Bitcoin miners, are they reaching their limit?

Author: Prathik Desai

Original Title: The Miners’ Mirage

Compiled and organized by: BitpushNews

The doomsday sentiment pervading crypto Twitter lately has surely worn you out. But what’s even more intriguing is the cognitive split in the market: some are impatiently writing obituaries for the bull market, while others dismiss it as just another cyclical ripple. Honestly, this scene is nothing new—there’s never a shortage of self-justifying narratives in the market. Certain signs, however, suggest that this time might be different.

For the first time since launch, the Bitcoin ETF has seen three consecutive days of net outflows totaling $1 billion; BTC’s funding rate has turned negative; and the “buy the dip” sentiment has mostly devolved into meme fodder on crypto Twitter.

Yet, historically, BTC has experienced multiple 25%-30% pullbacks, only to reach new all-time highs in the following months. Who can be sure which theory will play out this time?

But in the crypto space, there’s a group that doesn’t rely on sentiment, astrology, or other blind theories. There’s a class of market participants whose actions cannot be misinterpreted. They are the original on-chain participants of Bitcoin: the miners.

After U.S. President Donald Trump announced the first round of reciprocal tariffs on Asian countries including China (most mining machines come from China), miners went through a tough period.

However, their economic reality is mainly tied to simple math, including the halving conditions written into the Bitcoin whitepaper over fifteen years ago.

This article will dissect the current state of miner profitability—as BTC prices plummet, their revenues are being squeezed.

The financial situation of BTC miners is straightforward: they survive on fixed protocol revenues but face real-world variable expenses. When the market is volatile, they are the first group to feel the pressure on their balance sheets. Their income comes from selling mined BTC, while their operating costs are mainly the electricity required to run heavy computing equipment.

I’ve tracked the fees paid to them by the network, the costs required to earn this revenue, how much profit remains after deducting cash expenses, and the portion they can actually take home after accounting adjustments.

