Morning Brief | Nasdaq NCT announces strategic acquisition of Starks Network; AllScale completes $5 million seed round financing; WET token public sale shares sold out instantly again

Overview of major market events on December 8th.

Compiled by: ChainCatcher

Important News:

- Trump’s post contains “$BIG”, market questions whether he is launching another meme coin

- Banmuxia: This week’s Fed rate cut will normalize liquidity, and the market will see a broad rally this week or even this month

- Binance: Employee did use internal information for personal gain, has been suspended and legal responsibility will be pursued

- Fidelity CEO: Wall Street will be “forced” to adopt blockchain technology

- Robinhood to enter Indonesian market through acquisition of brokerage and crypto trading platform

- AllScale completes $5 million seed round led by YZi Labs

- Nasdaq NCT announces strategic acquisition of Starks Network (zCloak), entering on-chain digital asset infrastructure

What important events happened in the past 24 hours?

AllScale completes $5 million seed round led by YZi Labs

ChainCatcher reports that self-custody stablecoin digital bank AllScale has announced the completion of a $5 million seed round, led by YZi Labs, GSR Ventures, and Generative Ventures, with participation from Aptos, Deep Mind, INP Capital, Astera Ventures, Summer Sun Capital, Carry Investment, V3V Ventures, and others.

JPMorgan: US stock rally may not last after Fed rate cut

ChainCatcher reports, citing Golden Ten Data, that JPMorgan strategists say the recent stock market rally may stall after the Fed’s expected rate cut as investors take profits. Positive signals from policymakers have fueled continued bets and helped lift the stock market.

JPMorgan strategists remain bullish in the medium term, believing that a dovish Fed will support stocks. Meanwhile, weak oil prices, slowing wage growth, and easing US tariff pressures will allow the Fed to loosen monetary policy without exacerbating inflation.

Binance: Employee did use internal information for personal gain, has been suspended and legal responsibility will be pursued

ChainCatcher reports that Binance has issued an official announcement confirming that an employee used internal information to post content on social media for personal gain.

Investigations show that the employee issued a token on-chain at 05:29 UTC on December 7, and less than a minute later, posted a related tweet via the @BinanceFutures official account. Binance has immediately suspended the employee involved and will cooperate with relevant judicial authorities to take legal action.

At the same time, Binance announced that it will split a $100,000 reward among five whistleblowers who provide valid leads through official reporting channels.

Hassett: Trump will announce a large amount of positive economic news

ChainCatcher reports, citing Golden Ten Data, that Kevin Hassett, Director of the US National Economic Council, said Trump will announce a large amount of positive economic news.

ChainCatcher reports that regarding the previous news “SpaceX plans to sell internal shares at a valuation of $800 billion and plans to go public in the second half of next year,” Musk clarified on X platform, stating, “Many media outlets claim @SpaceX plans to raise funds at an $800 billion valuation, but this is not accurate. SpaceX has maintained positive cash flow for many years, regularly repurchasing shares twice a year to provide liquidity for employees and investors. The increase in valuation is due to progress in Starship and Starlink and the guarantee of global direct-to-cell spectrum, which greatly expands our addressable market.

One more thing that can be said is most important: although I really like @NASA, next year their (orders) will account for less than 5% of our revenue. Commercial Starlink is undoubtedly our largest revenue contributor. Some claim SpaceX receives “subsidies” from NASA. This is completely false.

The SpaceX team won NASA contracts because we provided the best product at the lowest price. Having the best product and being able to do it at the lowest price. Regarding astronaut transportation, SpaceX is currently the only option that meets NASA’s safety standards.”

Jupiter platform WET token public sale allocation sold out instantly again

ChainCatcher reports that Jupiter officially announced on social media at 23:40 (UTC+8) today that the HumidiFi (WET) public sale round has started, and the allocation was once again sold out instantly.

