Date: Sat, Dec 06, 2025 | 05:44 PM GMT

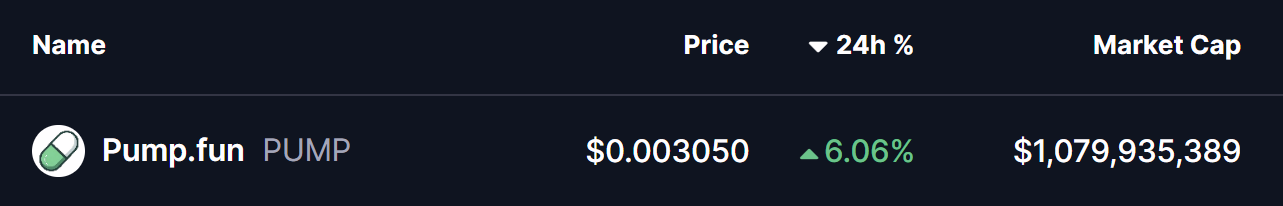

The broader cryptocurrency market has regained slight upward momentum, with both Bitcoin (BTC) and Ethereum (ETH) climbing back into the green by nearly 1% over the last several hours. This shift has allowed altcoins to stabilize, and Pump.fun (PUMP) is among the notable performers, posting over 6% intraday growth while developing a technical structure that hints at further upside potential.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Taking Shape

On the 4H chart, PUMP is framing a Bearish ABCD harmonic pattern, which—despite its name—is known for fueling a sharp CD-leg rally before price ever tests its completion zone.

The pattern initiated when PUMP surged from Point A ($0.002567) to the swing high at Point B, then retraced smoothly down to Point C near $0.002815. It was at this C-level that buyers stepped in, holding structure precisely where harmonic proportions align, confirming demand and strengthening bullish continuation probability.

PUMP 4H Chart/Coinsprobe (Source: Tradingview)

PUMP 4H Chart/Coinsprobe (Source: Tradingview)

Following the bounce, price has reclaimed the 50 MA and is already advancing toward the $0.003050 region. This MA recovery adds confidence that the CD-leg — typically the strongest acceleration phase within the harmonic sequence — is now underway.

What’s Next for PUMP?

If buyers sustain momentum above the 50 MA and avoid deeper pullback, PUMP could travel toward the 1.427 extension zone, aligning around $0.003644 — marking a potential 19% upside from current pricing.

However, traders should stay alert.

A drop back below the C-level at $0.002815 would slow bullish progression and could push price into temporary consolidation before any renewed breakout attempt. This wouldn’t invalidate the harmonic structure but could delay immediate upside movement.

For now, though, the setup remains constructive: Price reclaimed the MA, buyers defended structurally significant levels, and the pattern suggests a developing expansion phase rather than exhaustion.