Bitcoin ( BTC ) reclaimed $90,000 this week, but onchain data indicated that the move sat on shaky grounds. Despite a strong cost-basis cluster, demand, liquidity, and futures activity remained thin.

Key takeaways:

The $84,000 cost-basis cluster held 400,000 BTC, but spot demand above it remains shallow.

BTC liquidity signals resembled the weakness seen in early 2022, with losses dominating recent flows.

Recent futures activity was mostly shorts-covering, and not long-positional build-up.

BTC spot demand must improve above $84,000 cost basis

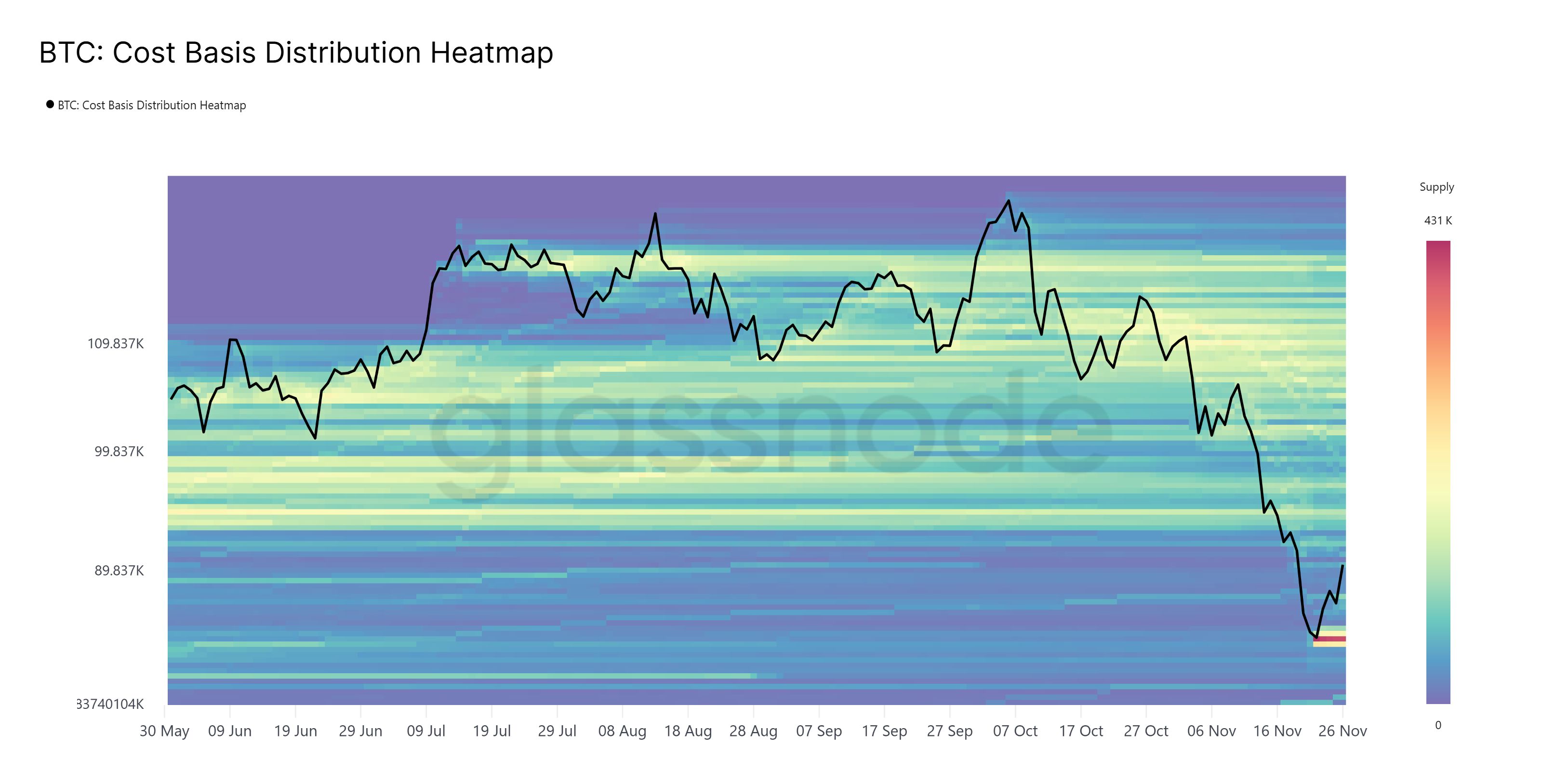

Bitcoin’s recent move took place at the back of a dense cost-basis cluster around $84,000. More than 400,000 BTC were acquired in this range, forming a clear onchain “floor.”

Bitcoin Cost Basis Distribution heatmap. Source: Glassnode

Bitcoin Cost Basis Distribution heatmap. Source: Glassnode But the issue is that despite this heavy base, spot participation above is visibly limited. Order books remained thin, and prices are moving through areas with minimal buyer engagement. For Bitcoin to hold above $90,000, this dynamic must shift from passive historical accumulation to active ongoing demand.

A healthier bullish structure requires more spot absorption between $84,000 and $90,000, which the market has yet to achieve after the recent dip.

