Bitcoin’s ( BTC ) latest drawdown has pushed the asset to its lowest price since May 2025, and Strategy’s MSTR stock is also feeling the pressure. Stock prices slipped to $197 at pre-market for the first time since October 2024, extending its woes.

Key takeaways:

Strategy’s $5.77 billion Bitcoin move is likely a custodial relocation.

MSTR’s Net Asset Value (NAV) multiple drops below one for the first time, increasing investors’ concern about the company.

One Bitcoin analyst said forced liquidation for Strategy remains unlikely despite market stress.

Wallet move sparks panic after a $5.7 billion Bitcoin transfer

Market anxiety surged on Friday after Strategy shifted 58,915 BTC ($5.77 billion) into new wallets, immediately triggering speculation on X that the company was preparing to sell part of its holdings. The noise intensified as bots and algo traders reacted aggressively to the move.

Strategy( @Strategy ) moved 58,915 $BTC ($5.77B) to new wallets today, likely for custody purposes.

— Lookonchain (@lookonchain) November 14, 2025

Analysts quickly pushed back against the panic, noting that the transfer appeared to be a custody restructuring, not a distribution. One crypto analyst wrote ,

“Arkham AI supposes this is wallet rebalancing rather than distribution. The market is reacting, and the bots are selling. Any excuse or piece of fake news is enough to screw over the smaller players.”

Despite the clarification, crypto market sentiment remained fragile as traders tried to assess whether deeper issues were emerging beneath the surface.

Related: Bitcoin, Ethereum now operate in ‘different monetary’ universes: Data

MSTR NAV drops below 1, an unpopular first for Strategy

The more alarming development came from Strategy’s valuation metrics. For the first time, Strategy’s Net Asset Value (NAV) multiple fell below 1, meaning the market now values MSTR shares at less than the value of the Bitcoin it holds, a dramatic reversal from years of premium pricing. At the moment, the mNAV value is back above , at 1.09, which is still low.

Bitcoin Strategy Tracker NAV data. Source: X

Bitcoin Strategy Tracker NAV data. Source: X

A NAV below 1 indicates that Strategy’s market value has fallen beneath the value of its BTC holdings minus liabilities, signaling that the market is valuing the company at a discount relative to its underlying BTC reserves. This typically reflects investor concerns about debt risk, liquidity or the sustainability of the company’s aggressive Bitcoin-acquisition model.

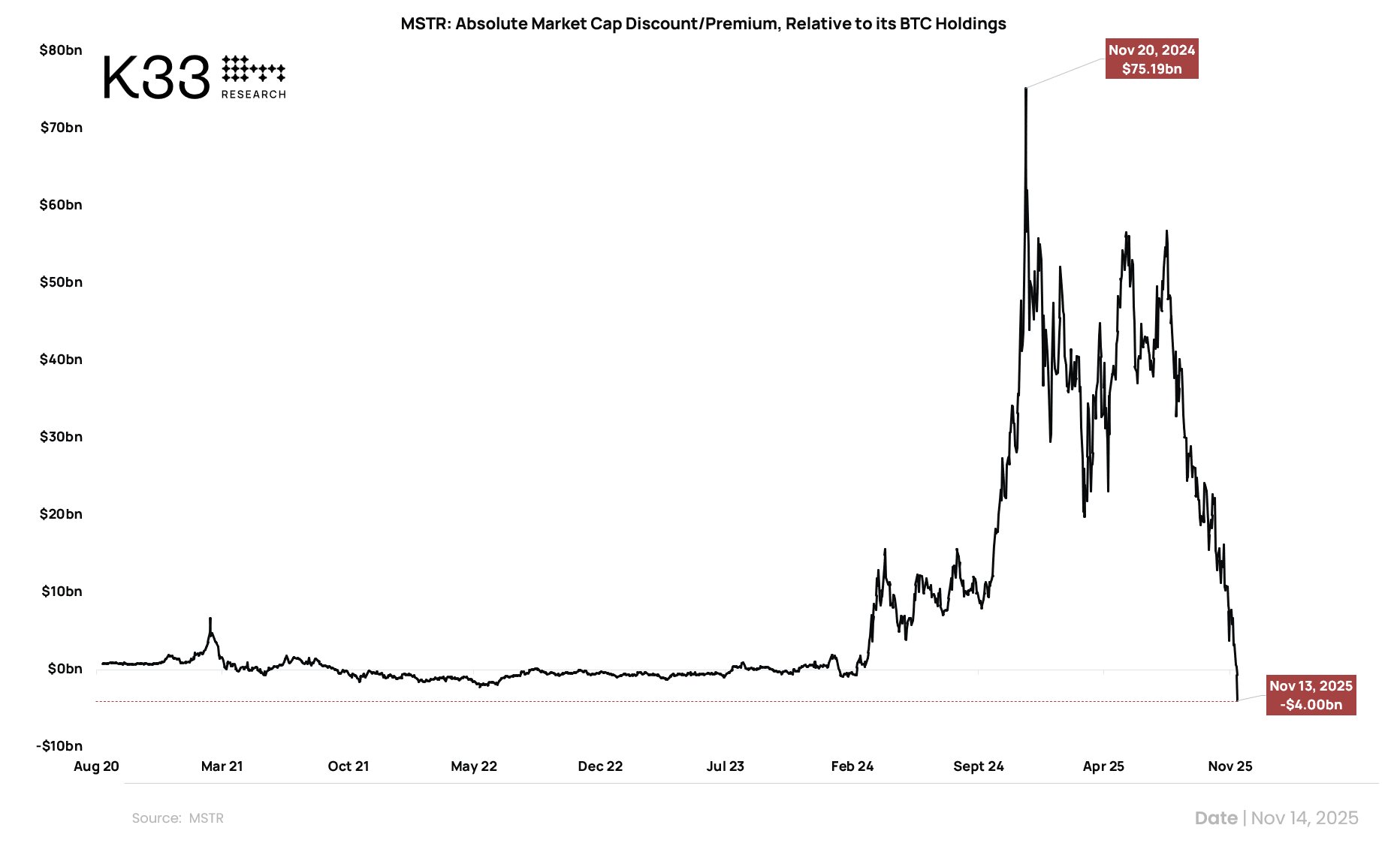

Likewise, K33 Research’s head of research, Vetle Lunde, highlighted a $79.2 billion drop in Strategy’s equity premium since November 2024. Lunde added that although Strategy raised $31.1 billion through dilution, nearly $48.1 billion of implied Bitcoin demand never translated into real BTC purchases. In simple terms, investor appetite for MSTR no longer fuels direct Bitcoin exposure as it might have before.

MSTR market cap discount/premium relative to BTC holdings. Source: Vetle Lunde/X

MSTR market cap discount/premium relative to BTC holdings. Source: Vetle Lunde/X

Still, Bitcoin proponent Willy Woo downplayed concerns about liquidation. The analyst said Strategy is unlikely to be forced to sell Bitcoin in the next bear market as long as MSTR trades above $183.19 by 2027, a level tied to roughly $91,500 BTC, assuming a 1x NAV multiple. Woo warned only of a potential partial liquidation if Bitcoin underperforms during the anticipated 2028 bull cycle.

Related: 3 reasons why Bitcoin and risk markets sold off: Is recovery on horizon?