Polkadot Weekly Report | Polkadot Featured in the UK House of Lords! Grayscale Polkadot Trust ETF Filing Updated!

Polkadot

The monthly Polkadot Technical Fellowship developer meeting was held this week, announcing the following major updates:

- Polkadot Asset Hub migration schedule: Targeted for November 4 (UTC 8–9am start), data migration is expected to take 4.5–7.5 hours, with an additional 1-hour "warm-up" and 1-hour "cool-down" window; a public migration monitoring dashboard will be available, and the process will reference the Kusama migration.

- Kusama migration review: Overall smooth; a minor flaw was found in the staking system (a small number of validators’ self-stake was not included in rewards), the fix is in progress, and a proposal will compensate affected validators from the treasury based on calculated amounts.

- Inflation and supply cap: Hard Pressure code is basically ready, discussion points include implementation of "dynamic burn accounting"; timeline is "can be implemented before March," and code may be merged even earlier.

- Elastic Scaling: Removed RFC-103 feature switch, fixed fork observation issues under multi-core (backported to 25.09 stable version); Kusama canary parachain tested "block confidence" ≈99%/12 hours, aiming for 100%; optimized block production latency—block producers establish connections one slot in advance, average block delivery latency ≈16ms (significant improvement in 3-core scenarios).

- Asset Hub asset model upgrade: Supports registration of "non-teleportable" foreign assets, defaulting to non-teleportable; benefits Hydration’s Hollar registering on AH but maintaining a single reserve (easier to operate); targeted to go live with AH contract capabilities.

- Snowbridge: XCM v5 is live; B2 contract upgrade completed and passed bidirectional transfer tests; previously, 6 Polkadot → Ethereum transfers (about $100,000) failed due to inconsistent upgrade schedules between AH and Bridge Hub in version 1.7, now replayed via referendum and process improved (dual-side dry run, phased changes, explicit dependencies).

- Polkadot SDK / Pallet evolution: Multiple pallets migrating from "Currency trait" to "Fungible trait" (identity, lottery, treasury, etc.); Kusama Asset Hub will enable "storage reclaim (weight reclaim)"; external contributions advancing binary Trie storage attempts; Zombienet testing supports "genesis instant onboarding," significantly shortening CI time.

- JAM interoperability and consistency: About 20 implementation teams participated in 0.7.0 fuzzing and continuous improvement, now moving to 0.7.1; Web3 Foundation takes over the first phase of test execution, while the core development team enters the next phase, researching and designing new test systems to verify JAM block production and network behavior.

- Governance / voting experience: RFC-150 allows "partial override voting under delegation" (no need to revoke delegation to vote independently), code is highly complete, pending migration scripts and merging.

- Cryptography / bridging: Advancing BLS-related capabilities on Westend to support subsequent bridging tests; ZK verifiers and BLS+APK-based test bridges have received funding and are progressing as planned.

- Community and organization: Technical streamlining for ambassador on-chain and funding paths, but it is recommended to synchronize with contract roadmap and latest governance treasury attitudes to avoid a "tech-ready / treasury-absent" implementation gap.

All videos can be replayed here:

Latest: Grayscale Polkadot Trust ETF document updated!

According to documents from the U.S. Securities and Exchange Commission (SEC): Grayscale Polkadot Trust ETF submitted an S-1 amendment (Amendment No.1) on October 20, 2025.

- Added staking functionality, which may directly bring on-chain returns to holders in the future;

- Supplemented risk disclosure and compliance explanations, improving regulatory transparency;

- Incorporated the latest U.S. legislative provisions to comply with a more streamlined ETF approval process.

Everything is ready, just waiting for the U.S. government shutdown to end before continuing the approval process.

Breaking news! $1.77 trillion asset management giant T. Rowe Price submitted an actively managed crypto ETF on October 22, covering $DOT (Polkadot). The recognition of Polkadot by traditional financial institutions is undeniable and is accelerating, reflecting not only DOT’s technical value but also its ecosystem maturity and investment potential being accepted by the mainstream market.

