With a $1 billion valuation, why couldn't Farcaster pull off a "decentralized" Twitter?

Farcaster acknowledges that decentralized social networking faces challenges in scaling, shifting its focus from a "social-first" approach to wallet business.

Original Article Title: " A 10 Billion Valuation and Five Years of Exploration, Why Did It 'Throw in the Towel'?"

Original Article Author: Bootly, via Bitpush News

After five years of establishment, raising approximately $180 million in total funding, and once reaching a valuation close to $10 billion, Farcaster has officially admitted that the path of Web3 social has not panned out.

Recently, Farcaster co-founder Dan Romero posted consecutively on the platform, announcing that the team will abandon the "social-first" product strategy and instead fully focus on the wallet direction. In his statement, this was not seen as a proactive upgrade but rather a choice made after a long period of attempts, compelled by reality.

"We tried for 4.5 years to put social first, but it didn't work."

This assessment not only signifies Farcaster's transformation but also once again shines a spotlight on the structural challenges of Web3 social.

The Gap Between Ideal and Reality: Why Farcaster Couldn't Become "Decentralized Twitter"

Farcaster emerged in 2020, amidst the rising narrative of Web3. It attempted to address three core issues of Web2 social platforms:

· Platform Monopoly and Censorship

· User Data Not Owned by Oneself

· Creators Unable to Monetize Directly

Its design concept was quite idealistic:

· Protocol Layer Decentralization

· Clients Can Freely Build

· Social Relationships On-Chain and Migratable

Among the many "decentralized social" projects, Farcaster was once seen as the product closest to Product-Market Fit (PMF). Especially after the 2023 Warpcast, numerous Key Opinion Leaders (KOLs) joined Crypto Twitter, making it seem like the prototype of the next-generation social network.

However, problems soon surfaced.

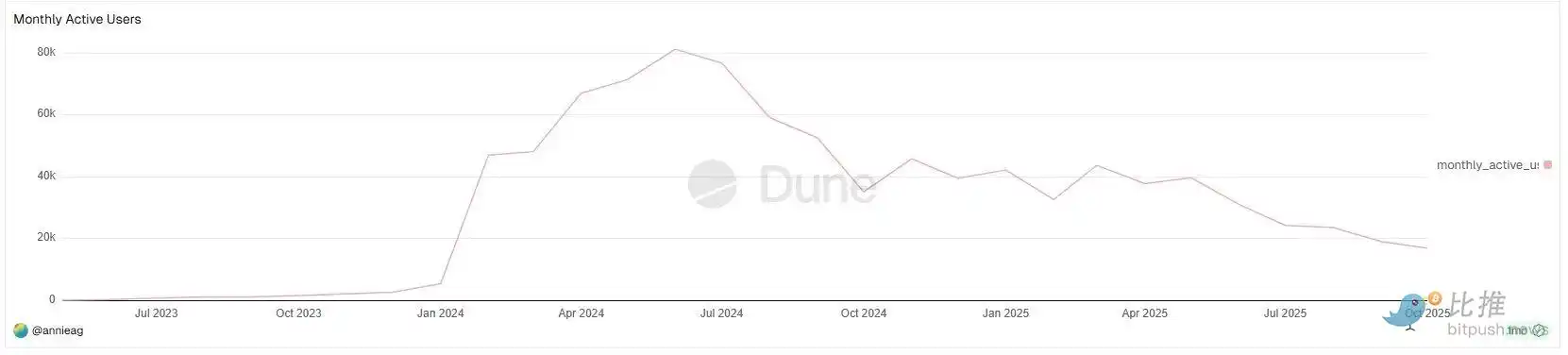

According to Farcaster Monthly Active Users (MAU) data on Dune Analytics, Farcaster's user growth trajectory revealed a very clear but not optimistic pattern:

Throughout most of 2023, Farcaster's monthly active users (MAU) were almost negligible;

The true inflection point in growth occurred in early 2024, with MAU rapidly rising from low thousands to approximately 40,000–50,000 in a short period of time, peaking at nearly 80,000 MAU in mid-2024.

This was the only truly significant scaling window for Farcaster since its inception. Particularly noteworthy is that this growth did not occur during a bear market, but rather during a phase of high Base ecosystem activity and intense SocialFi narratives.

However, this window did not last long.

