News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 26) | Kevin Hassett Emerges as Top Candidate for SEC Chair; Ethereum ETFs Record ~$104M Net Inflow in a Single Day; Texas Launches Bitcoin Reserve Program with First $5M IBIT Purchase2Strategy Pauses Bitcoin Purchases, Raising Market Concerns3Monad’s MON Token Jumps 46% After Early Slide Amid Market Slump

JPMorgan bets on high gains with its new Bitcoin product

Cointribune·2025/11/27 00:54

Bitcoin: A Relative Buying Opportunity Despite the Panic, According to k33

Cointribune·2025/11/27 00:54

The "Bankruptcy" of Metcalfe's Law: Why Are Cryptocurrencies Overvalued?

Currently, the pricing of crypto assets is largely based on network effects that have yet to materialize, with valuations clearly outpacing actual usage, retention, and fee capture capabilities.

Chaincatcher·2025/11/26 23:15

Need Funding, Need Users, Need Retention: A Growth Guide for Crypto Projects in 2026

When content becomes saturated, incentives become more expensive, and channels become fragmented, where lies the key to growth?

Chaincatcher·2025/11/26 23:15

EOS faces renewed turmoil as the community accuses the Foundation of running away with the funds

The collapse of Vaulta is not only a tragedy for EOS, but also a reflection of the shattered ideals of Web3.

Chaincatcher·2025/11/26 23:14

Exclusive: Revealing the Exchange’s New User Acquisition Strategy—$50 for Each New User

Crypto advertising has evolved from being barely noticeable to becoming pervasive everywhere.

Chaincatcher·2025/11/26 23:14

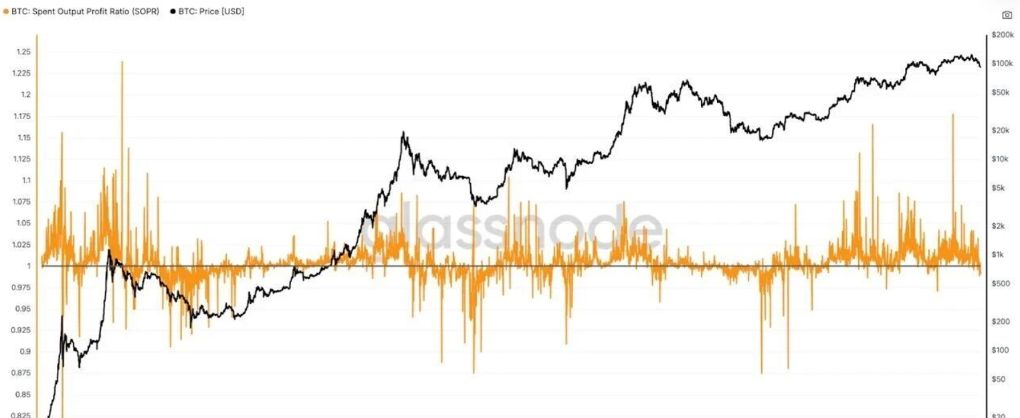

Has the four-year bitcoin cycle failed under institutional participation?

AICoin·2025/11/26 23:05

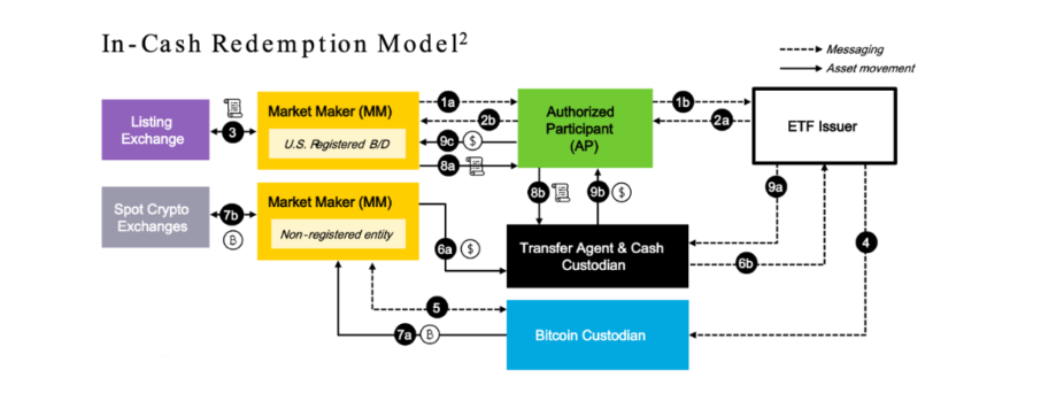

The truth behind BlackRock's "dumping": user redemptions rather than institutional selling

