News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Can Pump.fun survive after PUMP falls 80% amid legal woes?

AMBCrypto·2025/12/19 11:08

Ripple CEO Drops XRP Price Truth Bomb

TimesTabloid·2025/12/19 11:07

Fidelity’s Director of Global Macro Intensifies Bitcoin Outlook

Cointurk·2025/12/19 11:06

Unstoppable Crypto Bull Market: Why Sharp Drops and Fear Are Actually Bullish Signals

Bitcoinworld·2025/12/19 11:00

Bitcoin Demand Warning: CryptoQuant Signals Alarming Shift to Bear Market

Bitcoinworld·2025/12/19 10:57

Birth of a Parallel Financial System that Defied Institutions

Cryptotale·2025/12/19 10:51

Bitcoin rebounds on Japan rate hike as Arthur Hayes sees dollar at 200 yen

Cointime·2025/12/19 10:46

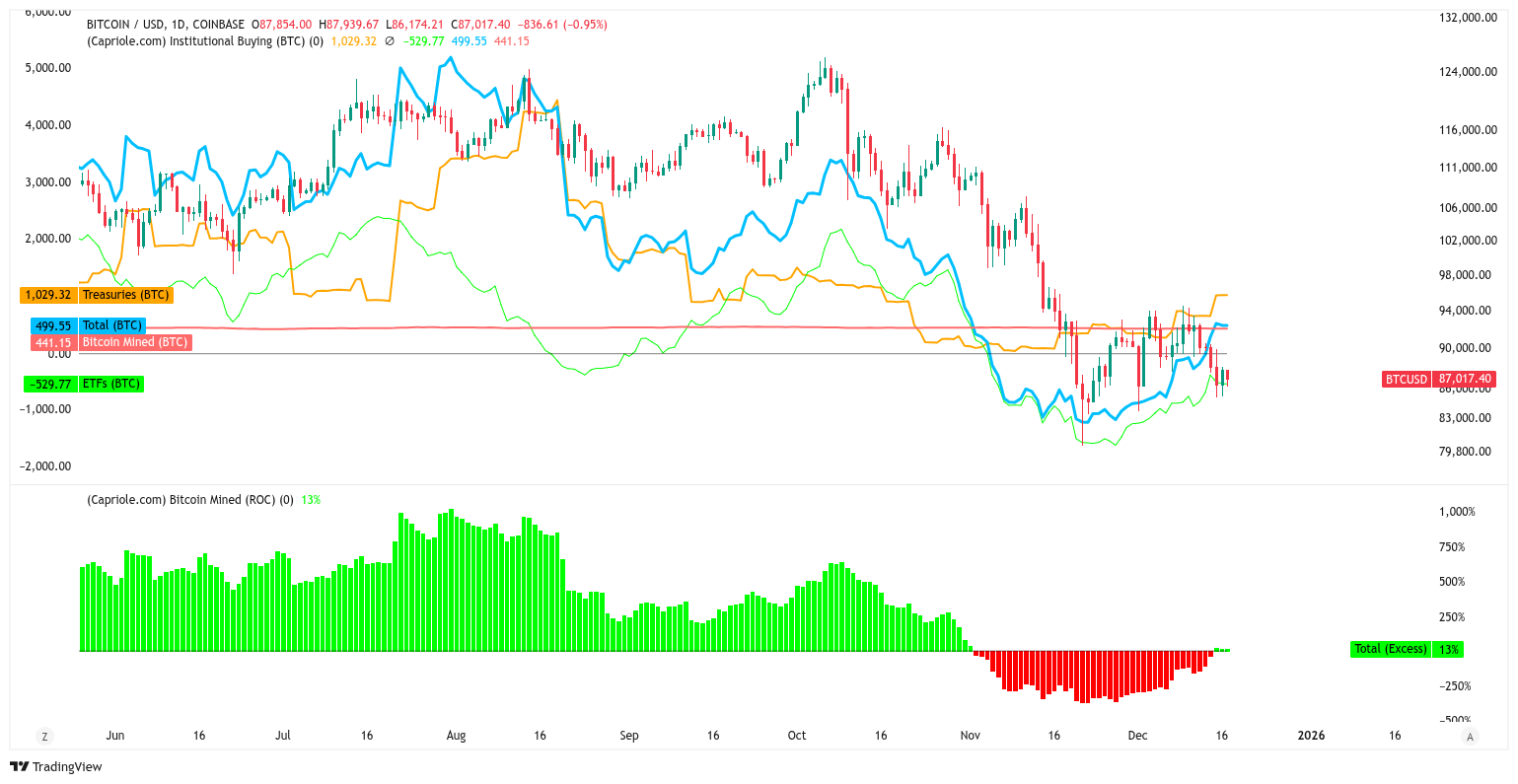

Bitcoin institutional buys flip new supply for the first time in 6 weeks

Cointime·2025/12/19 10:46

US Senate Confirms Michael Selig, Travis Hill to Lead CFTC and FDIC

Cryptotale·2025/12/19 10:30

Metaplanet ADR: A Strategic Gateway for US Investors to Access Bitcoin-Backed Assets

Bitcoinworld·2025/12/19 10:27

Flash

11:21

<h2>15x Leverage Short on $1.05 Billion ETH Whale Currently Sitting on $12.55 Million Unrealized Profit</h2>BlockBeats News, December 20th, according to HyperInsight monitoring, a whale shorted 35,221 ETH with 15x leverage (about $105 million), realizing a floating profit of $12.55 million from the single-coin position. The whale also earned $3.14 million from the funding fee. Their entry price was $3,332.52, and the liquidation price was $3,855.54.

11:14

London Stock Exchange responds to MSCI Index considering removal of Strategy: Continues to monitor, relevant inquiries will be handled according to internal proceduresJinse Finance reported, citing Reuters, that the MSCI index will decide on January 15 next year whether to remove Strategy. Analysts from Wall Street investment banks Jefferies and TD Cowen pointed out that if Strategy is ultimately removed, other indices in the global financial markets may follow suit, mainly including: the Nasdaq 100 Index, the CRSP US Total Market Index, and the FTSE Russell indices under the London Stock Exchange Group. As of now, the Nasdaq 100 Index has retained Strategy, CRSP declined to comment on whether it is considering removing Strategy, and a spokesperson for the London Stock Exchange Group stated that they will continue to monitor the situation, but related inquiries will be handled according to their internal management procedures.

11:03

A new address has taken a 5x leveraged long position on BTC and a short position on ETH, with positions exceeding $5 million.According to Odaily, Onchain Lens monitoring shows that a newly created address (0x89bc...7358) deposited 1 million USDC into HyperLiquid and opened a 5x leveraged BTC long position and ETH short position.

News