Consistently setting new all-time highs, silver has outperformed many altcoins this year. Traditionally considered a safe haven alongside gold, silver promises stable long-term gains, yet this year it acted like an altcoin, mirroring dramatic surges and potential corrections. So, what do economists anticipate?

var litespeed_vary=document.cookie.replace(/(?:(?:^|.*;\s*)_lscache_vary\s*\=\s*([^;]*).*$)|^.*$/,"");litespeed_vary||fetch("/wp-content/plugins/litespeed-cache/guest.vary.php",{method:"POST",cache:"no-cache",redirect:"follow"}).then(e=>e.json()).then(e=>{console.log(e),e.hasOwnProperty("reload")&&"yes"==e.reload&&(sessionStorage.setItem("litespeed_docref",document.referrer),window.location.reload(!0))});Silver Achieves Record Heights

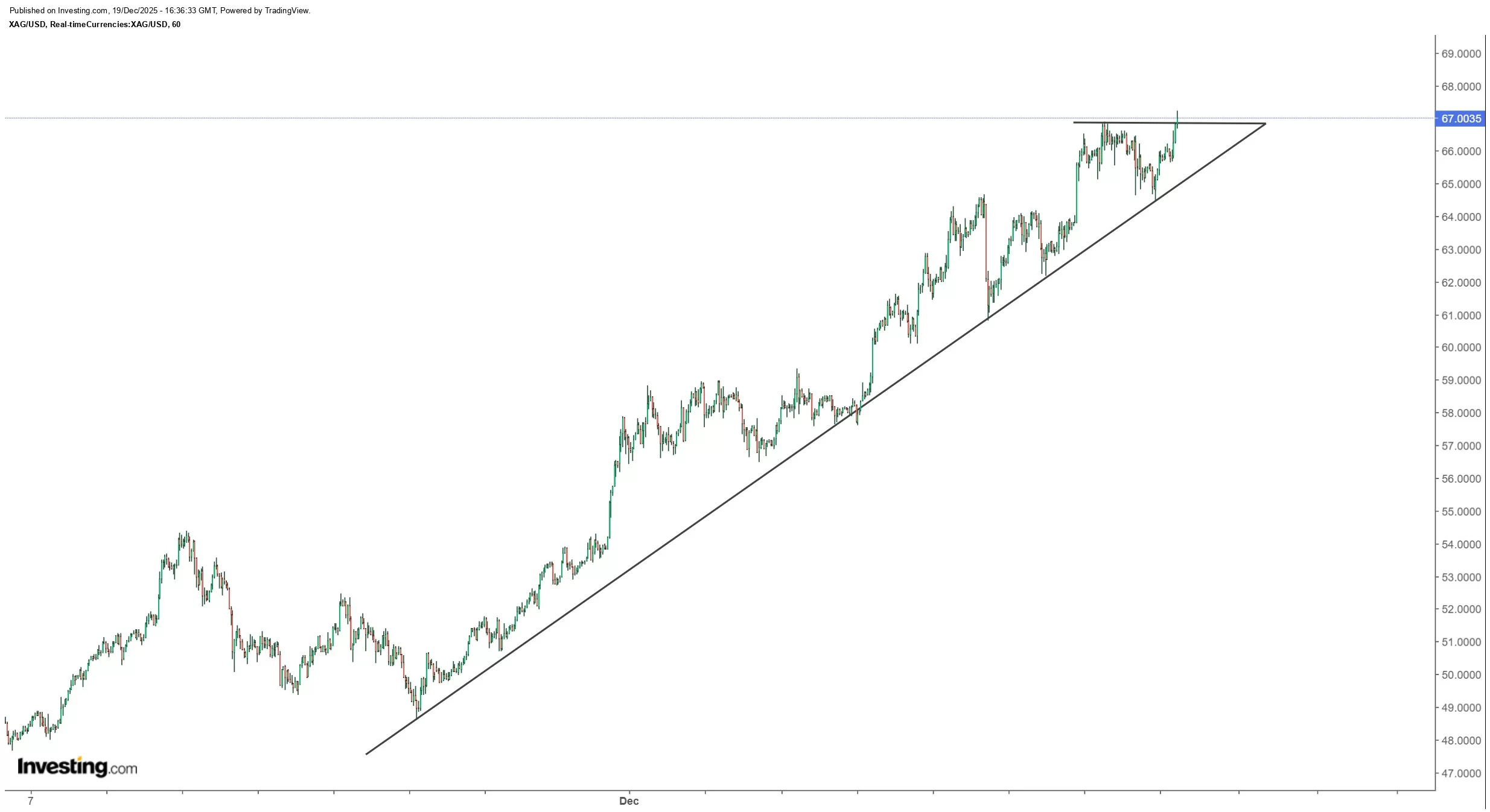

For 28 consecutive days, silver’s price has risen almost without interruption, bringing gains of over 37% in less than a month. This rise began after surpassing the previous high post-correction from the October peak of $54. On November 13, it tested the resistance for the second time and broke it on its third attempt on November 28, accelerating the rally.

Investment guru Peter Schiff, known as the “Gold Bug,” remarked, “Silver hit a record high trading above $67 for the first time. A CNBC guest claimed gold rose not from rising inflation expectations but due to central banks’ purchases. However, central banks foresee U.S. inflation eroding the dollar’s value, prompting their buying spree.”

Bald Guy Money contradicts expectations of a massive crash in precious metal prices, arguing that market conditions do not resemble 2008, forecasting much shallower corrections.

Silver Price Predictions

Patrick Karim, highlighting historical price patterns, argues against optimistic views like Bald Guy Money’s, warning of potential severe losses exceeding 70%, as previously witnessed.

Commodity analyst Tim Hack suggests contrary to market expectations, silver remains in a consolidation phase. He foresees a sharp ascent to $100 within two weeks, assuming recent trends persist, potentially elevating silver past the $100 mark.

Rashad Hajiyev revisits his theory on the breach of the 45-year cup and handle model, targeting higher peaks.

He states, “Silver is present at $67 and continues its ascent without significant pullbacks. I believe silver’s price acceleration is imminent, as we transition from the 45-year cup and handle formation to a new paradigm. Investors expecting a pullback will soon lose patience and join the rise, causing a parabolic climb…”