As Bitcoin’s price dipped to $90,500, raising concerns with consecutive red candlesticks, the U.S. stock markets remained closed today and will close early tomorrow. The article delves into the latest developments concerning Bitcoin $91,333 and altcoin ETFs, examining market appetite in this sector.

Bitcoin and Ethereum Insights

Bitcoin experienced positive inflows in the last two business days, albeit at a subdued pace, with only $21.12 million recorded in the latest activity. Despite billions in net outflows, cumulative net inflows remain at $57.63 billion, indicating that long-term net inflows are not significantly affected by recent selling pressure.

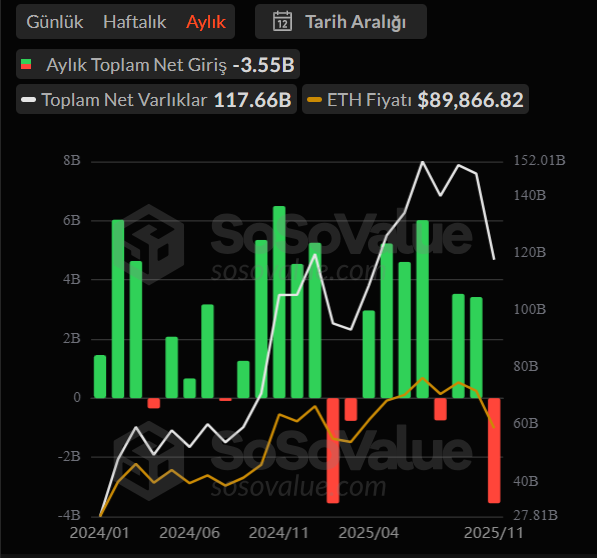

ETFs, representing 6.56% of Bitcoin’s market value with a net asset value of $117.6 billion, promise a bright future for BTC. The involvement of giants like Vanguard might increase banks’ interest in this area, potentially changing market dynamics in the coming year.

Sosovalue data shows a net inflow of $3.4 billion for BTC ETFs last month, followed by a net outflow of $3.55 billion this month. This trend seems to reflect high-cost ETF investors’ panic exits and others securing profits. Since 2024 started, there have been only six months of net outflows, with February 2025 being the most notable. The current month’s outflows are poised to break February’s record, with early closings tomorrow possibly confirming this. The recent month has emulated February’s chaos, partly due to AI bubble discussions.

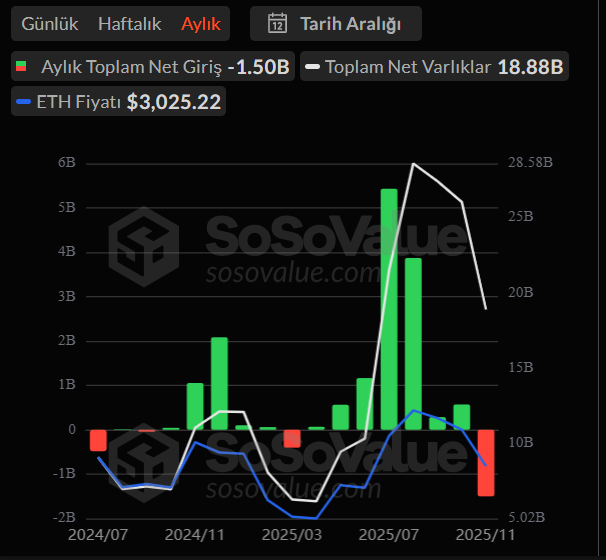

ETH ETFs saw a net inflow of $60.8 million yesterday, with total net inflows reaching $12.8 billion. Since its listing in July 2024, there has only been a significant outflow in March 2025 of $403 million, followed by substantial inflows. In July 2025, ETH outperformed BTC, achieving a $5.43 billion inflow. Despite record outflows of $1.5 billion this month, previous inflows have largely been maintained, offering some comfort.

SOL, XRP, and DOGE ETFs

These newly introduced ETFs, mostly under the 33ACT framework, show promising dynamics. Solana $142 ( SOL ) ETFs have witnessed $813 million in net inflows so far, bringing total assets to $917 million. With six different SOL ETFs, Solana shows promise; unlike BTC and ETH, SOL ETFs have had consistent net inflows over the last five weeks, ranging between $46 million and $200 million weekly.

XRP Coin is new but competing with SOL Coin, with $643 million net inflows and a total net asset value of $676 million. Representing only 0.5% of XRP Coin’s market cap, this week alone saw $221 million in net inflows. Despite last week’s downturn, weekly net inflows amounted to $179 million, with $243 million during launch week. Consistent inflows suggest a positive trend.

DOGE is the youngest of these ETFs, with participants including GDOD and BWOW, alongside Grayscale and Bitwise. Total net inflows hover around $2 million, with a remarkable $365 million net inflow recorded yesterday.