It is worth noting that since the previous public sale allocation was snatched by “bots” within 1 second, Jupiter decided to restart the public sale this Monday, originally scheduled for 23:00 (UTC+8) tonight, then postponed three times. Jupiter DTF once showed the public sale was postponed to 0:00 on December 9 (UTC+8), but ultimately “changed their mind” again.

Currently, Jupiter’s latest tweet still states that the HumidiFi (WET) public sale round will start at 0:00 on December 9 (UTC+8), while Jupiter DTF shows the public sale has ended (the countdown is no longer displayed).

Nasdaq NCT announces strategic acquisition of Starks Network (zCloak), entering on-chain digital asset infrastructure

ChainCatcher reports, citing GlobeNewswire, that Intercont (Cayman) Limited (Nasdaq: NCT) announced it has signed a letter of intent with Singapore Web3 technology company Starks Network Ltd to acquire a minority stake of less than 50% and jointly promote the development of the zCloakNetwork project, officially moving into on-chain digital asset infrastructure.

zCloak Network’s business covers AI digital identity, enterprise-grade self-custody wallets, stablecoin payments, and AI crypto payment technology, and has received investment from institutions such as Coinbase Ventures. The two parties will cooperate to apply Web3 technology to payment and business process digitalization in shipping trade, accelerating the industry’s intelligent upgrade.

As global stablecoin payments surpass the combined total of Visa and Mastercard for the first time in 2024, institutional demand for compliant, secure, and scalable wallet infrastructure continues to grow. NCT stated that this acquisition is an important step in promoting the group’s long-term strategy and exploring cross-industry layouts.

NCT and Starks executives said this cooperation symbolizes “the Venetian merchant setting sail again on the blockchain.” The two parties will jointly promote the implementation of enterprise-grade Web3 technology in the global shipping and trade sectors.

Robinhood to enter Indonesian market through acquisition of brokerage and crypto trading platform

ChainCatcher reports, citing Reuters, that Robinhood said in a blog post on Sunday that it will acquire Indonesian brokerage Buana Capital Sekuritas and licensed digital asset trader Pedagang Aset Kripto, marking the retail trading platform’s official entry into one of Southeast Asia’s major crypto hubs.

Indonesia has more than 19 million capital market investors and 17 million crypto traders, highlighting its appeal in stock and digital asset trading. Acquiring a brokerage helps companies meet regulatory requirements and establish a business foothold, making it easier to enter new markets; acquiring a licensed digital asset trader accelerates access to crypto products. Robinhood did not disclose the financial terms of the transaction, which is expected to be completed in the first half of 2026. The company said the major shareholder of both Indonesian companies, Pieter Tanuri, will continue to serve as Robinhood’s strategic advisor.

Securitize CEO: Digital asset liquidity is insufficient, the most successful tokenized asset is the US dollar

ChainCatcher reports, citing Decrypt, that Securitize co-founder and CEO Carlos Domingo said accessibility is not the only factor driving the wave of tokenized assets. It was once thought that tokenization could make illiquid assets liquid, but this is not the case. Whether it’s equity in an apartment building or tokenized Pokémon cards, digital assets inherit the illiquidity of their physical counterparts.

Domingo also said that as tokenization technology develops, this dynamic may eventually change, but in the meantime, people are mainly focused on assets that can enhance existing liquidity, namely cash and US Treasuries. We have moved in the opposite direction of illiquid markets; arguably, the most successful tokenized asset is actually the US dollar, as evidenced by the growth of stablecoins.

Trump releases national security strategy, does not mention cryptocurrency or blockchain

ChainCatcher reports that Trump released a national security strategy on Friday outlining his administration’s priorities, noting that America’s “core, vital national interests” revolve around artificial intelligence and quantum computing.

“We want to ensure that America’s technology and standards—especially in artificial intelligence, biotechnology, and quantum computing—drive the world forward.”

