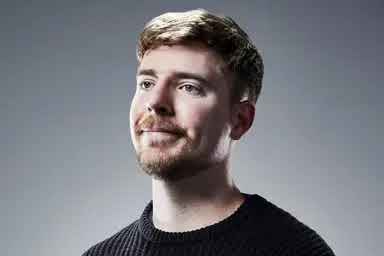

MrBeastSuckinMeatinu 價格SOL

TWD

MrBeastSuckinMeatinu(SOL)的 新台幣 價格為 -- TWD。

該幣種的價格尚未更新或已停止更新。本頁面資訊僅供參考。您可在 Bitget 現貨市場 上查看上架幣種。

註冊今日MrBeastSuckinMeatinu即時價格TWD

今日MrBeastSuckinMeatinu即時價格為 -- TWD,目前市值為 --。過去 24 小時內,MrBeastSuckinMeatinu價格跌幅為 0.00%,24 小時交易量為 NT$0.00。SOL/TWD(MrBeastSuckinMeatinu兌換TWD)兌換率即時更新。

1MrBeastSuckinMeatinu的新台幣價值是多少?

截至目前,MrBeastSuckinMeatinu(SOL)的 新台幣 價格為 -- TWD。您現在可以用 1 SOL 兌換 --,或用 NT$ 10 兌換 0 SOL。在過去 24 小時內,SOL 兌換 TWD 的最高價格為 -- TWD,SOL 兌換 TWD 的最低價格為 -- TWD。

MrBeastSuckinMeatinu 市場資訊

價格表現(24 小時)

24 小時

24 小時最低價 --24 小時最高價 --

歷史最高價(ATH):

--

漲跌幅(24 小時):

--

漲跌幅(7 日):

--

漲跌幅(1 年):

--

市值排名:

--

市值:

--

完全稀釋市值:

--

24 小時交易額:

--

流通量:

-- SOL

最大發行量:

--

MrBeastSuckinMeatinu 的 AI 分析報告

今日加密市場熱點查看報告

MrBeastSuckinMeatinu價格預測

SOL 在 2026 的價格是多少?

2026 年,基於 +5% 的預測年增長率,MrBeastSuckinMeatinu(SOL)價格預計將達到 NT$0.00。基於此預測,投資並持有 MrBeastSuckinMeatinu 至 2026 年底的累計投資回報率將達到 +5%。更多詳情,請參考2025 年、2026 年及 2030 - 2050 年 MrBeastSuckinMeatinu 價格預測。SOL 在 2030 年的價格是多少?

2030 年,基於 +5% 的預測年增長率,MrBeastSuckinMeatinu(SOL)價格預計將達到 NT$0.00。基於此預測,投資並持有 MrBeastSuckinMeatinu 至 2030 年底的累計投資回報率將達到 27.63%。更多詳情,請參考2025 年、2026 年及 2030 - 2050 年 MrBeastSuckinMeatinu 價格預測。

熱門活動

如何購買MrBeastSuckinMeatinu(SOL)

建立您的免費 Bitget 帳戶

使用您的電子郵件地址/手機號碼在 Bitget 註冊,並建立強大的密碼以確保您的帳戶安全

認證您的帳戶

輸入您的個人資訊並上傳有效的身份照片進行身份認證

將 SOL 兌換為 TWD

在 Bitget 上選擇加密貨幣進行交易。

常見問題

MrBeastSuckinMeatinu 的目前價格是多少?

MrBeastSuckinMeatinu 的即時價格為 --(SOL/TWD),目前市值為 -- TWD。由於加密貨幣市場全天候不間斷交易,MrBeastSuckinMeatinu 的價格經常波動。您可以在 Bitget 上查看 MrBeastSuckinMeatinu 的市場價格及其歷史數據。

MrBeastSuckinMeatinu 的 24 小時交易量是多少?

在最近 24 小時內,MrBeastSuckinMeatinu 的交易量為 --。

MrBeastSuckinMeatinu 的歷史最高價是多少?

MrBeastSuckinMeatinu 的歷史最高價是 --。這個歷史最高價是 MrBeastSuckinMeatinu 自推出以來的最高價。

我可以在 Bitget 上購買 MrBeastSuckinMeatinu 嗎?

可以,MrBeastSuckinMeatinu 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 mrbeastsuckinmeatinu 指南。

我可以透過投資 MrBeastSuckinMeatinu 獲得穩定的收入嗎?

