QCP Capital, SBI Alpha Execute First Uncleared Crypto Options Trade on Regulated Platform Using Bitcoin as Collateral

The trade was executed on the regulated Clear Markets platform and involved bitcoin as collateral. The risk management techniques involved were consistent with ISDA's requirements for uncleared derivatives.

Singapore-based QCP Capital and Japan-based SBI Alpha Trading on Thursday said they executed an over-the-counter (OTC) crypto options trade on a regulated platform without involving a clearing house, the first such transaction in the digital asset industry.

The so-called uncleared trade negotiated directly between QCP and SBI Alpha used bitcoin (BTC) as collateral and was executed on Clear Markets, operators of a U.S. and U.K.-based regulated electronic marketplace, according to a press release shared with CoinDesk.

London-based Zodia Custody acted as a custodian for collateral while Corda Network, developed by R3, played a role in risk management.

The trade used a multi-custodian collateral network to ensure the assets held in custody remain separate from the custodian's assets. That way, the collateral remains safe if the custodian goes bankrupt.

The trading parties collected the collateral at the start of the transaction and locked the same in an account at an independent custodian, which was controlled by all three parties to mitigate the counterparty risk stemming from the absence of a clearing house. All exchange-traded derivatives and most over-the-counter derivatives involve a clearing house that validates and finalizes the transaction, ensuring the parties to the trade honor their contractual obligations.

QCP and SBI Alpha also introduced a feature allowing real-time bolstering of collateral by periodic payments through the blockchain while protecting the collateral from loss in case of counterparty bankruptcy.

The unique risk management technique is consistent with International Swaps and Derivatives Association's (ISDA) requirements for uncleared derivatives in the multi-trillion dollar fiat currency swap business.

"This method of managing counterparty credit exposure, derived from traditional financial markets practices, eliminates significant risks taken by counterparties of FTX and other crypto trading units that have collapsed," the press release said.

"This reduces the cost of moving the collateral and enables increased frequency of variation margin payments, reducing the time between price changes and lowering the credit risk," the statement added.

12:27 UTC: Updates title and the lede to say the trade was executed on a regulated platform.

Updates second para to say Clear Markets is based in U.S. and U.K. Corrects typo in the fifth para.

Edited by Parikshit Mishra.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hard Times for ‘Smart Money’ as Crypto Hedge Funds Record Worst Year Since FTX

PENDLE Slides After Polychain Sell-Off: Will Buyers Defend $2?

Arthur Hayes Shifts from ETH to High-Quality DeFi Stocks as Fiat Liquidity Improves

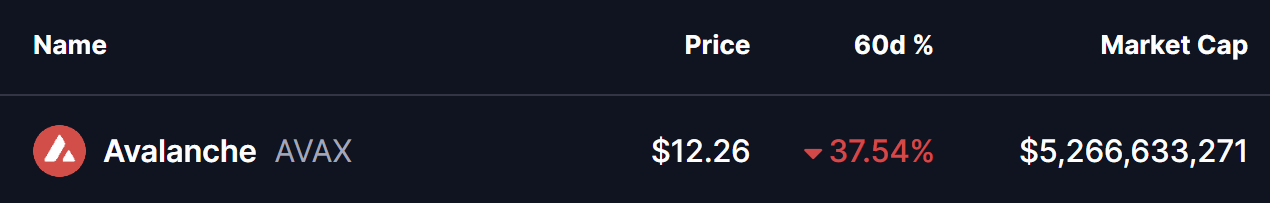

Avalanche (AVAX) Highlights Potential Reversal Setup – Will It Bounce Back?