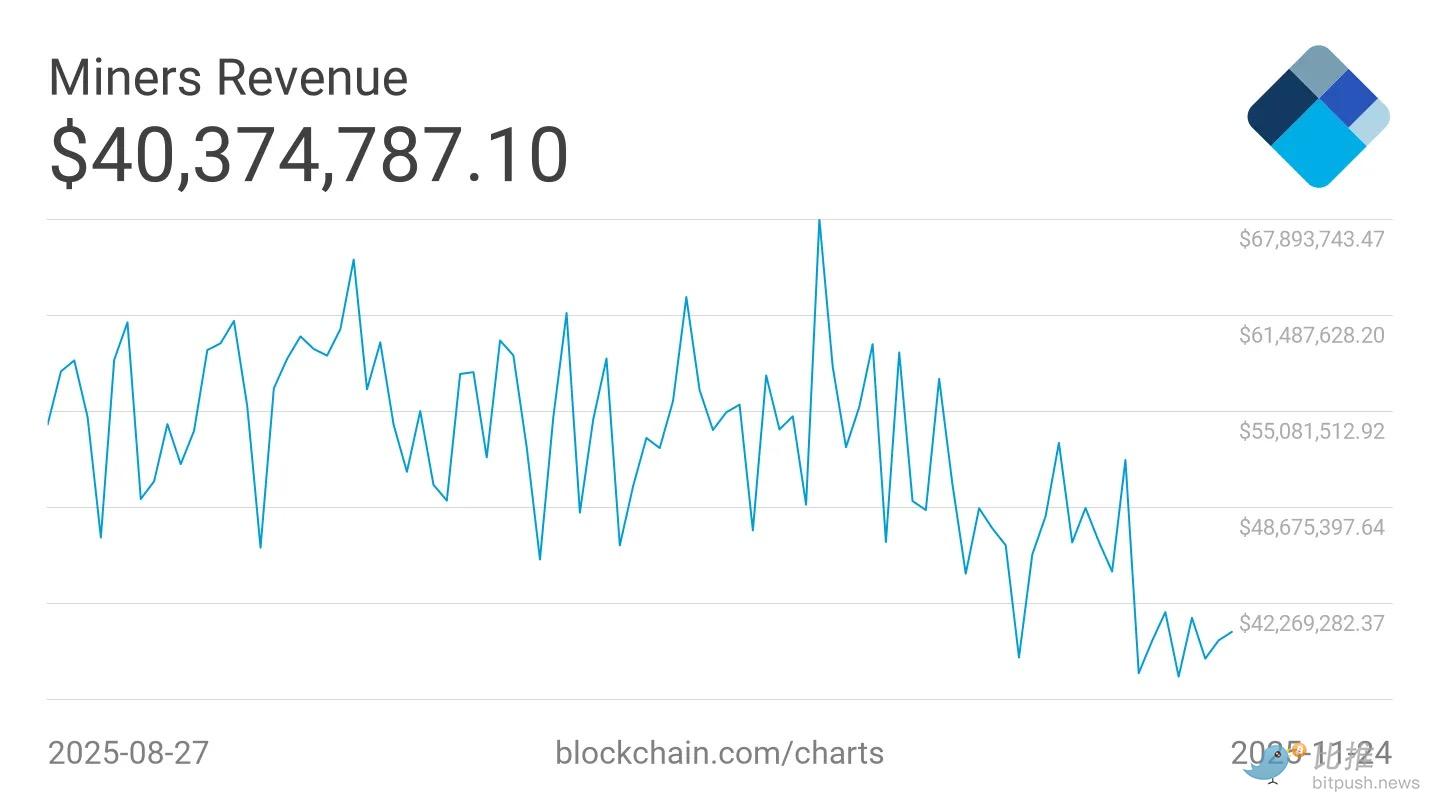

Long story short: At current BTC trading levels below $90,000, the mining industry is in trouble, far from thriving. Over the past two months, the average 7-day miner revenue has dropped 35% from $60 million to $40 million.

Let’s dive deeper into the data.

Bitcoin’s revenue is mechanical, set by protocol code.

The mining reward per block is 3.125 BTC, with an average block time of 10 minutes, resulting in about 144 blocks per day. This means about 450 BTC are mined daily. Over 30 days, global BTC miners collectively mine 13,500 BTC, which, at the current BTC price of about $88,000, totals approximately $1.2 billion. Once distributed across a record 1,078 Exahashes/second (EH/s) of hash rate, this $1 billion pie turns into just 3.6 cents per Terahash per day in revenue. This is the entire economic foundation supporting a $1.7 trillion network’s security.

On the cost side, electricity is the most important variable, varying by region and mining machine efficiency.

If you use modern miners, such as S21-level devices, which consume 17 joules per Terahash and have low electricity costs, you can still maintain cash profits. But if your mining fleet relies on older equipment or higher electricity prices, every hash you calculate adds to your costs. At the current hash price (affected by network difficulty, bitcoin price, block subsidy, and transaction fees), an S19 miner can barely break even at an electricity price of $0.06 per kWh. If difficulty rises, prices drop slightly, or a heatwave pushes up electricity costs, the economic situation will slip further into losses.