當然,Bitget 推出了一個 機器人交易平台,其提供智能交易機器人,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 MrBeastSuckinMeatinu?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

相關加密貨幣價格

Shiba Inu 價格(TWD)Dogecoin 價格(TWD)Pepe 價格(TWD)Cardano 價格(TWD)Bonk 價格(TWD)Toncoin 價格(TWD)Pi 價格(TWD)Fartcoin 價格(TWD)Bitcoin 價格(TWD)Litecoin 價格(TWD)WINkLink 價格(TWD)Solana 價格(TWD)Stellar 價格(TWD)XRP 價格(TWD)OFFICIAL TRUMP 價格(TWD)Ethereum 價格(TWD)Worldcoin 價格(TWD)dogwifhat 價格(TWD)Kaspa 價格(TWD)Smooth Love Potion 價格(TWD)

您可以在哪裡購買MrBeastSuckinMeatinu(SOL)?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

1 TWD 即可購買 MrBeastSuckinMeatinu

新用戶可獲得價值 6,200 USDT 的迎新大禮包

立即購買 MrBeastSuckinMeatinu

加密貨幣投資(包括透過 Bitget 線上購買 MrBeastSuckinMeatinu)具有市場風險。Bitget 為您提供購買 MrBeastSuckinMeatinu 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 MrBeastSuckinMeatinu 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

Bitget 觀點

cryptoKing111

5小時前

$SOL Technical Analysis & Market Outlook 📊

Current Price: $126.64 (+1.70% 24h)

Technical Analysis 🔍

Short-term (15min): SOL shows bullish momentum with RSI at 63.32, indicating healthy buying pressure without being overbought. The MACD histogram is positive at 0.048, suggesting continued upward momentum. Key resistance at $127.47 and support at $124.93.

Daily Perspective: The broader trend remains challenging with RSI at 39.20, indicating oversold conditions that could present a buying opportunity. SOL has declined from recent highs of $146.85 to current levels around $126, representing a significant correction.

Market Dynamics 📈

Whale Activity: A major whale "0x35d" has taken a massive 20x leveraged short position on SOL, currently sitting on $15.9 million in unrealized profits. This bearish positioning from smart money suggests continued downside pressure in the near term.

Ecosystem Strength: Despite price weakness, Solana's fundamentals remain robust. The recent Breakpoint hackathon attracted 9,000+ participants with 1,576 projects submitted, showcasing strong developer interest. The hardware wallet project Unruggable won the grand prize, highlighting innovation in the ecosystem.

Sector Performance: The Solana ecosystem shows mixed signals with a mean return rate of -1.03% over 24h, though top performers like DOOD (+15.09%) demonstrate selective strength within the ecosystem.

Trading Strategy 💡

For Conservative Traders: Wait for a break above $130 resistance with volume confirmation before entering long positions. The current consolidation between $125-$130 offers a defined risk range.

For Aggressive Traders: The oversold daily RSI presents a potential contrarian opportunity, but be mindful of the whale short position creating additional selling pressure.

Risk Management: Given the 20x leveraged whale position against SOL, position sizing should be conservative with tight stop losses below $124.

SOL remains a fundamentally strong Layer 1 blockchain with robust ecosystem development, but short-term technicals suggest patience may be rewarded with better entry points.

This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves substantial risk of loss.

$SOL $BTC

BTC-0.02%

SOL+0.02%

Agora_flux

6小時前

🚨 TOM LEE’S FUND SEES BITCOIN BACK TO $60K SOON

Fundstrat, led by Tom Lee, told clients to expect a major crypto correction in H1 2026.

In an internal report, crypto head Sean Farrell said his base case points to $BTC at $60K–$65K, $ETH at $1.8K–$2K, and $SOL at $50–$75.

BTC-0.02%

ETH-0.13%

Bitcoinworld

6小時前

Critical Bitcoin Correction Forecast: Fundstrat Predicts $60K-$65K Range by H1 2026

Are you prepared for a potential market shift? A recent private report from financial research firm Fundstrat is sending ripples through the crypto community with a stark prediction: a significant Bitcoin correction could be on the horizon for early 2026. According to information obtained by Cointelegraph, the firm’s analysis suggests Bitcoin’s price may retreat to a range between $60,000 and $65,000 in the first half of that year. This forecast, while speculative, offers a crucial perspective for long-term investors navigating the volatile digital asset landscape.

What Does the Fundstrat Report Say About the Bitcoin Correction?

