Must Read Odaily Airdrop Hunter 24-Hour Express Featured Topics Event Articles Hot List Selected Opinions ODAILY Selected In-depth Content

According to Odaily, Liquid Capital (formerly LDCapital) founder Yi Lihua posted on X, stating that the market's panic sentiment has reached its peak today. He understands the market's focus on the "four-year cycle" as well as daily, weekly, and yearly technical indicators, but still insists that the current range is a good zone for bottom-fishing spot assets and is optimistic about the subsequent market trend. He emphasized that it is more important to remain greedy when others are fearful. Even if one has been correct ten times before, there is no guarantee of being right the next time, but investment and trading should always follow one's own logic. He added that his sharing and operations will not be swayed by short-term information.

He pointed out that the crypto market is highly volatile, and it has only been a little over a month since the pullback from the highs. As bearish news is gradually released, buying is usually better than selling.

According to Odaily, CryptoQuant founder and CEO Ki Young Ju posted on X, stating that the average cost for bitcoin investors who entered in the past 6 to 12 months is around $94,000. He said that only when the price falls below this cost range can a bear market cycle be confirmed. For now, it is still too early to draw conclusions, and it is better to remain on the sidelines.

According to Odaily, Bitwise CEO Hunter Horsley posted on X, stating that the traditional "four-year crypto cycle" model is no longer applicable to the current market structure. Since the launch of bitcoin ETFs and changes in the regulatory environment, both market participants and trading motivations have changed significantly. He said that the crypto market may have been in a bear phase for about the past six months, but is now close to emerging from the downturn, and believes that the overall allocation environment for crypto assets is "stronger than ever."

According to Odaily, trader Eugene posted that BTC falling below $100,000 is of critical significance: first, the last support of the high-cycle bullish structure has been breached, and the 50-week trend line has been lost for the first time since 2022; second, $100,000 as a strong psychological threshold has shifted from support to resistance. He emphasized that under these circumstances, he has "no intention of bottom-fishing this correction" and regards the $90,000 low area as the next focus, with capital preservation as the main strategy for now.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

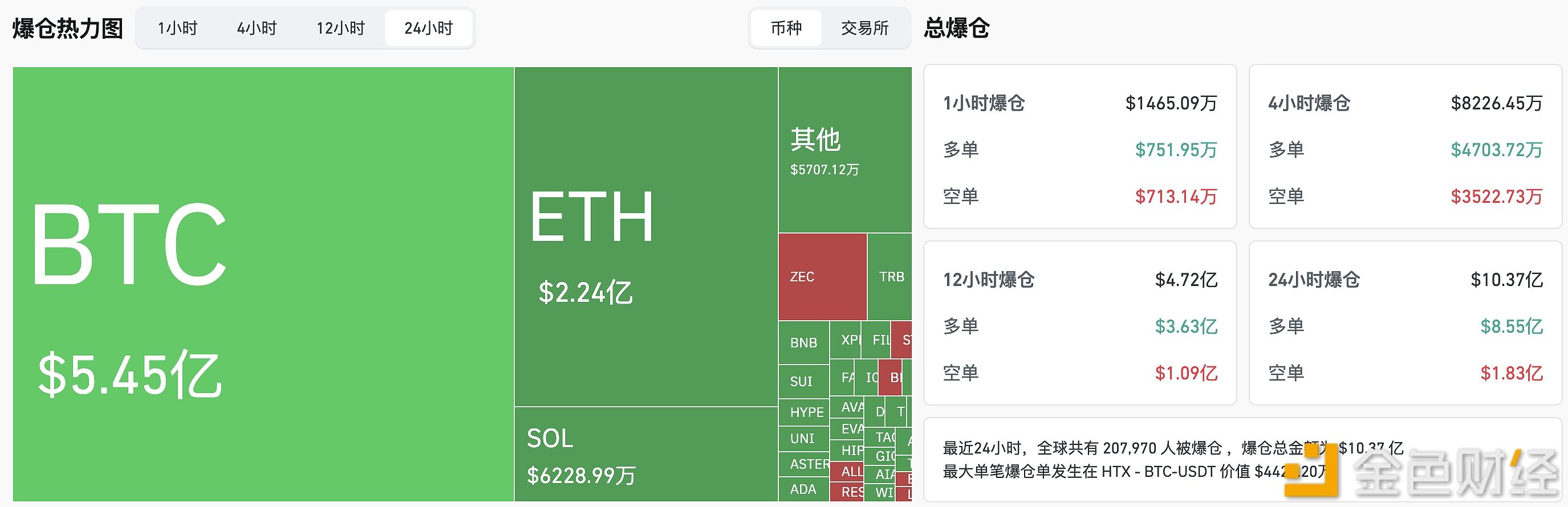

In the past 24 hours, liquidations across the entire network reached $1.037 billion.

Data: 100 WBTC transferred out from Galaxy Digital, worth approximately $9.51 million

Data: 1.927 million ENA flowed into a certain exchange's Prime, worth approximately $5.51 million

Data: If ETH breaks through $3,353, the total short liquidation intensity on major CEXs will reach $1.11 billions.