CZ comments on Xue Manzi’s recollection of Binance: No in-depth conversation with He Yi at first meeting, let alone “10 hours”

ChainCatcher reports, investor Xue Manzi posted on X recalling Binance’s development history, mentioning that “in June 2014, CZ met He Yi (then OKCoin co-founder and head of marketing) for the first time at a blockchain sharing event in Shanghai. It is said that the two talked for 10 hours, discussing everything from bitcoin philosophy to exchange operations, and He Yi invited CZ to join OKCoin Global as CTO.”

In response, CZ commented that (in the article) “many details are inaccurate, I won’t go into them one by one. The first time I met He Yi, I just said hello and didn’t chat, let alone for 10 hours.”

Fidelity CEO: Wall Street will be “forced” to adopt blockchain technology

ChainCatcher reports, citing DLnews, Fidelity Investments CEO Abigail Johnson bluntly stated that the traditional financial system is built on a complex network of “primitive technology” reconciliation processes, which is really a bit scary. She pointed out that although blockchain will eventually replace the existing system, the transition will not be smooth and will require competitive pressure and regulatory standards to push the industry forward.

Fidelity has been betting on blockchain since 2013, and its bitcoin ETF has reached $20 billion, second only to BlackRock. Johnson admitted to underestimating the time required for the transition, but firmly believes that competition and regulation will eventually force traditional financial institutions to adopt new technology.

Trump’s post contains “$BIG”, market questions whether he is launching another meme coin

ChainCatcher reports, according to Trends News monitoring, Trump posted on Truth Social the day before yesterday, fiercely criticizing the legal troubles facing US college sports (NCAA): a judge with no knowledge or experience ruled, causing the NCAA and sports leagues to lose, and Trump said this would bring “$BIG trouble.” Since the “$” symbol usually represents a tradable asset code on social platforms, the community speculated that Trump might be launching another meme coin.

According to various platform updates, the token with the highest consensus triggered by Trump’s post was created about 10 seconds after his post on the Solana network via the Bonk platform. As of press time, the token has 5,148 holders and a peak market cap of $5.3 million, currently retraced to $360,000.

ChainCatcher reminds users that most meme coins have no real use case and are highly volatile. Please invest with caution.

Bloomberg: DAT company stocks have fallen sharply this year, median drop of 43%

ChainCatcher reports, citing Bloomberg, the stocks of crypto asset treasury (DAT) companies listed in the US and Canada have fallen sharply this year, with a median drop of 43%, and some companies have fallen by more than 99%.

Previously, these companies raised funds to buy bitcoin or other tokens, and their stock prices soared with their holdings, but as token holdings do not generate income and debt interest and dividend burdens increase, investor sentiment has shifted sharply. SharpLink Gaming’s stock has fallen 86% from its peak, Greenlane Holdings has fallen more than 99%, and Trump family-backed Alt5 Sigma has also fallen about 86%. Strategy company’s stock has fallen 38% this year.

Banmuxia: This week’s Fed rate cut will normalize liquidity, and the market will see a broad rally this week or even this month

ChainCatcher reports, Chinese crypto analyst Banmuxia wrote, “This week’s Fed rate cut and balance sheet expansion will normalize tight liquidity. This week will be a broad rally (US stocks, crypto, precious metals, etc.), and even the coming month may be a month of broad rally.”

Banmuxia also quoted his article from November 11, stating, “Starting in December, the Fed will stop shrinking its balance sheet and may begin to expand it. At this time, liquidity will return to normal, similar to October 2019. The real massive liquidity injection will wait until next May when Trump controls the Fed, similar to March 2020.”

