How to buy DAI (DAI) in United Arab Emirates

Simple 3-step guide to buying DAI today in United Arab Emirates

Step 1: Create a free account on the Bitget website or the app

Step 2: Place an order for DAI using a payment method of your choice:

Buy DAI with a debit/credit card

For Visa or Mastercard, select Credit/Debit card, then click Add New Card under the "Buy" tab Credit/Debit in the Buy Crypto tab of the Bitget app

Credit/Debit in the Buy Crypto tab of the Bitget app Credit/Debit in the Buy Crypto tab of the Bitget websiteSelect your preferred fiat currency, enter the amount you wish to spend, link your credit card, and then complete your payment with zero fees.

Credit/Debit in the Buy Crypto tab of the Bitget websiteSelect your preferred fiat currency, enter the amount you wish to spend, link your credit card, and then complete your payment with zero fees. Add a new card to complete your payment on the Bitget app

Add a new card to complete your payment on the Bitget app Enter your bank card details to complete your payment on the Bitget websiteFor Diners Club/Discover card, click Buy Crypto > [Third Party] in the top navigation bar to place your DAI order.How to buy crypto with credit/debit card

Enter your bank card details to complete your payment on the Bitget websiteFor Diners Club/Discover card, click Buy Crypto > [Third Party] in the top navigation bar to place your DAI order.How to buy crypto with credit/debit cardBuy DAI with Google Pay or Apple Pay

Converting your Google Pay and Apple Pay balance into DAI is easy and secure on Bitget. Simply click Buy Crypto > [Third Party] in the top navigation bar to place your DAI order.How to buy crypto via third-party gatewayBuy {0} with bank transfer

We accept various payment methods, including iDeal and SEPA for EUR, PIX for BRL, PayID for AUD, UPI for INR, QRIS, DANA, and OVO for IDR, SPEI for MXN, and GCash for PHP. These services are facilitated by Alchemy Pay, Banxa, Mercuryo, and Simplex payment gateways. Simply select Buy Crypto > [Third Party] in the top navigation bar and select a fiat currency to place your DAI order.Buy DAI with the fiat balance in your Bitget account

You can Deposit fiat funds using Advcash, SEPA, Faster Payments, or PIX payment gateways to top up your Bitget fiat balance. Then, click Buy Crypto > [Cash conversion] in the top navigation bar to place your DAI order.P2P trading

With Bitget P2P, you can buy crypto using over 100 payment methods, including bank transfers, cash, and e-wallets like Payeer, Zelle, Perfect Money, Advcash, and Wise. Simply place an order, pay the seller, and receive your crypto. Enjoy secure transactions with escrow protection.How to buy crypto on Bitget P2P

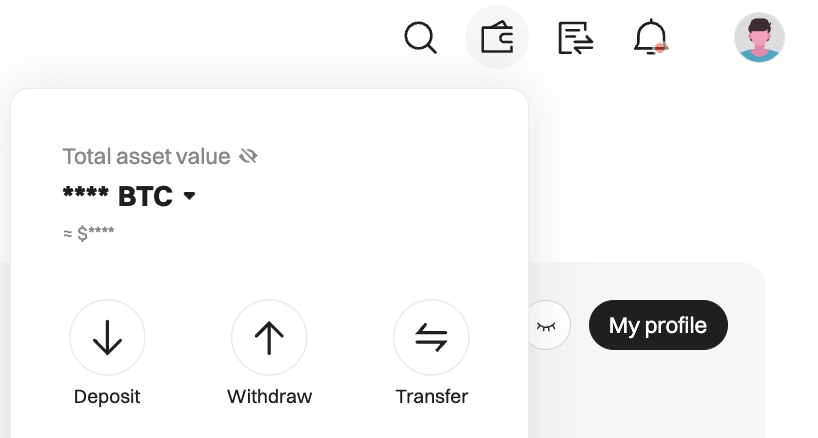

Step 3: Monitor DAI in your Bitget spot wallet

Latest DAI news

View moreBuy DAI

Bitget—where the world trades DAI

FAQ

Can I buy $1 worth of DAI?

Can I buy $10 of DAI?

Where else can I buy DAI?

Where is the best place to buy DAI?

Should I buy DAI right now?

Buy DAI in a different country

Recently added coins

Explore other crypto guidesThe United Arab Emirates (UAE) was established in 1971, and we just celebrated the 50th anniversary of the UAE in 2021. The UAE has a population of about 10 million people, with about 10% locals and 90% expatriates from all over the world. The surface area of the United Arab Emirates is 83,000 square kilometers, which is slightly larger than Ireland and smaller than Portugal. The official languages in the United Arab Emirates are English and Arabic.

The UAE, as the name suggests, is made up of several emirates, more precisely, seven emirates. The first emirate is the most important, and it is the one of Abu Dhabi, the capital of the United Arab Emirates. This one represents 80% of the Emirates territory. The second Emirates we often hear about because it is rather the tourist capital is Dubai. The other five emirates are Ajman, Fujairah, Ras Al Khaimah, Sharjah, and Umm Al Quwain.

The time difference varies depending on the season (summer or winter). Concerning temperatures, there is also a distinction between summer and winter. During the winter, you can expect temperatures between 22 and 30 degrees. In the summer, it is much warmer, and temperatures average 35 to 40 degrees.

Acting as the national currency of the United Arab Emirates is the Dirham (AED), and with Bitget, you can purchase cryptos within minutes, no matter where you are in the United Arab Emirates. Our exchange offers secure payment options to make trading more accessible and safer than ever, including P2P trading, crypto deposits, and other third-party merchants such as Apple Pay, Google Pay, and several different credit card services.