First Mover Americas: Bitcoin Rallies as TradFi Players Jump Into Crypto

The latest price moves in crypto markets in context for June 21, 2023.

This article originally appeared in , CoinDesk’s daily newsletter putting the latest moves in crypto markets in context..

Bitcoin, the world’s largest cryptocurrency by market value, rallied over the past 24 hours after various traditional finance firms announced moves into the crypto market, indicating bullish sentiment.Bitcoin jumped 8% on the day, pushing it to $28,800, after trading flat for the last few days at around $26,800. Altcoins also surged, with bitcoin cash (BCH) rallying over 20% in the same time period. Banking giant Tuesday that it had applied for a digital asset custody license in Germany and crypto exchange EDX Markets (which is ,) started offering trading for BTC, ether (ETH), litecoin and bitcoin cash. Just last week, BlackRock filed for a spot BTC exchange-traded fund (ETF) too. “This move towards crypto by major financial institutions reflects a significant shift in their stance on the industry's potential, especially given the timing,” Mark L. Newton, head of technical strategy at FundStrat, said in a note.

Grayscale Bitcoin Trust’s (GBTC) share price to soar on Tuesday on optimism about converting the fund into an ETF after BlackRock for a spot bitcoin ETF. The shares rose past $16 on secondary markets for the first time since May 10, according to TradingView , and have gained some 24% since Thursday, the day of BlackRock's filing. The discount on GBTC’s share price relative to net asset value narrowed to as little as 33% Tuesday morning, according to CoinDesk’s calculation. This is the level since last September, and lower than the 34% it recorded in early March.

Investment management company Invesco, which has $1.4 trillion assets under management, reapplied for a spot bitcoin ETF. In 2021, Invesco for a bitcoin ETF in conjunction with Galaxy Digital. It also filed for a bitcoin futures ETF, but after a futures ETF by ProShares was approved and began trading first. In its filing, Invesco argued that the lack of a spot bitcoin ETF pushes investors toward riskier alternatives, as seen in like FTX, Celsius Network, BlockFi and Voyager Digital Holdings. Invesco also emphasized the need for investor protection, saying that approval for such a spot bitcoin ETF hinges on a surveillance sharing agreement with a significant, regulated market, not on the regulation of the spot bitcoin market itself.

Edited by Sheldon Reback.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENDLE Slides After Polychain Sell-Off: Will Buyers Defend $2?

Arthur Hayes Shifts from ETH to High-Quality DeFi Stocks as Fiat Liquidity Improves

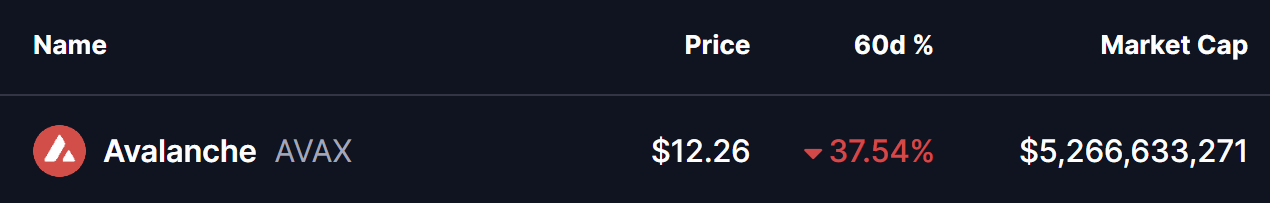

Avalanche (AVAX) Highlights Potential Reversal Setup – Will It Bounce Back?

Tom Lee’s Investment Firm Reveals Price Predictions for Bitcoin, Ethereum, and Solana: “First Bear, Then…”