – $200.

Mediocre path: If it fails to break through in competition and only maintains its current market share, $UNI will become a high-quality "DeFi bond", its value supported by stable buyback and burn, with price likely fluctuating in the $30 – $60 range.

Competitive landscape: Moat and breaking points

Moat: @Uniswap’s Chief Deity in Kun Palace represents its strongest brand, liquidity, and user habits, which are insurmountable gaps for other competitors in the short term.

Breaking point: Competitors in Dui Palace, Tianrui + Jiutian, their high token incentive model (ve(3,3)) is aggressive but unsustainable. The key for @Uniswap to break through is to use V4 Hook, @Unichain and other technical iterations to create new sources of value without seriously harming LP income, achieving "having your cake and eating it too".

Core risk warnings

Governance risk: The greatest uncertainty remains in the vote. Although the probability of passing is high, Dumen is the main obstacle, so beware of whales like @a16z raising new legal concerns at the last minute.

Competitive risk: Zhen Palace Liuhe + Xiumen, suggesting other protocols may unite to grab liquidity. If the fee switch causes a large loss of LPs, it will shake the foundation.

Macro and regulatory risk: Kan Palace Xuanwu + Jingmen, be wary of black swans in global regulatory policy after 2026, as well as systemic risks from crypto market bull-bear cycles.

Prospects deduction: Success or failure lies in ecosystem integration

???? Uniswap: Value Return and Defense Battle of the DeFi Overlord

Core prospects: The protocol will completely transform from a "governance tool" to a "yield asset", completing the value capture loop, but its liquidity throne faces unprecedented challenges.

1️⃣ Value reshaping (1-2 year golden window)

Pattern positioning: Kun Palace "Chief Deity + Wu Bing Azure Dragon Returns", symbolizing the return of the king and value revaluation. The activation of the fee switch is the key to igniting this trend. $UNI will shed its label as a "valueless governance token" and become a core asset with clear cash flow and deflation expectations.

Valuation target: Based on hundreds of millions of dollars in annualized buyback and burn, its P/E ratio will move from the current 2.2x (fee basis) towards traditional tech stocks (20-30x). It is highly probable that the market cap will return to previous highs ($44.5) within 1-2 years, and in the medium to long term may challenge the $75-$100 range.

2️⃣ Moat defense (core contradiction)

Risk: Dui Palace Tianrui + Jiutian, competitors are launching fierce attacks with extremely high capital efficiency (ve(3,3) model). @Uniswap’s strategy of sacrificing some LP income in exchange for protocol revenue is a double-edged sword.

Key to success or failure: Whether innovations such as V4 Hook and PFDA auctions can create enough new sources of income for LPs to offset the fee cut. If so, the moat is reinforced; if not, it will fall into a negative spiral of liquidity loss.

⛓️ Unichain: A high-risk ecological breakout battle

Core prospects: This is a high-risk gamble. If successful, it opens up a trillion-dollar valuation space; if it fails, it may become a mediocre "backup chain".

Unichain revenue situation

1️⃣ Opportunities and ambitions

Pattern positioning: Gen Palace "Kaimen + White Tiger + Tianpeng". Kaimen means huge market opportunities and new narratives, Tianpeng indicates bold speculation and expansion, suggesting @Unichain aims to solve mainnet performance bottlenecks and value capture challenges through a dedicated chain model, building new ecosystem barriers.

Imagination space: If @Unichain can deeply bind its sequencer revenue, V4 native advantages, and $UNI tokenomics, it will no longer be just a chain, but the value settlement layer for the entire @Uniswap ecosystem, with potential far beyond a simple DEX protocol.

2️⃣ Risks and challenges

Dangerous pattern: White Tiger indicates fierce competition and a sense of oppression, showing @Unichain will face direct competition from mature L2 ecosystems like @base, @Arbitrum, and @Optimism. Tianpeng also hints at "over-speculation" and "security vulnerabilities".

Core problem: Ecosystem cold start: How to attract top applications beyond @Uniswap itself to settle in and form network effects is its life-or-death line.

Value proof: In the early stage, can annualized sequencer revenue of only $7.5 million support the huge cost of chain development and maintenance, and feed back to $UNI holders?