Meme Hot List

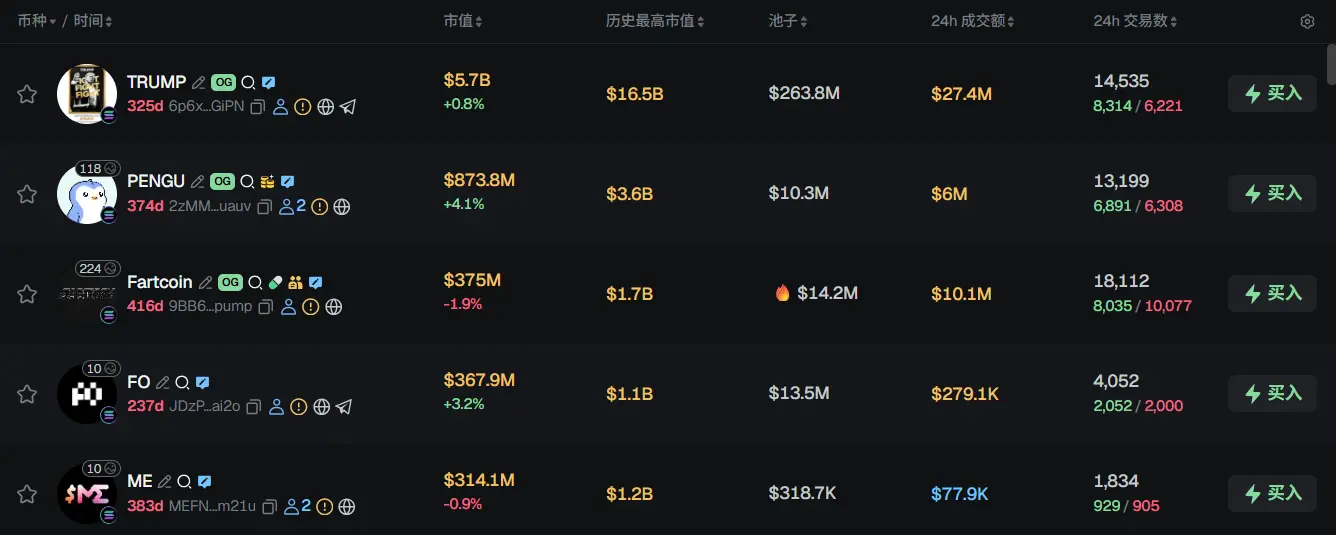

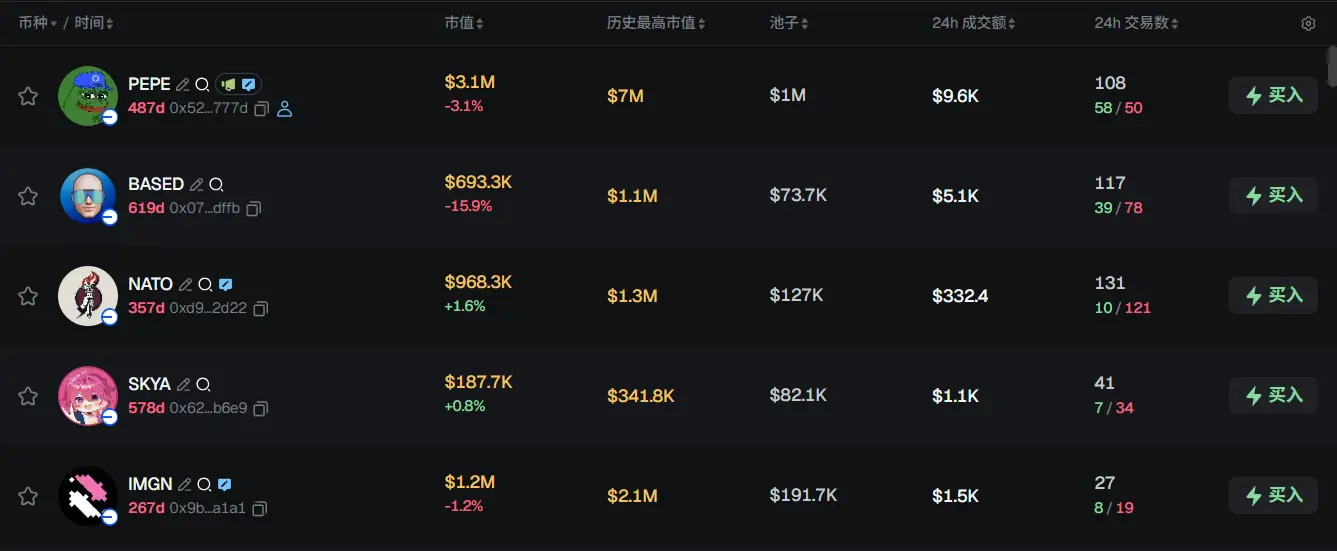

According to data from the meme token tracking and analysis platform GMGN, as of 09:00 on December 9 (UTC+8),