The analysis, reportedly authored by Sean Farrell, Fundstrat’s Head of Digital Asset Strategy, was not released through official public channels. Instead, it was distributed privately to select clients, adding an air of exclusivity to its insights. The core of the prediction hinges on a broader market recalibration. The report doesn’t just foresee a Bitcoin correction; it extends the outlook to other major cryptocurrencies. Specifically, it projects Ethereum (ETH) could fall to between $1,800 and $2,000, while Solana (SOL) might see a decline to a range of $50 to $75.

This coordinated forecast suggests analysts are anticipating a sector-wide pullback rather than an issue isolated to Bitcoin. The reasoning likely ties into macroeconomic cycles, potential regulatory developments, and the natural ebb and flow of investor sentiment after prolonged bull markets. Understanding this context is key for anyone with exposure to digital assets.

Why Should Investors Pay Attention to This Prediction?

While price predictions are inherently uncertain, reports from established firms like Fundstrat carry weight due to their methodological approach. They analyze trends, on-chain data, and macroeconomic indicators. Therefore, this warning of a Bitcoin correction serves as a valuable stress test for your portfolio strategy. It’s not necessarily a call to panic sell, but a prompt to review your risk tolerance and investment horizon.

Consider these actionable insights based on such forecasts:

Reassess Your Portfolio Allocation: Ensure your exposure to volatile assets like Bitcoin aligns with your long-term goals.

Dollar-Cost Average (DCA): This strategy can mitigate timing risk if prices do decline.

Secure Your Holdings: Use reputable, secure wallets for long-term storage, especially during turbulent periods.

Diversify: Don’t put all your capital into a single asset or sector, even one as prominent as cryptocurrency.

How Reliable Are Long-Term Crypto Price Forecasts?

It’s crucial to maintain perspective. The crypto market is famously unpredictable, and forecasts looking nearly two years ahead involve significant speculation. Many variables can change the trajectory, including:

Unexpected regulatory clarity or crackdowns

Major technological breakthroughs (like Ethereum’s ongoing upgrades)

Shifts in global monetary policy and inflation

Institutional adoption rates surpassing expectations

Therefore, treat this prediction of a Bitcoin correction as one informed scenario among many. It highlights a potential risk that prudent investors should acknowledge, not a guaranteed future. The value lies in preparing for volatility, not in attempting to time the market perfectly.

Navigating Market Volatility with Confidence

The ultimate takeaway from Fundstrat’s analysis is the enduring importance of a disciplined strategy. Whether a Bitcoin correction arrives in 2026 or not, markets will fluctuate. Successful investing is less about predicting every dip and peak and more about having a plan that withstands them. This involves clear goals, risk management, and a focus on the fundamental technology and adoption trends driving the asset class forward, rather than short-term price noise.

In conclusion, the Fundstrat report provides a sobering, long-view checkpoint for the crypto market. A potential pullback to the $60K-$65K range for Bitcoin in H1 2026 is a plausible scenario based on historical cycles and growth patterns. However, it remains a prediction. By focusing on sound investment principles—education, security, diversification, and a long-term perspective—you can navigate such forecasts not with fear, but with prepared confidence. The journey of cryptocurrency investment is a marathon, not a sprint, and being ready for all terrains is what separates the resilient from the reactive.

Frequently Asked Questions (FAQs)

Q1: Is the Fundstrat Bitcoin correction report official? A1: The report was distributed privately to select clients and has not been released through Fundstrat’s official public channels. Its details were reported by crypto news outlets like Cointelegraph and Wu Blockchain.

Q2: What is the predicted price for Ethereum and Solana? A2: The same report suggests Ethereum (ETH) could fall to $1,800-$2,000 and Solana (SOL) could drop to $50-$75 during the same projected correction period in H1 2026.

Q3: Should I sell my Bitcoin based on this prediction? A3: This prediction is a long-term forecast and not financial advice. It should inform your risk assessment and strategy, not dictate panic selling. Consider your investment goals, timeline, and risk tolerance before making any decisions.

Q4: How accurate are long-term crypto price predictions? A4: They are highly speculative. While based on analysis, the crypto market is influenced by countless unpredictable factors, making any forecast years in advance uncertain. They are best used for scenario planning, not as guarantees.

Q5: What can I do to prepare for potential market volatility? A5: Key steps include diversifying your portfolio, practicing dollar-cost averaging, ensuring your assets are in secure storage, and avoiding investing more than you can afford to lose. Focus on a long-term strategy.