The actively managed ETF feature means professional investment teams will dynamically manage the crypto asset portfolio, making it more likely to attract long-term capital and prudent investors. This could become a new catalyst for Polkadot’s liquidity and market depth, opening a broader institutional capital gateway for DOT and signaling that the crypto market is moving toward mainstream financial systems!

Reminder! Polkadot’s Elastic Scaling feature is now officially live! It introduces a "vertical scaling" mechanism for Polkadot’s native rollup, allowing on-chain applications to dynamically allocate compute cores as needed, achieving more efficient execution performance and providing users with a near-Web2 smooth experience.

This upgrade marks the completion of Polkadot’s three-phase scaling roadmap:

- Async Backing: Block time reduced to 6 seconds, throughput increased 8–10x

- Agile Coretime: Introduced on-demand core resource mechanism, replacing the auction model

- Elastic Scaling: Multi-core dynamic execution, up to 3x performance improvement

The combination of these enables Polkadot Rollup bandwidth to reach 20MB/s, delivering interaction speeds almost indistinguishable from Web2. It is especially suitable for:

- High-concurrency gaming

- Real-time trading

- AI inference and data streaming applications

Currently, rollup teams can:

- Test and enable elastic scaling themselves

- Conduct performance benchmarking

- Share optimization results with the ecosystem

Elastic Scaling user guide:

PolkaWorld shared Efímero this week, a one-time-use chain, bringing new possibilities for high-frequency user interaction and short-term events. It is not only a technical experiment but also reflects the spirit of geeks in the Polkadot community constantly exploring on-chain infrastructure transformation. Learn what Efímero is in our latest video!

PolkaWorld also shared a series of videos celebrating Parity’s tenth anniversary this week! Over the past decade, Parity has focused on building the foundational infrastructure for Polkadot. Now, this foundation is solid, and finally, they and Gavin can build the products they have always envisioned! The next decade will be product-driven! For the Chinese version, check out PolkaWorld’s three recent videos.

In addition, Gavin Wood was interviewed by The Kus during Parity’s team-building last week, discussing the next decade for Parity and Polkadot! The interview video will be released next week, stay tuned!

Another major integration for the Polkadot ecosystem!

Crypto App now officially supports deposit and withdrawal of USDT and USDC on Polkadot Asset Hub! Stablecoin users on Crypto App can now seamlessly enter and exit the Polkadot ecosystem, where a series of cool games and DeFi activities await you!

Gavin in action! Polkadot appears in the UK House of Lords! Web3 education and policy dialogue officially begins! Last Wednesday, the "Web3 Education, Innovation & Opportunity" roundtable event, hosted by Baroness Uddin and Dr. Lisa Cameron, was held at the House of Lords in London. Polkadot founder Gavin Wood attended in person, discussing Web3 education, innovation, and policy opportunities with leaders from UK politics, academia, and industry.

This event was co-organized by the Polkadot Blockchain Academy team and supported by the Polkadot Event Bounty treasury. With the theme "Empowering Web3 Adoption through Education," it became one of the first high-level meetings in UK politics to formally discuss Web3 education and regulatory innovation.

This roundtable not only sparked heated discussion in UK political circles but is also seen as a key milestone for Polkadot in bringing Web3 into the national policy agenda. In the future, the team will use this event as a starting point to promote global Web3 education and blockchain knowledge, helping more countries share the innovative achievements of this emerging industry!

Polkadot Cloud is worth your choice! This week, the entire network experienced another global AWS outage, throwing the internet into chaos... This once again reminds us: 99% of the online world is still controlled by a handful of cloud providers. The meaning of Web3 is to make the network distributed, verifiable, and always online. Decentralization is not a slogan; it is the "backup heart" of the internet. Polkadot Cloud is worth your choice!

Polkadot TPS growth leads the entire network! Data monitoring platform Chainspect released the latest ranking: On October 23, Polkadot ecosystem ranked first in the full-chain throughput (TPS) growth list with a +23% increase!

🥇 Polkadot —— TPS soared +23%

🥈 Arbitrum —— up +21%

🥉 Flow —— up +16%

This means Polkadot continues to expand its lead in network performance and concurrent processing capabilities, with its multi-chain architecture and recent system parachain migration results gradually showing effect.

