Home Depot Faces Decline: Industry-Wide Slowdown or Company-Specific Challenge?

- Home Depot shares slumped 2–3% premarket after Q3 2025 earnings missed profit forecasts and slashed full-year guidance. - Weak comparable sales growth (0.2% vs 1.3% expected) and housing market pressures highlighted sector-wide challenges. - GMS acquisition added $900M revenue but couldn't offset 1.6% transaction volume decline and margin pressures. - Analysts revised 2025 EPS forecasts down 5% as Stifel downgraded HD to "Hold," reflecting cyclical uncertainty. - Mixed investor reactions persist, with in

Home Depot (HD) shares dropped in premarket trading on November 18, 2025, after the home improvement giant posted third-quarter fiscal 2025 earnings that fell short of profit forecasts and sharply reduced its full-year guidance. The stock, which slipped around 2–3%, lagged behind major market indices,

The company announced adjusted earnings per share (EPS) of $3.74, missing the consensus range of $3.81–$3.84,

Home Depot’s performance underscores the difficulties the home improvement industry faces as the housing market cools. Although the acquisition of GMS Inc. added about $900 million to revenue,

The profit warning reverberated across Wall Street.

Institutional investors have shown mixed reactions. While Empowered Funds LLC and Parnassus Value Equity Fund increased their holdings in Q2 and October 2025, respectively,

Looking forward, the company’s prospects depend on broader economic trends. If housing activity stabilizes and the Fed lowers rates, demand for home improvement projects could rebound; however, continued high rates and affordability concerns may extend the downturn. Home Depot’s earnings call later Tuesday and Lowe’s report on Wednesday will

At present, the stock trades at a forward P/E of 24.34,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster News Today: Transparent Token Unlocks Fuel 9% Surge for Aster, $1.38 Target in Focus

- ASTER surged 9% to $3.27B market cap after team clarified tokenomics and Binance's CZ disclosed $2.5M holdings. - Misstated unlock schedules and a $10M trading competition fueled demand, with price stabilizing above $1.14. - Analysts highlight $1.38 target if $1.26 resistance holds, but warn of risks from stagnant fees and declining user growth.

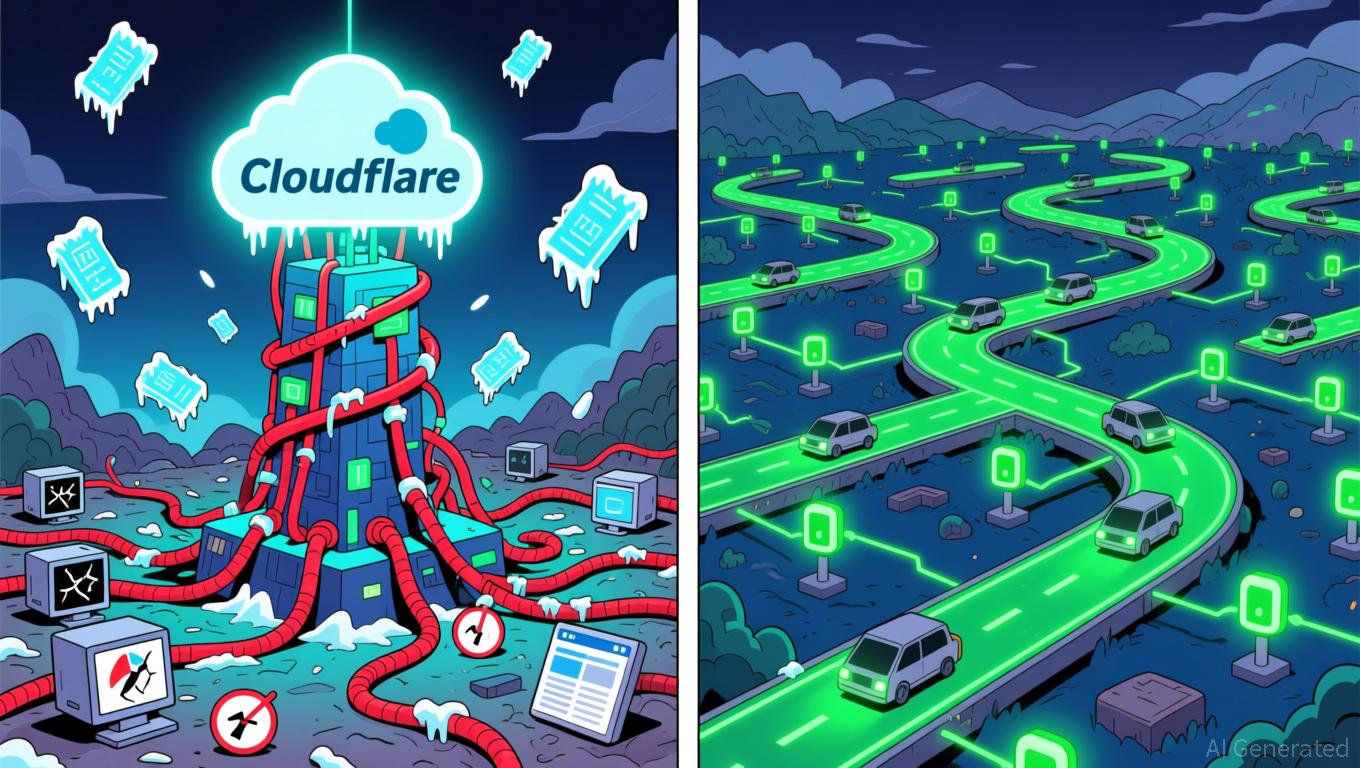

Bitcoin News Update: Recent Cloud Outages Highlight Systemic Risks, Fueling DePIN Adoption

- Cloudflare's 2025 global outage disrupted major websites and crypto platforms, exposing centralized infrastructure vulnerabilities and boosting DePIN interest. - The incident caused 500 errors and API failures, impacting services like ChatGPT, X, and crypto exchanges, while pushing Cloudflare's stock down 3.5%. - DePIN advocates argue decentralized infrastructure reduces single-point failures, with projects like Gaimin promoting distributed cloud models using global resources. - Blockchain's operational

Bitcoin Updates Today: Is Bitcoin's Decline a Temporary Correction or the Start of a Crash? Experts Disagree

- Bitcoin's recent sharp price swings, dipping below $90,000 before rebounding to $96,500, have intensified debates over bear market risks versus bull cycle consolidation. - MicroStrategy's CEO Michael Saylor denied Bitcoin sales, reaffirming accumulation strategies as institutional ETF redemptions hit $870M, signaling bear market concerns. - Technical analysts highlight critical $92,000–$95,000 support zones, with breakdown risks pushing prices toward $85,000–$90,000 amid deteriorating market sentiment. -

ICP Caffeine AI and Its Transformative Impact on the AI-Powered Investment Sector

- ICP Caffeine AI, a blockchain-AI platform by DFINITY, launched in 2025, boosted ICP token price by 56% and partnered with Microsoft and Google Cloud. - Its cost-efficient AI tools and chain-of-chains architecture enable real-time portfolio optimization and risk management for institutions. - Despite a 22.4% Q3 dApp activity drop, it achieved $237B TVL, but faces scalability and regulatory challenges from competitors and SEC scrutiny. - Analysts project growth if ICP sustains above $6.50, but institutions