Deutsche Börse Partners with Chainlink to Bring Market Data Onchain via DataLink

Contents

Toggle- Quick Breakdown

- Expanding onchain access to market data

- Chainlink’s role in institutional adoption

Quick Breakdown

- Deutsche Börse Market Data + Services partners with Chainlink to publish real-time multi-asset class market data onchain.

- Data from Eurex, Xetra, 360T, and Tradegate will be available via Chainlink’s DataLink across 40+ blockchains.

- Integration gives 2,400+ DeFi protocols access to institutional-grade market data, enabling regulated financial products onchain.

Deutsche Börse Market Data + Services, the market data arm of Deutsche Börse Group, has entered a strategic partnership with Chainlink to deliver its multi-asset class market data directly to blockchains for the first time. The move brings real-time feeds from the exchange operator’s key venues Eurex, Xetra, 360T, and Tradegate onchain via Chainlink’s institutional-grade publishing service, DataLink.

The initiative marks a breakthrough in bridging traditional finance and blockchain-based systems. Deutsche Börse Market Data + Services, which distributed four billion data points daily and supported €1.3 trillion in securities trading last year, will now make its trusted feeds accessible across more than 40 blockchains and 2,400 DeFi protocols in the Chainlink ecosystem.

We’re excited to announce that Deutsche Börse Market Data + Services has formed a strategic partnership with Chainlink to publish its market data onchain for the first time. https://t.co/2OuPryzJpf

Real-time data from the largest exchanges in Europe, Deutsche Börse Group’s… pic.twitter.com/O3GflnQla4

— Chainlink (@chainlink) October 1, 2025

Expanding onchain access to market data

Through the partnership, blockchain applications will gain access to real-time data across equities, derivatives, FX, ETFs, and private investor trading. Eurex alone recorded 2.08 billion exchange-traded derivatives contracts in 2024, while Xetra posted €230.8 billion in ETF and ETP turnover. Meanwhile, 360T remains a global hub for corporate FX hedging with more than 2,900 buy-side clients, and Tradegate processed €247.8 billion in turnover this year with 34 million transactions.

By bringing this high-quality data onchain, developers and institutions can build next-generation financial products from tokenized assets to risk management tools backed by the same feeds that power traditional markets.

Chainlink’s role in institutional adoption

DataLink leverages Chainlink’s proven infrastructure, which has secured nearly $100 billion in DeFi total value locked (TVL) and facilitated over $25 trillion in transactions. For Deutsche Börse, adopting Chainlink’s data standard provides a regulated, secure, and scalable channel to connect its feeds with decentralized markets.

“This partnership bridges the worlds of traditional finance and blockchain,” said Dr Alireza Dorfard, Head of Market Data + Services at Deutsche Börse.“

With Chainlink, we are embedding trusted data into the foundations of digital markets.” Meanwhile, DeFi platform River has strengthened its cross-chain stablecoin infrastructure by integrating Chainlink price feeds to deliver secure and accurate collateral pricing across multiple blockchains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

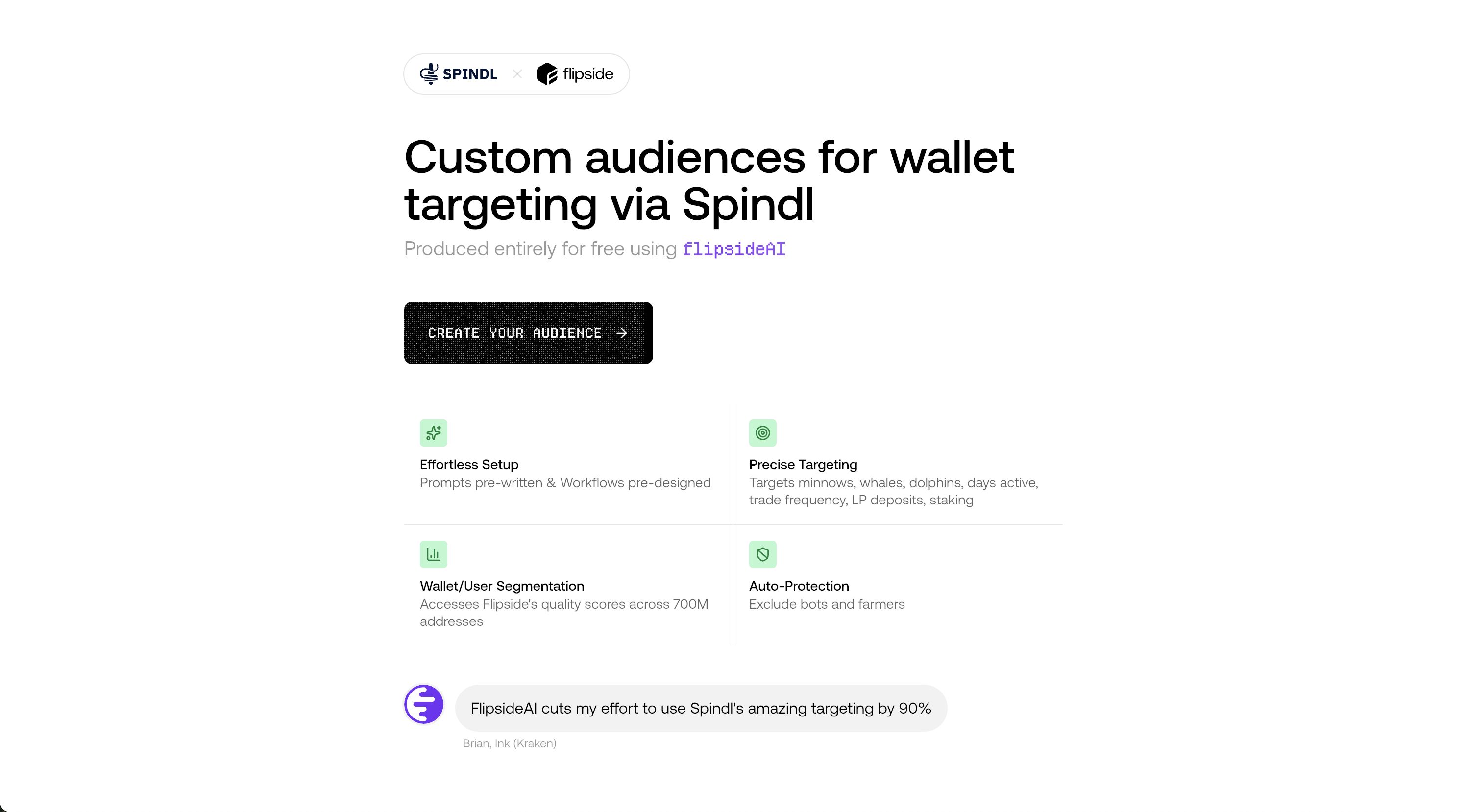

Wallet Targeting Agent for Spindl: Activate High-Value Users With Ease

The market faces a significant correction— is this the midpoint or the end of the cycle?

There are differing interpretations regarding the reasons for this pullback, but it is certain that the market is currently in a crucial waiting period, including the reopening of the U.S. government and a potential policy shift by the Federal Reserve. It is also undeniable that bitcoin’s fundamentals are stronger than ever before.

Giants step back, ETF cools down: What is the real reason behind bitcoin's recent decline?

With structural support weakening, market volatility is expected to increase.

Is the fact that Strategy is no longer "aggressively buying" the reason for bitcoin's recent decline?

Spot Bitcoin ETFs, which have long been regarded as "automatic absorbers of new supply," are also showing similar signs of weakness.