Q6: Who is Sean Farrell? A6: Sean Farrell is the Head of Digital Asset Strategy at Fundstrat Global Advisors, the market research firm believed to have authored the private report containing these predictions.

Did this analysis help you think about your crypto strategy? If you found these insights valuable, share this article with your network on social media to help other investors stay informed and navigate the market with clarity. Knowledge is the best tool for any investment journey.

To learn more about the latest Bitcoin trends, explore our article on key developments shaping Bitcoin price action and institutional adoption.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

BTC-0.02%

ETH-0.13%

Chimexremy

7小時前

Solana Price Approaches $130: What’s Behind The Recent Surge?

The Solana price has shown encouraging signs of recovery, climbing 6% on Friday to approach the $126 mark. This uptick follows a concerning dip below the crucial $120 level, which had sparked fears of a potential downtrend that could drag the cryptocurrency down toward the $100 threshold.

Solana Price Gains Ground

Chris MacDonald, an analyst at The Motley Fool, recently highlighted two key factors contributing to Solana’s resurgence. One significant catalyst is a proactive initiative by the Solana Foundation.

Bitcoinist reported earlier this week that the organization is currently assessing whether its network can withstand potential threats from quantum computing technologies.

In collaboration with Project Eleven, a security firm specializing in post-quantum cryptography, the Solana team has launched a quantum-resistant testnet following a comprehensive threat assessment.

The second notable factor driving the Solana price uptick is the announcement from health and wellness company Mangoceuticals, which revealed plans to allocate $100 million toward acquiring and holding $SOL .

Despite the positive momentum, experts caution that Solana’s price is currently following a “clean corrective structure.”

Moving Averages Signal Downtrend

From a technical analysis perspective, the 50-day simple moving average (SMA) is situated around $143, significantly higher than the current trading range, while the 200-day SMA looms even further at approximately $170, suggesting a prevailing downtrend rather than a healthy consolidation phase.

In the short term, the 20-day exponential moving average has also rolled over near $133 and has consistently rejected previous attempts at a bounce.

Analysts note that until the Solana price can close above the low-$130s for an extended period, any rebounds will likely be seen merely as counter-trend movements.

Immediate support lies just below current trading levels at the $125 mark, followed by critical levels in the $121–$120 range, and another demand zone around $110.

A more significant downturn could push the price into the high $90s, with projections indicating a potential dip to around $80 if liquidations accelerate further, as NewsBTC reported on Thursday.

The market has already registered an eight-month low near $116.9. A decisive close beneath that level could likely drag the Solana price toward the psychologically significant $100 mark.

On the upside, the Solana price could encounter initial resistance clustered in the $133–$138 range, with stronger resistance observed in higher levels between $144 and $147 that could prevent any new recoveries in the short-term.

To facilitate further price recovery, the Solana price will need to clear that second group of resistance levels on a daily close, ideally supported by increased trading volume, to pave the way toward prices between $160 and $165.

SOL+0.02%

Blockchain_Matrix

7小時前

$SOL IS TARGETING THE 127–128 ZONE AFTER STABILIZING ABOVE 126.00💥🔥

Price action on SOL/USDT shows a clear attempt to reclaim strength after a sharp intraday pullback. The bounce from the 125.40–125.60 support zone was clean, followed by higher lows and steady consolidation near 126.30. This behavior suggests buyers are still active and defending dips rather than allowing deeper continuation to the downside. As long as price holds above the 126.00 base, the structure remains favorable for a continuation push toward the recent highs.

From a long trade perspective, continuation is favored if SOL sustains above 126.00 and builds acceptance above 126.50. A clean break and hold above the 126.80–127.00 resistance zone could open the path toward the 127.80–128.50 range, where sellers previously stepped in. The market is not showing aggressive rejection yet, which keeps the upside scenario valid, especially if volume expands on the next push.

On the flip side, the short trade opportunity only becomes attractive if SOL fails to hold 126.00 and shows strong rejection near 126.80–127.00. A breakdown back below 125.90 would shift momentum in favor of sellers and expose the 125.20–124.80 liquidity zone. Until that happens, shorts remain counter-trend and higher risk.

Short Outlook:

Neutral to mildly bullish above 126.00. Bullish continuation above 127.00, bearish only if price loses 125.90 decisively.

SOL+0.02%

Bitget 平台新上架幣種的價格