Undercurrents in the Race for Federal Reserve Chair: "Draining Wall Street" Becomes the Core Issue

Trump desires low interest rates, but the Federal Reserve chair candidates he favors advocate for restricting the central bank's primary tool for achieving low rates—quantitative easing.

Trump is eager for low interest rates, but the Federal Reserve chair candidates he favors advocate restricting the central bank’s core tool for achieving low rates—quantitative easing.

Source: Golden Ten Data

The main contenders for Federal Reserve chair under President Trump are forming a consensus around a policy that appears at odds with Trump’s style.

According to Politico, Trump has been loudly criticizing current Fed Chair Jerome Powell, with the real intention of appointing a new central bank chief next year who aligns more closely with his own philosophy. However, much of the discussion in this succession race has focused on an issue seemingly contrary to Trump’s stance: limiting the size of the Fed’s financial asset holdings.

It is well known that Trump favors low interest rates. He has repeatedly expressed his desire to lower mortgage rates and reduce the federal government’s interest burden. But now, policy momentum is shifting toward restricting the Fed’s main tool for achieving this goal—the Fed currently holds assets well in excess of $6 trillion, a result of the institution not only cutting short-term rates to zero during past crises, but also expanding its balance sheet by purchasing trillions of dollars in Treasuries and mortgage-backed securities, thereby pushing down the long-term rates that are more critical for home and auto loan borrowers.

Now, Trump’s allies are fiercely debating whether the Fed should reduce its intervention in the next recession. This poses a key question for the president as he weighs candidates for Fed chair: does he want to weaken the Fed’s influence on markets, or use that influence to achieve his goal of ultra-low interest rates?

Treasury Secretary Bessent, who is overseeing the selection process—and is himself considered one of Trump’s candidates—wrote in a 5,000-word magazine article that the Fed must commit to “reducing its distorting influence on markets.” Republicans have long accused the Fed of undermining market discipline by injecting massive amounts of cash into the financial system, and Bessent broadly defines the current relationship between government and markets as unhealthy.

This view is echoed by other names on the Fed chair shortlist. Former Fed governor Kevin Warsh recently used populist rhetoric on Fox Business, declaring: “We need to pull money out of Wall Street.” At a roundtable with reporters last month, when asked whether he was seeking a Fed chair candidate who supports balance sheet reduction, Bessent did not give a direct answer. He explained that the main point of his article was more forward-looking: to warn about future asset purchases, rather than to call for an immediate shrinking of the Fed’s balance sheet.

“Just as the effectiveness of antibiotics diminishes over time, the effect of repeated interventions also gradually weakens,” he admitted to the author, but acknowledged that reform is indeed a consideration in his selection process. However, as the author observes, the only time Trump has commented on the size of the Fed’s balance sheet was in a cryptic tweet in December 2018, calling for a halt to balance sheet reduction—out of concern that liquidity in key funding markets could be impaired.

Some leading candidates have shown different positions. Warsh has spent the past fifteen years pushing to limit the size of the central bank, arguing that shrinking the Fed’s balance sheet would allow it to cut short-term rates without triggering inflation (though not all experts agree with this view). Fed governor Michelle Bowman, who is on Bessent’s shortlist, has called for establishing the “smallest possible balance sheet,” describing it as a way to preserve policy space.

Bessent himself has not entirely ruled out the possibility of heading the Fed. Although he previously indicated he would decline, Trump’s latest remarks are intriguing: “I’m considering him for the Fed... but he doesn’t want the job. He’s more interested in the Treasury Secretary role, so we haven’t really considered him.”

One reason for the current situation is that concerns over the Fed’s expanding power are indeed driving the actions of Bessent, Warsh, and others. The Treasury Secretary’s arguments reflect small-government principles in many ways. In an article for International Economics magazine, he pointed out that the Fed’s asset purchases (i.e., quantitative easing) created room for Congress’s massive post-pandemic spending and exacerbated wealth inequality by artificially inflating asset prices.

But it is hard to believe that the highly improvisational Trump would want a Fed leadership that refuses to go all out during a recession. However, for Republicans who want to constrain the Fed’s presence in markets, this may be the best opportunity.

The Fed is currently set to stop shrinking its balance sheet on December 1, a decision aimed at preventing liquidity disruptions in the financial system. Stephen Miran, the White House’s chief economist (currently on leave) and a Fed governor, supports this decision. He told the author that the move may have limited stimulative effect on markets, as the central bank will simultaneously swap mortgage-backed securities for short-term Treasuries—meaning the market will take on the long-term debt risk previously held by the Fed.

Regarding more aggressive interventions, Miran said that when the Fed’s dual mandate of full employment and price stability faces “major, not minor, risks,” he does not oppose quantitative easing. It should be noted that academia has yet to reach consensus on key questions such as how quantitative easing affects market pricing and to what extent it can stimulate a recessionary economy.

In a speech last month, Powell suggested that, in retrospect, the Fed’s asset purchases in 2021 may have lasted too long—a view some experts held at the time. But he also defended quantitative easing as a critical policy tool, especially when the 2020 pandemic froze markets and sent unemployment soaring.

The core issue now is how the situation will evolve in the coming months, as Powell’s term as chair expires in May next year. Voices advocating a more cautious approach to quantitative easing are gaining greater influence, signaling that the Fed’s response to future recessions may undergo profound changes.

But regardless of who is ultimately chosen, there is reason to believe that Fed officials appointed by Trump will still be forced to use all policy tools in the event of an economic slowdown—especially at a time when Americans are deeply concerned about the cost of living. As the saying goes, in times of crisis, everyone turns to God. The tough stances these candidates take now will likely crumble in the face of a future crisis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

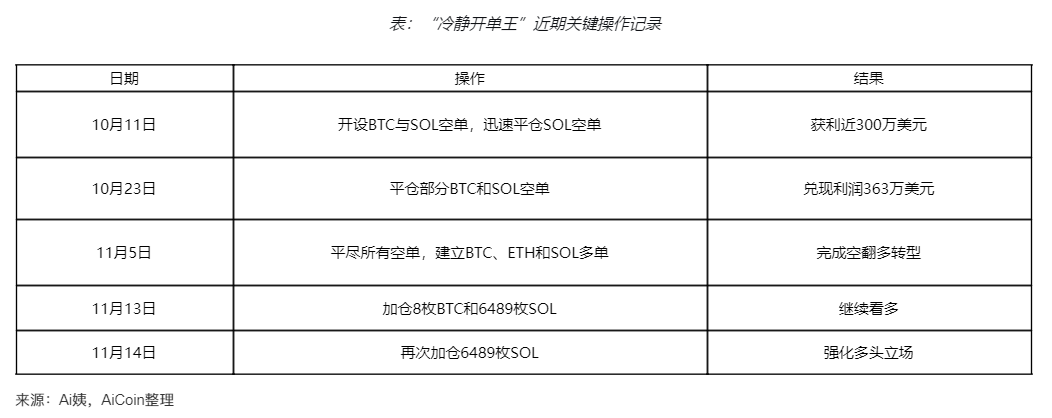

"The Calm Order King" increases positions against the trend, strengthening the bulls!

Nvidia earnings day could be awkward? Renowned analyst: Even with strong performance, the market will remain "nervous and uneasy"

On the eve of its earnings report, Nvidia is facing a dilemma: if its performance guidance is too strong, it may trigger concerns about over-investment; if it only raises guidance moderately, it could be seen as slowing growth. In either case, it may lead to market volatility.