???? Symbiotic relationship: Prosper together, decline together

Success Scenario (70% probability): @Uniswap relies on its brand and liquidity to stabilize the base, providing initial users and credibility for @Unichain; @Unichain, with lower transaction costs and more flexible Hook applications, feeds back to @Uniswap, consolidating its leading position and opening up new revenue sources. The two form a flywheel, and $UNI becomes the universal key to the entire ecosystem's value.

Failure Scenario (30% probability): @Uniswap loses liquidity due to the fee switch, and its market share is eroded; @Unichain stagnates due to lack of ecosystem. The two drag each other down, and $UNI’s value return story ends in disappointment.

???? Key observation points for future evolution

-

Early December 2025: Final vote result of the fee switch proposal and the market’s immediate reaction.

-

Mid-2026: V4 adoption rate and early deployment on @Unichain.

-

2027: Unichain’s independent TVL and number of native applications, and whether it can form its own ecosystem.

The ultimate fate of Uniswap Labs: Spin-off and IPO?

In the future, Uniswap Labs spinning off part of its business (such as @Unichain development, frontend services) into independent companies and seeking an IPO is a highly likely path.

✅ Favorable factors supporting IPO (probability: about 60%-70%)

1️⃣ Chart shows "Kaimen" can open

Representing Uniswap Labs' initiative, the Gen Eight Palace itself carries "Kaimen", which stands for new organizations, new opportunities, and cooperation. Spinning off part of the business into a company fits this sign.

Tianpeng star falls in this palace, indicating bold capital operations and expansion, showing the Labs team has enough ambition and drive to push for such large-scale financing moves.

2️⃣ Clear value carrier, avoiding core conflicts

This move cleverly separates "protocol governance rights" (belonging to $UNI tokens) from "technical service and development rights" (belonging to the listed company’s equity). The listed company can clearly use its technical capabilities, software development income, and future @Unichain sequencer revenue as the basis for valuation, no longer directly tied to the securities attributes of $UNI tokens, thus resolving the most fatal regulatory contradiction.

3️⃣ Successful precedents to follow

Just like the relationship between @Coinbase and @Base, and earlier, @ethereum and @Consensys. @Consensys, as the core development force of the Ethereum ecosystem, has undergone multiple rounds of financing and has repeatedly been rumored to go public. This provides a clear blueprint for Uniswap Labs.

⚠️ Challenges and risks faced (obstacles remain)

1️⃣ Market competition and pressure

Gen Palace sees White Tiger, meaning that even if spun off and listed, the process will be accompanied by extremely fierce market competition and huge external pressure. The capital market will compare it to companies like @Coinbase and scrutinize its profitability and growth potential.

2️⃣ Subtle balance of the pattern

The listed company will still need to deeply rely on the @Uniswap protocol’s brand and ecosystem. Ensuring the interests of the listed company and the decentralized community are aligned will be a major governance challenge. If the listed company’s actions harm the protocol’s interests (such as charging excessive fees), it will trigger strong opposition from the $UNI community and shake the foundation.

3️⃣ Business independence and valuation basis

The capital market will ask: What is the core moat of this company? If it is just the frontend service provider of the @Uniswap protocol, its value is limited. It must prove it has technical advantages and income sources independent of the protocol (such as exclusive operation rights for @Unichain, cross-chain technology patents, etc.) to obtain a high valuation.

Final words✍️

At the crossroads of DeFi, Uniswap Labs is using the fee switch as a key to open the golden age of value capture: the proposal is highly likely to pass, $UNI will transform from a governance tool to a yield asset, join hands with the @Unichain ecosystem to break through, and form a mutually beneficial flywheel effect. Furthermore, if Labs successfully spins off and goes public, it will resolve regulatory shackles, inject mainstream capital vitality, and push $UNI to new heights. But success or failure depends on community consensus, competitive defense, and the guidance of fate.

Are you ready to witness the return of the DeFi king and the rise of the Web3 financial empire?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Government Reopens, Crypto Braces for Liquidity Surge and FED Rate Cut Uncertainty

Bitcoin Enters ‘Fear Zone’ After $100K Breakdown — Sentiment Suggests a Bullish BTC Setup

IOTA Integrates With zCloak.Money to Deliver Fully On-Chain Multisig Wallets

MoonPay Drops A Next-Gen Stablecoin Suite For Cross-Chain Builders