With the advancement of JAM architecture and Elastic Scaling, Polkadot’s throughput growth is far from its ceiling. Future multi-chain interoperability will be faster, more stable, and stronger.

The Bittensor team tweeted, "Bittensor is built on Substrate, which is a seriously underestimated advantage. Chains based on Substrate architecture have achieved 20 times the speed of Solana in terms of performance."

This not only validates Polkadot’s real-world scalability, but also proves the structural advantages of the Substrate framework in high-performance, modular blockchain development. Polkadot is not just a multi-chain interoperable network, but an on-chain operating system born for performance, flexibility, and long-term sustainability.

Polkadot will complete the Asset Hub migration on November 4, fully upgrading ecosystem performance! This migration will significantly improve network efficiency and user experience:

✅ Lower transaction fees

✅ Smoother cross-chain transfers

✅ Higher network security

At the same time, SubWallet now fully supports automatic migration of DOT and KSM, allowing users to update assets without manual operation. After migration, the staking experience will also be faster and more stable, laying the foundation for new staking scenarios in Polkadot 2.0 (such as #DOT, #TAO, etc.).

It is worth noting that the amount of crypto assets stolen in 2024 has reached $494 million. SubWallet provides cold wallet and multi-chain security support, offering users a safer asset management environment. After migration, Polkadot will enter a more efficient and secure new 2.0 stage.

Ecosystem Projects

Hydration’s HOLLAR stability mechanism has gained another layer of "shield"!

Hydration team member lolmcshizz tweeted this week that HOLLAR’s stability module (HSM) is currently earning passive income for the system at an annualized yield of 6.5%.

This means HOLLAR not only relies on algorithms or collateral mechanisms to maintain price stability, but also earns yield from this pool itself, providing extra "ammunition" during market volatility to help maintain the 1:1 peg. This yield is generated automatically, not through trading or speculation. The arbitrage mechanism (such as buying and selling when the price deviates slightly) is already written into the protocol, requiring no manual intervention.

You can think of HSM as HOLLAR’s "automatic yield-generating stable fund pool"—it stabilizes the exchange rate and generates interest. Passive income + protocol-embedded arbitrage make HOLLAR more stable and smarter.

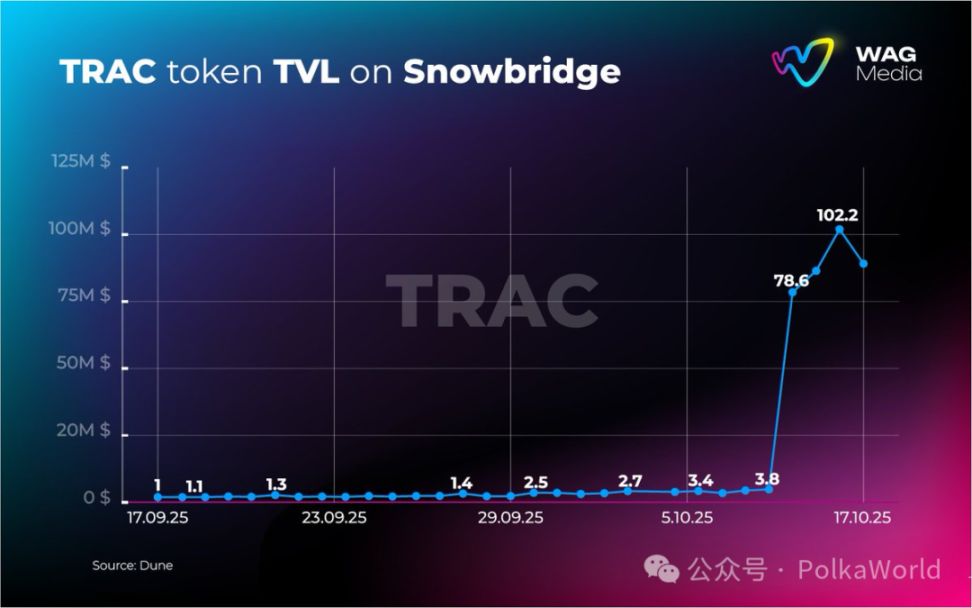

Snowbridge hits a new high: cross-chain TVL reaches $166 million!

