News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

‘It felt so wrong’: Colin Angle on iRobot, the FTC, and the Amazon deal that never was

TechCrunch·2025/12/20 21:48

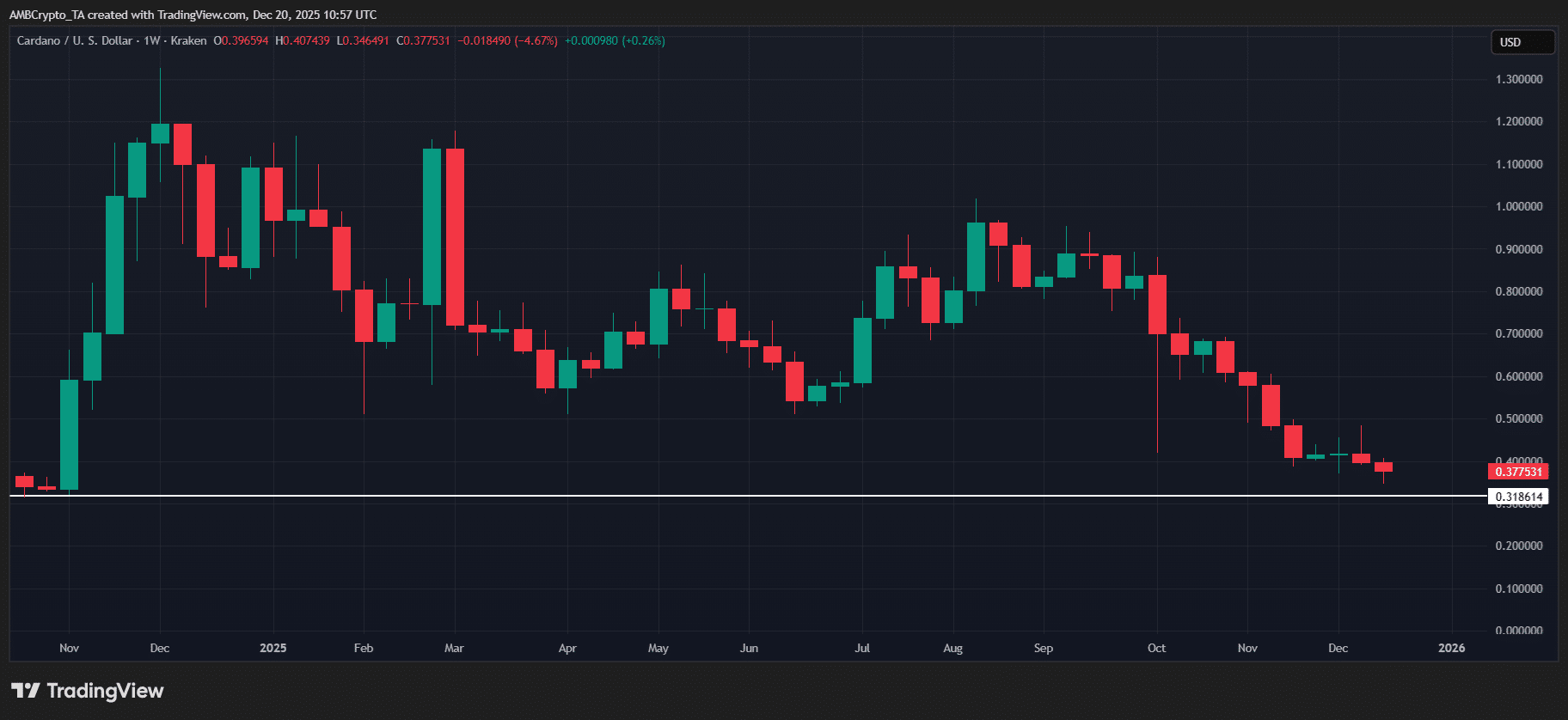

Cardano erases 100% of election rally gains – Can ADA hold top 10?

AMBCrypto·2025/12/20 21:03

Why SEI must reclaim KEY support to avoid drop below $0.07

AMBCrypto·2025/12/20 20:03

Ethereum Faces Uncertainty with Tight Trading Range

Cointurk·2025/12/20 20:03

Fundstrat Internal Report Projects Crypto Drawdown Despite Tom Lee Bullish Stance

BTCPeers·2025/12/20 20:00

Expert to XRP Investors: Are You Mentally Prepared for What’s Coming?

TimesTabloid·2025/12/20 19:06

SEI Network Eyes Critical 20-Day MA Breakout as Analysts Debate Recovery Potential

BlockchainReporter·2025/12/20 19:00

Ethereum treasury company SharpLink's stock dips slightly after another round of buybacks

The Block·2025/12/20 18:58

Solana treasury Sharps inks staking partnership with Bonk

The Block·2025/12/20 18:58

Flash

01:06

Etherealize co-founder: The crypto industry needs to demonstrate real-world use cases before Trump leaves officeAccording to Deep Tide TechFlow, on December 21, as reported by Decrypt, Etherealize co-founder Danny Ryan stated that the crypto industry needs to "prove its value" before Trump leaves office, in order to avoid facing policy reversals after future government changes. He pointed out that the current U.S. government has promoted crypto-supportive legislation and regulatory improvements, but this environment will not last forever. Therefore, the industry should expedite the implementation of regulations and integration with capital markets. Ryan said that if crypto cannot demonstrate practical use during the current administration's term, future political forces may reconsider these policy supports. He emphasized that now is the industry's "window of opportunity" to make crypto a part of the financial system, rather than waiting for political changes to bring uncertainty.

01:05

EF: In 2026, the focus shifted from speed to security, establishing strict 128-bit encryption rulesBlockBeats News, December 21st, the Ethereum Foundation announced that in 2026, it will shift its focus from speed to security and set strict 128-bit encryption rules. The Foundation stated that over the past year, zkEVM has made significant progress in performance, but some solutions rely on insufficiently validated mathematical assumptions. Theoretically, there is a risk of on-chain state forgery. Therefore, the next stage's more critical work is to strengthen formal verification, resistance to attacks, and basic cryptographic security.

The Foundation will provide security audit and evaluation tools in the future, requiring zkEVM to achieve a minimum of 128-bit security strength by 2026, equivalent to the current mainstream cryptographic accreditation level. The new standard may slow down the progress of some scalability projects. Still, the Foundation emphasizes that in the long run, resilience to attacks and credibility are essential prerequisites for attracting institutions and high-value applications. It is better to focus on security first and then improve performance.

01:00

James Wynn closed his bitcoin short position 4 hours ago, earning $21,000 in profit, and then opened a long position.PANews reported on December 21 that, according to monitoring by Lookonchain, James Wynn closed his bitcoin short position 4 hours ago, making a profit of $21,000. He then switched to a long position, opening a 40x leveraged long position with 14.08 bitcoin ($1.24 million). The liquidation price is $87,111.

News