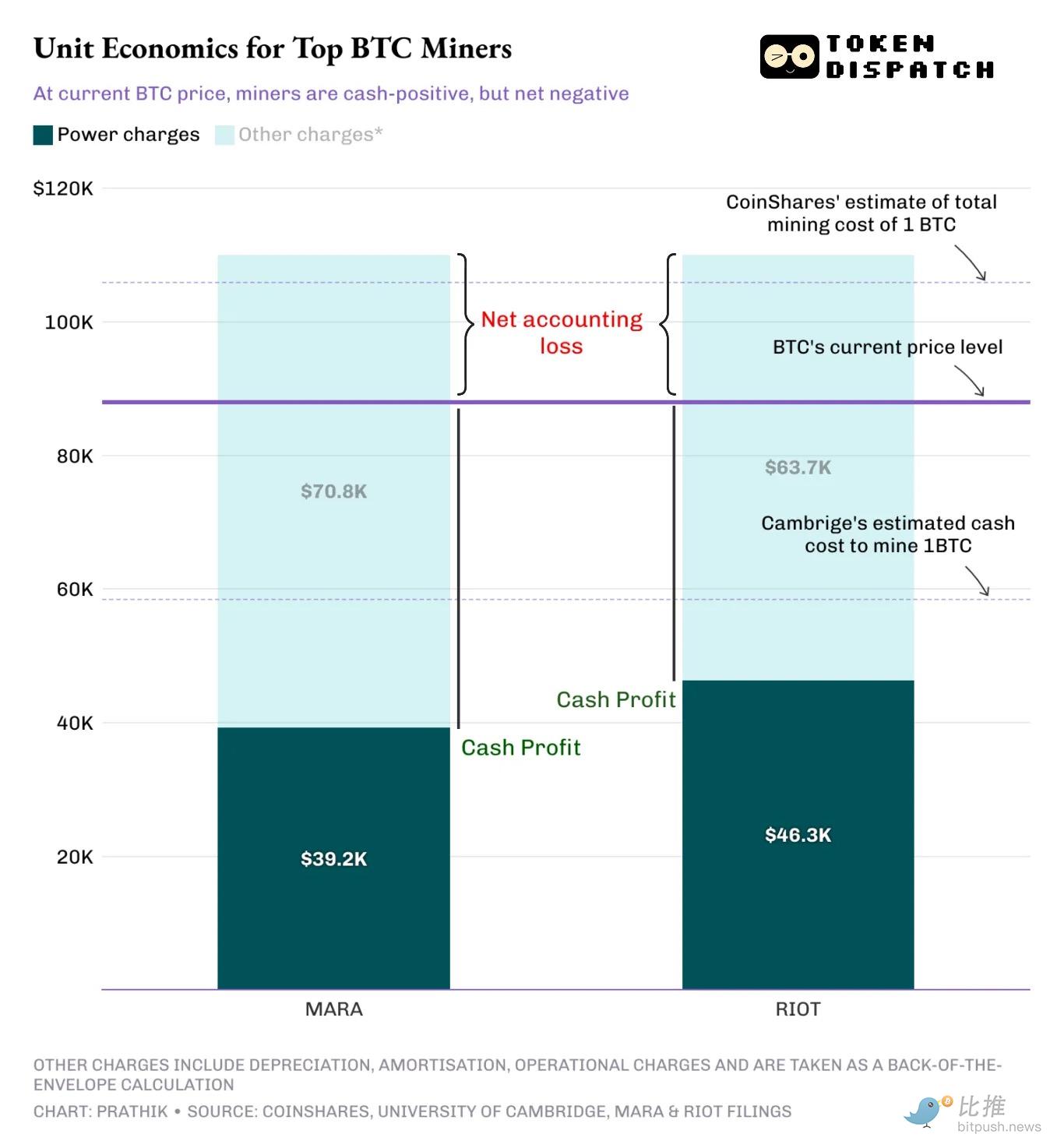

In December 2024, CoinShares estimated that the cash cost for listed mining companies to produce one BTC in Q3 2024 would be about $55,950. Now, Cambridge University estimates the cost at about $58,500. Actual mining costs vary by miner.

The largest listed bitcoin mining company, Marathon Digital, had an average energy cost of $39,235 per BTC mined in Q3 2025. The second-largest listed miner, Riot Platforms, had a cost of $46,324. Even though BTC’s trading price has dropped 30% from its peak to $86,000, these miners are still thriving. But that’s not the whole picture.

Miners also need to consider non-cash items, including depreciation, impairment, and equity incentives. These factors together make mining a capital-intensive business. Once these are included, the total cost of mining one BTC can easily exceed $100,000.

MARA mines using both self-owned and third-party hosted hardware. Simply by using all this equipment, it must pay for electricity, account for depreciation, and reserve for hosting fees.

Rough estimates put its total mining cost per BTC at over $110,000.

CoinShares also estimated the total mining cost at about $106,000 in December 2024.