AICoin·2025/11/26 23:05

Bitcoin miners, are they reaching their limit?

Bitpush·2025/11/26 23:02

Flash

- 00:47CryptoQuant: Significant Increase in Large Holder Deposits to Exchanges During Bitcoin Price DropAccording to ChainCatcher, citing The Block, on-chain analytics firm CryptoQuant pointed out that after bitcoin's price fell below $80,000 last week, the amount of bitcoin transferred by whales to exchanges surged. Data shows that the daily inflow to exchanges reached 9,000 BTC, with 45% coming from large deposits of over 100 BTC in a single transaction, a proportion described as "abnormally high." The average single deposit in November soared from 0.6 BTC to 1.23 BTC, marking a new high for the past year. On one exchange platform, the average single deposit even increased from 12 BTC at the beginning of the month to 37 BTC recently. CryptoQuant noted that this further confirms the view that "whales are reducing their bitcoin holdings through exchanges," and in the context of the current price correction, investor selling continues to put pressure on the market. Other major assets have also seen active exchange activity. Although the total inflow of Ethereum has not increased significantly, the proportion of large deposits has risen. As the price of Ethereum fell to around $2,900, the average daily single deposit reached 41.7 ETH, hitting a nearly three-year high. In terms of altcoins, since July, the daily number of transactions transferred to exchanges has consistently exceeded 40,000, with a peak of 78,000 transactions on October 17.

- 00:47Tether CEO responds to S&P's downgrade of USDT rating, saying the fragility of the old system is making those in power uneasyChainCatcher News, Tether CEO Paolo Ardoino responded to S&P's latest rating of Tether by saying, "We are proud to be hated by you." Paolo Ardoino pointed out that traditional rating systems have long guided investors toward "investment-grade" institutions that ultimately collapsed, causing global regulators to question the independence of rating agencies. He stated that the traditional financial system is unwilling to see any company break free from its "dysfunctional gravity," but Tether has built the industry's first over-capitalized, toxic asset-free, and consistently highly profitable company, proving that the fragility of the old system is making the "emperor's new clothes" style rulers uneasy.

- 00:38Opinion: Bitcoin's decline is related to Trump's drop in approval ratingsChainCatcher reported that Bitcoin critic and economist Paul Krugman stated in a blog post that the recent decline in Bitcoin (BTC) is not a coincidence, but is related to the drop in poll numbers for pro-cryptocurrency U.S. President Trump. Krugman wrote in his Substack article "The Trump Trade is Unraveling" that the sharp decline in Trump's poll numbers has had a negative impact on the price of Bitcoin. He believes that Trump had promised to support the digital asset industry and promote pro-cryptocurrency policies, so Bitcoin has essentially become a bet on "Trumpism." He added that President Trump's apparent loss of power has weakened his efforts to promote cryptocurrency, which in turn has affected the price of Bitcoin. Krugman has long been a critic of Bitcoin. He believes that Bitcoin is economically useless, neither a medium of payment nor a hedge against inflation, and behaves more like a highly volatile tech stock.

![[Bitpush Daily News Selection] Bloomberg: Hassett is a top candidate for Federal Reserve Chair and previously led the development of the crypto regulatory framework; Bitwise Dogecoin ETF BWOW may be listed on NYSE Arca as early as Wednesday; Texas invests $10 million in BlackRock Bitcoin ETF; Bitcoin sees its worst January in nearly three years, with a record $3.7 billion ETF outflow in a single month](https://img.bgstatic.com/multiLang/image/social/01582b32c50c68df86392683edeac2ba1764167940940.png)