News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Bitcoin rebounds on Japan rate hike as Arthur Hayes sees dollar at 200 yen

Cointime·2025/12/19 10:46

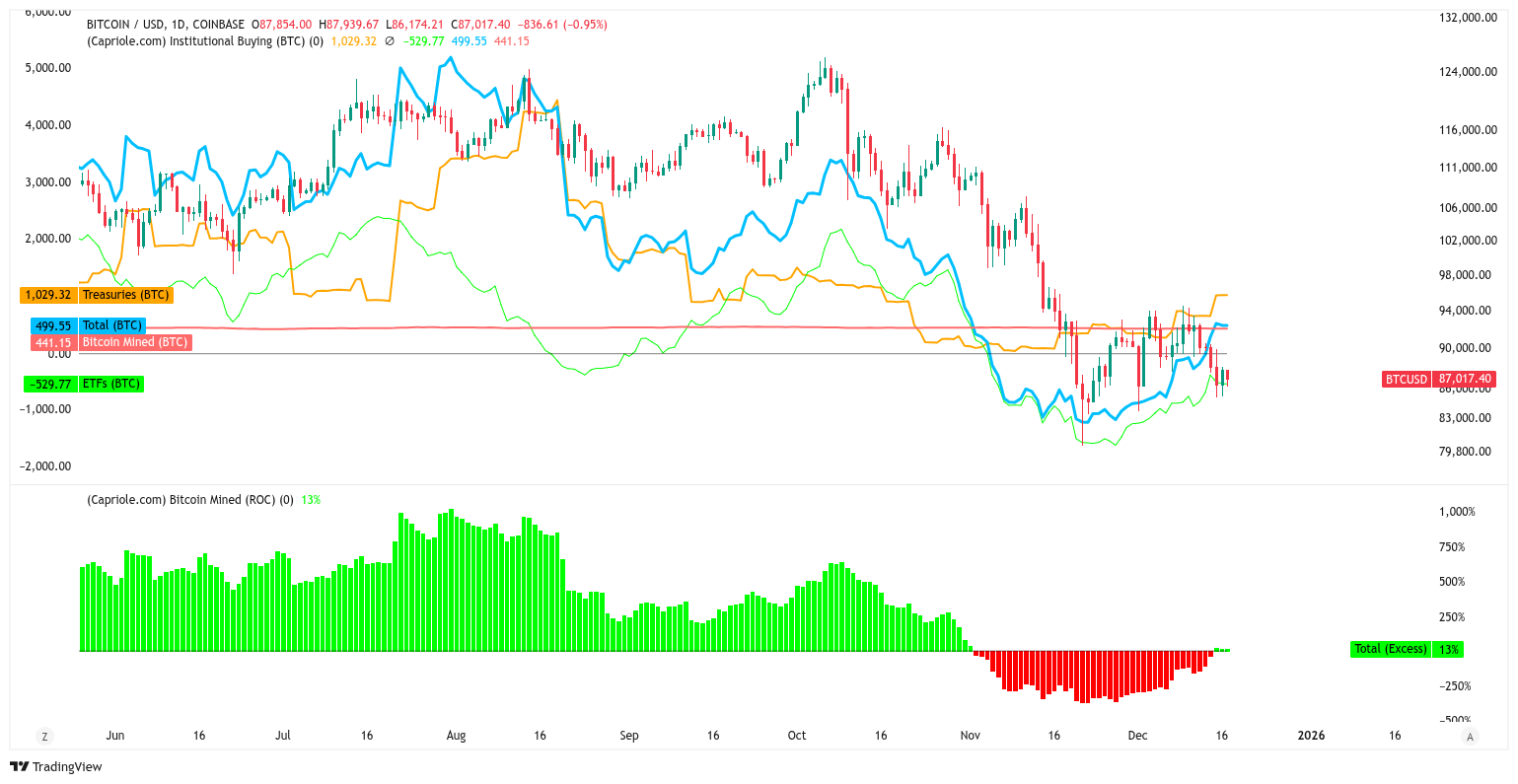

Bitcoin institutional buys flip new supply for the first time in 6 weeks

Cointime·2025/12/19 10:46

US Senate Confirms Michael Selig, Travis Hill to Lead CFTC and FDIC

Cryptotale·2025/12/19 10:30

Metaplanet ADR: A Strategic Gateway for US Investors to Access Bitcoin-Backed Assets

Bitcoinworld·2025/12/19 10:27

Analyst: The Most Hated XRP Rally Is About to Start. Here’s why

TimesTabloid·2025/12/19 10:24

Will the crypto industry be doing well in 2026?

BlockBeats·2025/12/19 10:11

What Is DOGEBALL? Inside the New Crypto Presale and Why Everyone Is Racing to Join the Whitelist

BlockchainReporter·2025/12/19 10:03

Matrixport Research: Four-Year Cycle Turning Signal Emerges, Bitcoin Enters Structural Adjustment Phase

Odaily星球日报·2025/12/19 10:02

Buterin Elevates Transparency Standards with Blockchain Verification

·2025/12/19 09:51

JPMorgan Enters Public Blockchain with Tokenised Money-Market Fund

·2025/12/19 09:51

Flash

23:17

Hyundai Group office building in South Korea evacuated due to bomb threat and bitcoin ransom demandAccording to Jinse Finance, on Friday, two buildings of South Korea's Hyundai Group were urgently evacuated due to a bomb threat. An anonymous caller demanded 13 bitcoins as ransom in exchange for canceling the threatened attack. Special forces searched the buildings but ultimately found no explosives.

22:56

US FTC approves Nvidia's $5 billion investment in IntelJinse Finance reported that the US Federal Trade Commission (FTC) has approved Nvidia's investment in Intel, but the specific details of the transaction have not been disclosed. In September this year, Nvidia announced it would invest $5 billion in the struggling Intel, a move seen as significant support for the domestic semiconductor industry. However, the deal has also raised concerns in the market about changes in the competitive landscape, particularly the potential risks it may pose to major competitors TSMC and AMD.

22:56

Goldman Sachs: The stock market still has further upside potential before the end of the yearJinse Finance reported that the Goldman Sachs trading desk team stated in a report to clients, "We are now entering a seasonally bullish period, with a healthier positioning structure. As long as there is no major shock, the market trend will not be easily reversed. Although we do not necessarily expect a sharp rebound, there is still further upside potential before the end of the year."

News