News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

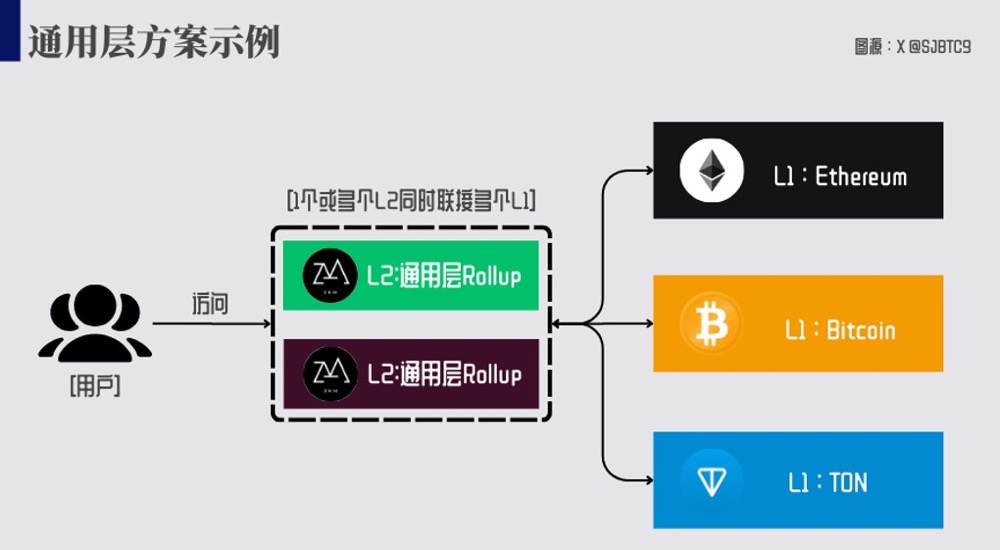

In the context of Ethereum's downturn, where is the breakthrough for the Rollup scheme

Eric SJ(重开版)·2024/09/04 03:52

23 protocols, an overview of the current chain abstraction protocol model

Eric SJ(重开版)·2024/09/02 06:41

Web3 Lawyer: MakerDAO Brand Upgrade, Disillusionment with DeFi and Decentralised Stablecoins

曼昆区块链法律服务·2024/08/30 03:16

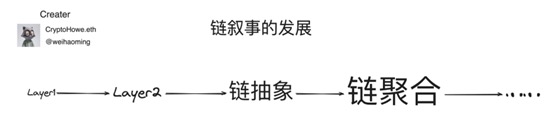

How to view the current blockchain narrative and its future development

cryptoHowe.eth·2024/08/30 03:07

Missed DOGS? Don't worry, it's not too late to pay attention to the new CATS

依始·2024/08/29 10:44

Flash

18:25

Northern Data has sold its bitcoin mining business to a company operated by Tether executives.According to a report by Jinse Finance, citing the Financial Times, Northern Data, supported by Tether, has sold its bitcoin mining business to Peak Mining, a company operated by Tether executives. The buyers—Highland Group Mining Inc., Appalachian Energy LLC, and 2750418 Alberta ULC—are directly linked to Tether's leadership. Records from the British Virgin Islands show that Highland Group Mining is controlled by Tether co-founder and chairman Giancarlo Devasini and the company's CEO Paolo Ardoino. Canadian documents indicate that Devasini is the sole director of Alberta ULC. The equity structure of Appalachian Energy LLC, registered in Delaware, remains opaque, with no publicly listed directors.

15:53

IOSG Founding Partner: 2025 will be the "worst year" for the crypto market, but BTC may reach $120,000–$150,000 in the first half of 2026PANews, December 21 – Jocy, founding partner of IOSG, posted on X that 2025 will be the "worst year" for the crypto market. OG investors will experience three waves of sell-offs. From March 2024 to November 2025, long-term holders (LTH) will cumulatively sell about 1.4 million BTC (worth $121.17 billions): First wave (end of 2023 to early 2024): ETF approval, BTC rises from $25,000 to $73,000; Second wave (end of 2024): Trump is elected, BTC surges toward $100,000; Third wave (2025): BTC remains above $100,000 for an extended period. Unlike the single explosive distributions in 2013, 2017, and 2021, this time it will be a multi-wave, sustained distribution. Over the past year, BTC has been consolidating at its peak for a year, something that has never happened before. Since the beginning of 2024, the number of BTC unmoved for over two years has decreased by 1.6 million (about $140 billions). However, the other side of risk is opportunity. In terms of investment logic: Short term (3-6 months): Fluctuation between $87,000 and $95,000, institutions continue to accumulate positions; Mid-term (first half of 2026): Driven by both policy and institutions, target $120,000-$150,000; Long term (second half of 2026): Increased volatility, depending on election results and policy continuity.

15:53

Opinion: 2025 will be the "worst year" for the crypto market, but bitcoin may reach $120,000-$150,000 in the first half of 2026According to Odaily, IOSG founding partner Jocy posted on X stating that 2025 will be the "worst year" for the crypto market, with OG investors experiencing three waves of sell-offs. From March 2024 to November 2025, long-term holders (LTH) are expected to cumulatively sell about 1.4 million BTC (worth $121.17 billion): The first wave (end of 2023 to early 2024): ETF approval, BTC rises from $25,000 to $73,000; the second wave (end of 2024): Trump is elected, BTC surges towards $100,000; the third wave (2025): BTC remains above $100,000 for an extended period. Unlike the single explosive distribution seen in 2013, 2017, and 2021, this time features multiple sustained waves of distribution. Over the past year, BTC has been consolidating at its peak for an entire year, something that has never happened before. Since the beginning of 2024, the amount of BTC unmoved for over two years has decreased by 1.6 million (about $140 billion). However, the other side of risk is opportunity, and in terms of investment logic: Short term (3-6 months): Fluctuation in the $87,000-$95,000 range, institutions continue to accumulate positions; Mid term (first half of 2026): Driven by both policy and institutions, target of $120,000-$150,000; Long term (second half of 2026): Increased volatility, depending on election results and policy continuity.

News