The top five trending ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

The top five trending Solana tokens in the past 24h are: TRUMP, PENGU, Fartcoin, FO, ME

The top five trending Base tokens in the past 24h are: PEPE, BASED, NATO, SKYA, IMGN

What are some great articles worth reading in the past 24 hours?

The financing flywheel stalls, crypto treasury companies are losing their bottom-fishing ability

During the brief rally that began in April, crypto treasury companies acted as the main force increasing their holdings, providing the market with a steady stream of ammunition. But when both the crypto market and stock prices fell simultaneously, these crypto treasury companies seemed to collectively go silent.

When prices hit a stage bottom, it should be the time for these treasury companies to buy the dip. But in reality, buying slowed or even stopped. This collective silence is not simply because “ammunition” was exhausted at the top or due to panic, but rather because the highly premium-dependent financing mechanism suffered a “money-can’t-be-used” systemic paralysis during the down cycle.

Tether financial analysis: Needs another $4.5 billion in reserves to maintain stability

In fact, understanding financial institutions requires overturning the logic of traditional enterprises. The starting point of analysis is not the profit and loss statement (P&L), but the balance sheet—and cash flow should be ignored. Here, debt is not a limitation, but rather the raw material of the business. What really matters is the arrangement of assets and liabilities, whether there is enough capital to withstand risk, and whether enough return is left for capital providers.

Kevin Hassett: A new era for the Fed? In-depth analysis of a potential chairman

Imagine the world’s most powerful financial institution—the Federal Reserve—is about to completely change its course. This is not just a simple policy tweak, but a reshaping of its core DNA. Today, we’ll delve into a potential watershed moment in US economic history: Kevin Allen Hassett possibly becoming Fed chairman. This is not just a personnel change; it concerns a complete overhaul of how the Fed operates in the future, which will profoundly affect every aspect of our lives, from your mortgage rate to the price of everyday goods.

For more than a century, the Fed has been seen as the guardian of financial stability, often operating under a consensus that puts price stability first. But what if that consensus is about to be broken? What if the next Fed chairman sees the world from a completely different perspective, one that could fundamentally change our economic landscape?

41 developers support a $1.7 trillion empire: A panoramic analysis of the Bitcoin core development team and funding system

How many developers does a $2 trillion company need? What are the development costs?

According to public information, among US-listed companies with a market value of over $2 trillion, the number of technical or development staff ranges from several thousand to tens of thousands, with annual salary expenses reaching hundreds of millions or even billions of dollars.

For Bitcoin, whose market value once reached $2.5 trillion and is still close to $1.75 trillion today, these two numbers are 41 and $8.4 million, respectively. That’s right, this absolute “big brother” of the crypto world has only 41 people in its core development organization, supported by annual donations of several million dollars and salaries from a handful of companies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exclusive Interview with HelloTrade: The "On-Chain Wall Street" Backed by BlackRock

After creating the largest bitcoin ETF in history, BlackRock executives are now reconstructing Wall Street on MegaETH.

US SEC Chairman Makes Bold Prediction: The Era of Global Financial On-Chain Has Arrived

SEC Chairman Atkins stated that tokenization and on-chain settlement will reshape the U.S. capital markets, creating a more transparent, secure, and efficient financial system.

With a $1 billion valuation, why couldn't Farcaster pull off a "decentralized" Twitter?

Farcaster acknowledges that decentralized social networking faces challenges in scaling, shifting its focus from a "social-first" approach to wallet business.

Spot Bitcoin ETFs Stumble: $60.5 Million Flees in Sharp Reversal