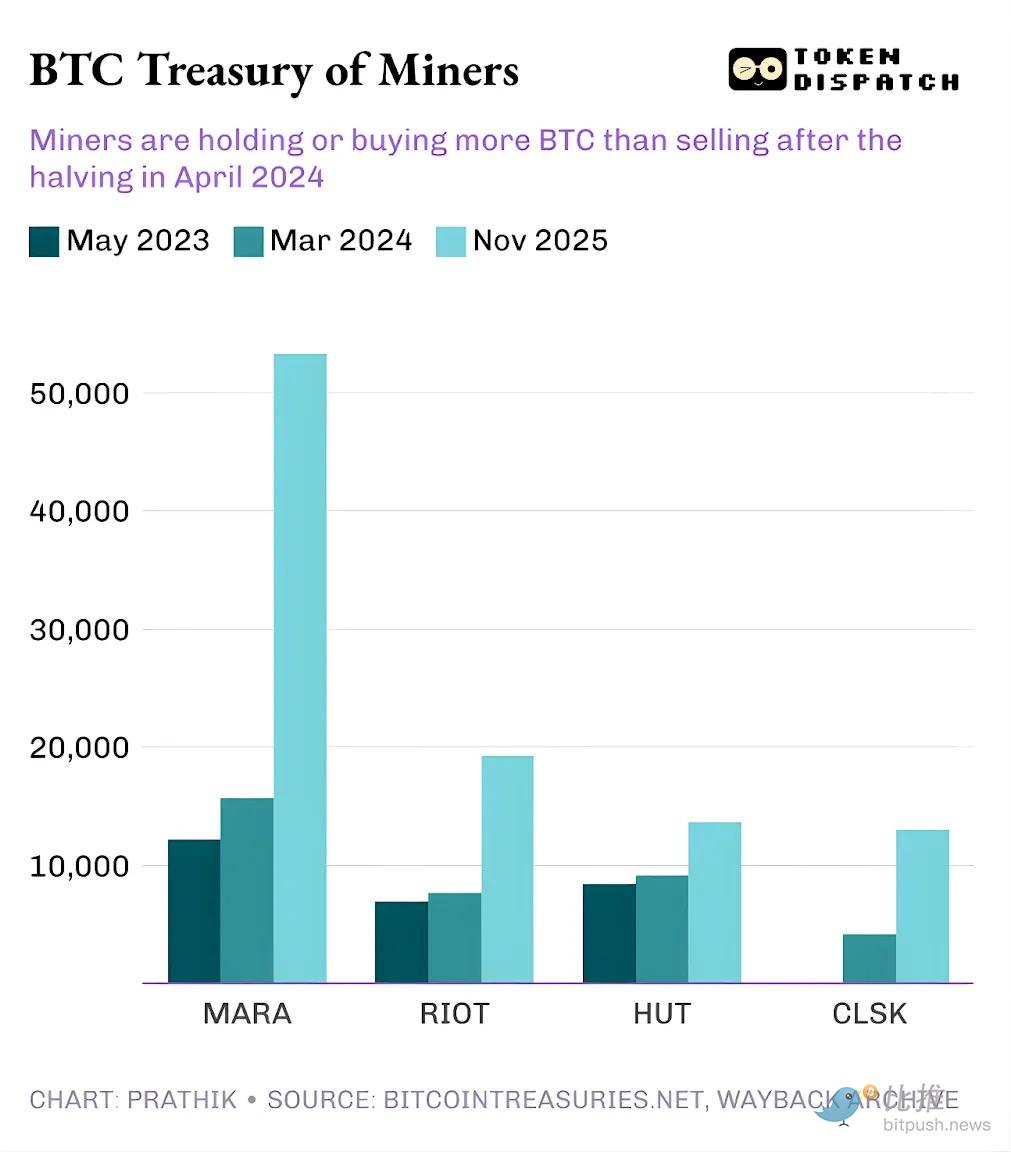

On the surface, the mining industry seems robust—cash profits are strong, accounting profits are within reach, and the scale of operations allows for easy financing. However, when you zoom out, you’ll understand why more and more miners are choosing to hold onto their mined BTC, or even buy more BTC from the market, rather than sell.

Stronger miners like MARA can cover their costs because they have ancillary businesses and access to capital markets.

However, many other miners could fall into losses with just one difficulty adjustment.

Taking all this together, there are two breakeven scenarios coexisting in the mining world:

The first scenario is industrial miners operating with efficient mining fleets, cheap electricity, and light capital balance sheets. For them, the BTC price could fall from $86,000 to $50,000 before daily cash flow turns negative. Today, they can earn over $40,000 in cash profit for every BTC mined, but whether they can squeeze out any accounting profit at current price levels depends on the miner.

The second scenario is that once you factor in depreciation, impairment, and equity incentive expenses, the rest of the miners will struggle to stay above the breakeven point.

Even if you assume a conservative total production cost for 1 BTC between $90,000 and $110,000, this means many miners are already below their economic breakeven point. They can continue mining because their cash costs haven’t been breached yet, but their accounting costs have. This may prompt more miners to hold onto their BTC rather than sell now.

As long as miners’ economic situation remains cash flow positive, they will continue mining. At a price of $88,000, the system appears stable, but this only holds if miners don’t sell their BTC. Once BTC drops further, or miners are forced to liquidate their BTC holdings, they begin to approach their breakeven line.

Therefore, while price crashes will continue to affect retail and trading communities, they are currently unlikely to hurt miners. However, if miners’ access to capital becomes more restricted, this situation could hit miners much harder. At that point, the flywheel effect will be interrupted, and miners will need to double down on developing their ancillary businesses to survive.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan bets on high gains with its new Bitcoin product

Bitcoin: A Relative Buying Opportunity Despite the Panic, According to k33

The "Bankruptcy" of Metcalfe's Law: Why Are Cryptocurrencies Overvalued?

Currently, the pricing of crypto assets is largely based on network effects that have yet to materialize, with valuations clearly outpacing actual usage, retention, and fee capture capabilities.

Need Funding, Need Users, Need Retention: A Growth Guide for Crypto Projects in 2026

When content becomes saturated, incentives become more expensive, and channels become fragmented, where lies the key to growth?