Liquidity needs to stabilize as short-term holders lose confidence

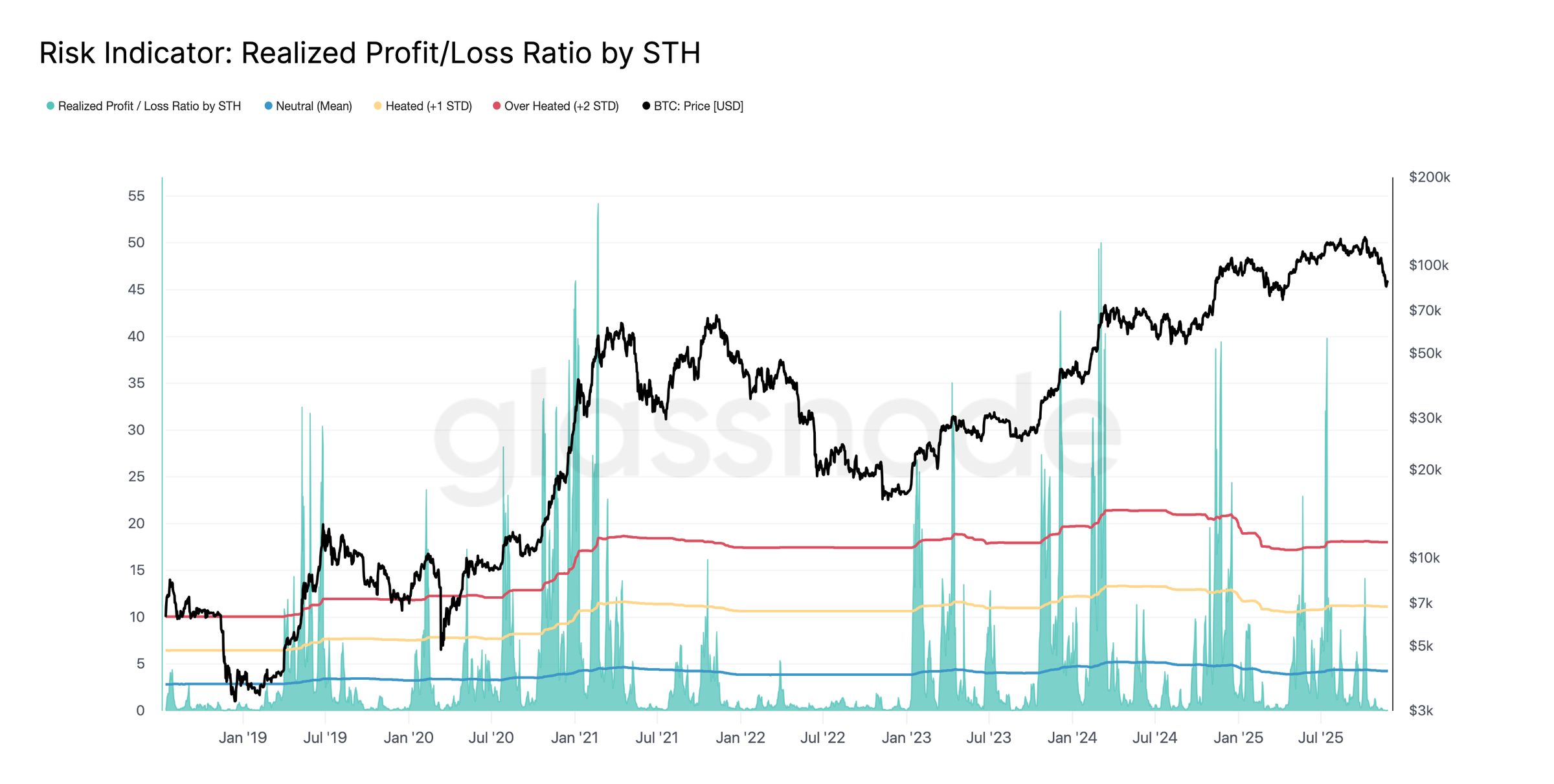

Glassnode noted that Bitcoin continued to trade below the short-term holder (STH) cost basis ($104,600), placing the market in a low-liquidity zone similar to the Q1 2022 post-ATH fade.

The $81,000–$89,000 compression, coupled with realized losses now averaging $403 million/day, implied that investors were exiting rather than buying into the strength. The STH Profit/Loss Ratio’s collapse to 0.07x reinforced that demand momentum has evaporated.

Profit/Loss ratio of STH. Source: Glassnode

Profit/Loss ratio of STH. Source: Glassnode For the trend to shift, realized losses must begin contracting, and STH profitability must recover above neutral levels. Without a liquidity reset, the market remains at risk of drifting toward the “True Market Mean” near $81,000 again.

Related: Bitcoin bounces to seven-day highs, but can BTC break $95K on Thanksgiving?

BTC futures markets need offensive buy bids

The breakout to $91,000 has so far been fueled mainly by shorts covering, not fresh long exposure. Open interest continued to decline, cumulative volume delta is flat, and shorts liquidation pockets drove the move through $84,000, $86,000, and $90,000.

Bitcoin’s price, open interest, and cumulative volume delta. Source: Hyblock Capital

Bitcoin’s price, open interest, and cumulative volume delta. Source: Hyblock Capital Funding rates hovering near neutral reflect a cautious derivatives environment. Leverage is bleeding out in an orderly fashion, but buyers aren’t stepping in with conviction.

Thus, a supportive trend shift would require rebuilding open interest on the long side, along with sustained positive funding driven by actual demand, rather than forced short exits.

Related: Bearish Bitcoin mining data may be counter signal that encourages spot-driven BTC rally