News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

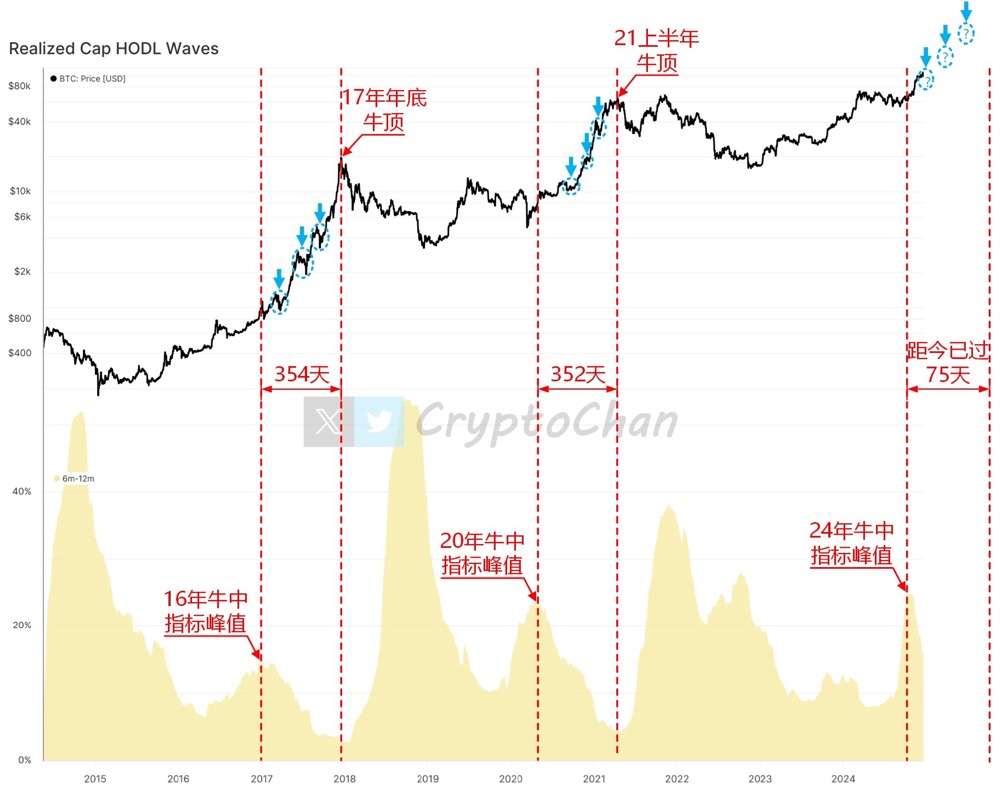

BTC on-chain indicator reaches its lowest point as LTH/STH ratio returns to the bull market starting point

CryptoChan·2024/12/21 05:48

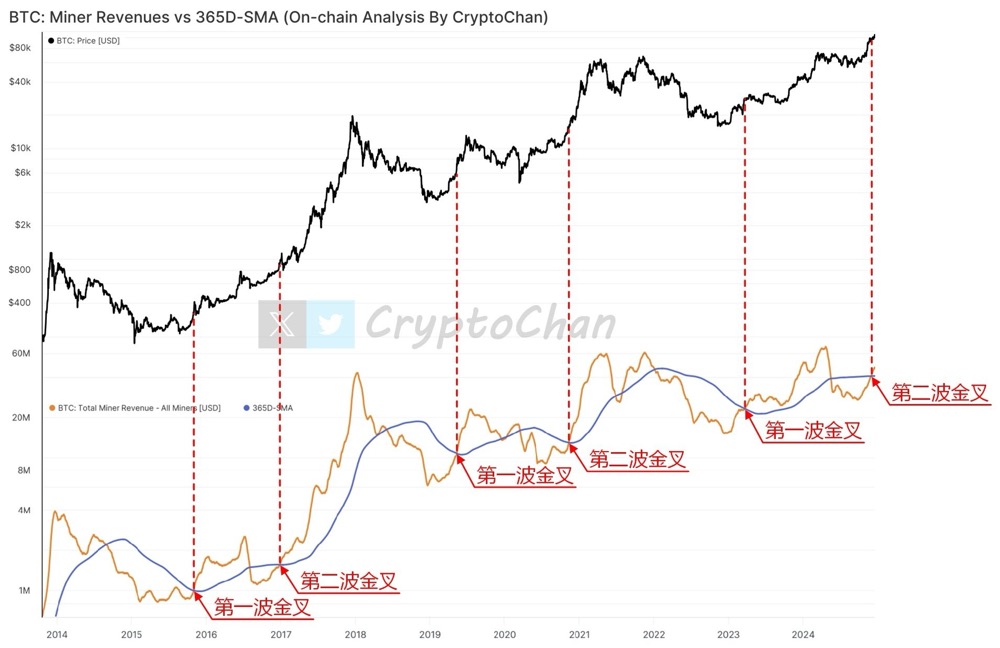

Indicator update: BTC completes the second wave of golden cross, historical signals reappear

CryptoChan·2024/12/20 10:37

Flash

09:40

Techub News: Company founder Alma has no founding connection with Central Research, and Big Demo Day is a public event.ChainCatcher news: In response to recent false information circulating on social platforms, Techub News issued a statement saying: Techub News founder and CEO Alma has never participated in the founding of Central Research, nor has she served as its "co-founder" or held any similar position. Such claims are not true. Big Demo Day is a public entrepreneurial roadshow event co-organized by multiple parties, and has received support from institutions such as Hong Kong Cyberport. Techub News has only participated in some editions of the event as a co-organizer or partner media, and is not involved in Central Research's internal governance, personnel appointments, or operational management. Equating this event simply as an "internal event" of Central Research, or interpreting Alma's public appearances as participation in its operations, are both misunderstandings.

09:36

An address withdrew 2,000 ETH worth $5.98 million from an exchange.Address 0x4F5…61177 has started its fourth round of trading. Half an hour ago, it withdrew 2,000 ETH from a certain exchange, valued at $5.98 million, with a withdrawal price of $2,991.65 per ETH. The most recent trading round for this address ended one month ago, which was the only time it incurred a loss. Over the past 11 months, this address has made three rounds of ETH trading, earning a total profit of $1.506 million, with two wins and one loss.

09:34

Machi Big Brother closed all BTC and HYPE long positions 15 minutes ago, with a net weekly loss of approximately $1.46 million.According to Deep Tide TechFlow, on December 21, on-chain data monitoring shows that "Brother Machi" Huang Licheng closed all his Bitcoin long positions and HYPE long positions 15 minutes ago. He currently still holds a 25x leveraged Ethereum long position, with a holding of 5,400 ETH and a liquidation price of approximately $2,795. As of now, Brother Machi has made 15 long trades this week, with 12 profitable and 3 losing trades, resulting in a win rate of 80%. The overall net loss for his positions this week is about $1.46 million.

News