Starting in the latter half of 2024, MAU data showed a noticeable decline, presenting a fluctuating downward trend over the following year:

· MAU rebounded multiple times, but the peaks trended lower

· By the second half of 2025, MAU had dropped to less than 20,000

In reality, Farcaster's growth has always been unable to "break the circle," with its user base highly homogeneous:

· Crypto industry professionals

· VCs

· Builders

· Crypto-native users

For the average user:

· The registration threshold is high

· Social content is heavily "in-group"

· The user experience is not superior to X/Instagram

This has led Farcaster to consistently fail to generate true network effects.

DeFi KOL Ignas on X (@DeFiIgnas) bluntly stated that Farcaster "simply acknowledged what everyone had been feeling for a long time":

The network effect intensity of X (formerly Twitter) is almost impossible to be positively breached.

This is not an issue of crypto narratives but a structural barrier of social products. From a product perspective, the social aspect of Farcaster's issues is quite typical:

· User growth has always been locked within the crypto-native crowd

· Content is highly self-referential, making overflow difficult

· Creator Monetization and User Retention Did Not Form a Positive Feedback Loop

This is also why Ignas succinctly summarized Farcaster's new strategy in one sentence:

"It's easier to add social to a wallet than to add a wallet to a social product."

This assessment fundamentally acknowledges that "social is not Web3's primary need."

"Bubbles Are Comfortable, but Numbers Are Harsh"

If MAU data answers "How is Farcaster doing," another question is: How big is this market itself?

Crypto creator Wiimee provided a set of impactful comparative data on X.

Following an "accidental breakout from the crypto content circle," Wiimee created content for the general audience for four consecutive days. The analysis data showed that within approximately 100 hours, he gained 2.7 million impressions, more than double the total views of all his crypto content in a year.

He remarked: "Crypto Twitter is a bubble, and it's small. Speaking to the general public for four days is more impactful than speaking to insiders for four years."

This is not a direct critique of Farcaster but reveals a more underlying issue: crypto social is inherently a highly self-referential ecosystem with weak external outreach capabilities. When content, relationships, and followers are all limited to the same group of native users, even the most sophisticated protocol design struggles to break through the market's size limit.

Thus, the challenge Farcaster faces is not "the product is not good enough" but rather "there are not enough people in the space."

Wallet, Unexpectedly Achieving PMF

What truly altered Farcaster's internal judgment was not a reflection on social but an unexpected validation of the wallet.

Earlier in 2024, Farcaster introduced a built-in wallet in the app, originally intended as a supplement to the social experience. However, from the usage data, the wallet's growth rate, usage frequency, and retention performance were notably different from the social module.

Dan Romero emphasized in a public response: "Every new wallet user and retained user is a new user for the protocol."

This sentence itself has revealed the core logic of the roadmap adjustment. The wallet is not facing "expressiveness," but the real, rigid on-chain operational needs: transfer, transaction, signature, and interaction with new applications.

In October, Farcaster acquired the AI Agent-driven token issuance tool Clanker and gradually integrated it into the wallet system. This move was also seen as the team's clear commitment to the "wallet-first" path.

From a business perspective, this direction has obvious advantages:

· Higher frequency of use

· Clearer monetization path

· Closer integration with on-chain ecosystem

In contrast, social features are more like icing on the cake rather than the growth-driving engine.

Although the wallet strategy is data-driven, community controversy has followed.

Several long-time users have made it clear that they are not against the wallet itself but feel uncomfortable with the accompanying cultural shift: from "users" being redefined as "traders," from "co-builders" being labeled as the "old guard."

This exposes a practical issue: when the product direction changes, community emotions are often harder to migrate than the roadmap. Farcaster's protocol layer remains decentralized, but the decision-making power regarding product direction still lies largely with the team. This tension is amplified during the transition.

Romero later admitted communication issues but also made it clear that the team has made a choice.

This is not arrogance but a common reality check for a late-stage startup project. In this sense, Farcaster has not abandoned the social ideal but has let go of the fantasy of scaling it.

Perhaps as an observer said, "First make users stay for the tool, then there is room for social interaction."

Farcaster's choice may not be the most romantic, but it may be the closest to reality, diving deep into integrating native financial tools (wallet, transaction, issuance), which is the practical path to transforming into sustainable business value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How to achieve an annualized return of 40% through arbitrage on Polymarket?

By demonstrating arbitrage structures with live trading, this provides a clear reference for the increasingly intense arbitrage competition in the current prediction markets.

Interpretation of ZAMA Dutch Auction Public Sale: How to Seize the Last Interaction Opportunity?

ZAMA will launch a sealed-bid Dutch auction based on fully homomorphic encryption on January 12, selling 10% of its tokens to achieve fair distribution, with no front-running and no bots.

Standard Chartered Bank lowers its 2025 Bitcoin price forecast to $100,000.