Over the past week, the total value locked (TVL) of the official Polkadot ↔️ Ethereum cross-chain bridge Snowbridge hit a record high of $166 million, marking a true liquidity explosion for this trust-minimized cross-chain channel.

The main driver of this growth came from TRAC’s cross-chain locking. This not only represents project teams’ trust in Polkadot infrastructure, but also means cross-chain assets are flowing back from the Ethereum ecosystem to Polkadot, seeking a more efficient and sovereign operating environment.

This week’s podcast recommendation — Hyperbridge: the team laying the "undersea cable" for the crypto world!

This week, Polkadot officially retweeted MR SHIFT (@KevinWSHPod)'s latest DROPS podcast preview, featuring Hyperbridge co-founder @seunlanlege. The episode will be released this Sunday.

In this episode, they discuss in depth:

- How Hyperbridge is becoming the "undersea cable" of the crypto world: building invisible cross-chain infrastructure to securely connect isolated blockchains;

- Problems with traditional cross-chain bridges: multi-signature risks and security vulnerabilities, and how Hyperbridge solves these with trust-minimized design;

- The importance of decentralization and permissionless participation: why it is key to global accessibility;

- Experience working with Gavin Wood: what Polkadot got right in terms of architecture and philosophy;

- The philosophy of open and verifiable systems: rejecting "gatekeeper" culture and returning to code- and consensus-driven trust mechanisms.

The episode will be officially released this Sunday. If you care about cross-chain infrastructure, crypto security, and the future of Web3 network interconnectivity, don’t miss this episode.

vDOT delegation feature is coming soon! This feature will be launched in two core phases:

🔸 Inheritance mechanism (same as $DOT delegation mechanism):

You can delegate your $vDOT to any address, any amount, any voting strength, including DAOs, KOLs, etc.

🔸 Innovative mechanism (DOT voting driven by $BNC):

You can also delegate vDOT to @Bifrost’s OpenGov voting track, where $BNC holders vote on that track to guide the voting direction of delegated vDOT.

Currently, the vDOT delegation feature is in DAO internal testing. If you want to participate in testing, you can fill out the form directly:

RWA (Real World Asset tokenization) is becoming a new growth engine for Polkadot!

Real world assets (RWA) are bringing traditional values such as real estate, gold, carbon credits, and music copyrights onto the blockchain. The global RWA market has reached $2.4 billion, and is expected to exceed $2 trillion by 2030.

On Polkadot, multiple projects are turning this trend into reality:

🏠 Xcavate —— Real estate tokenization, lowering investment thresholds

🥇 TVVIN —— 1:1 gold tokens, compliant custody

⚡ Energy Web —— Provides energy decarbonization tracking for Amazon, United Airlines, etc.

🎵 Beatport IO / mufi —— Automated music copyright revenue sharing

🚚 Aventus —— On-chain supply chain data, efficiency improved by 80%+

With shared security, modular architecture, and cross-chain capabilities, Polkadot is becoming the core infrastructure for RWA on-chain. The future is tokenized.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether Dominance Surges to Highest Since April. What Does it Mean?

RootData Crypto Calendar Fully Upgraded: Say Goodbye to Information Delays and Build Your 24/7 Trading Alert System

Only with information transparency can wrongdoers be exposed and builders receive their deserved rewards. The RootData calendar section has evolved into a more comprehensive, accurate, and seamless all-weather information alert system, aiming to help crypto investors penetrate market uncertainties and identify key events.

Major Overhaul in US Crypto Regulation: CFTC May Fully Take Over the Spot Market

The hearing on November 19 will determine the final direction of this long-standing dispute.

As economic fissures deepen, Bitcoin may become the next "pressure relief valve" for liquidity

Cryptocurrencies are among the few areas where value can be held and transferred without relying on banks or governments.