XRP Prices Jump as Hinman Speech Released in Ripple Labs Filing

Hinman suggested in his 2018 speech that bitcoin (BTC) and ether (ETH) were not securities, in his view.

jumped 7.4% in the past 24 hours to buck nominal gains in the broader crypto market as traders likely bet on a favorable outcome for payments company Ripple Labs in its ongoing Ripple vs SEC lawsuit.

Latest Coverage:

These gains came as documents tied to William Hinman, the former director of the U.S. Securities and Exchange Commission (SEC)’s Division of Corporation Finance from 2017 to 2020, were released to the public in connection with the SEC's lawsuit against Ripple Labs.

Hinman suggested in his 2018 speech that bitcoin (BTC) and ether (ETH) were not securities, in his view. “We do not need to see a need to regulate Ether, as it is currently offered, as a security,” one of the Hinman emails read.

Latest Coverage:

Ripple Labs claims Hinman’s remarks at the time mean XRP should not be considered a security – which could result in a favorable outcome for the payments firm.

In 2020, the SEC sued Ripple on allegations that the firm sold unregistered securities. Ripple has historically maintained a distance from XRP, the token that powers some of its products and the XRP Ledger network. But any progress in the case has an impact on XRP prices.

Edited by Parikshit Mishra.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes Shifts from ETH to High-Quality DeFi Stocks as Fiat Liquidity Improves

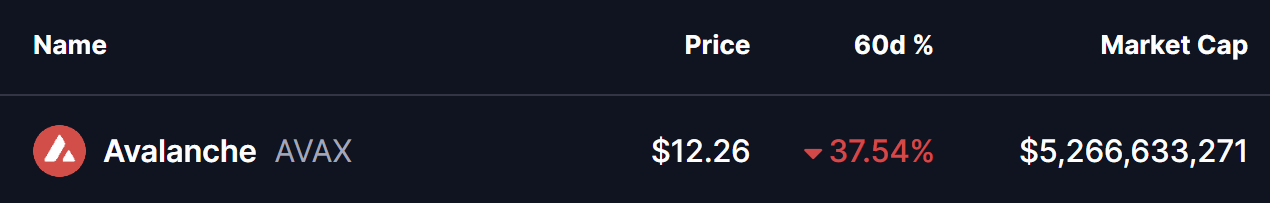

Avalanche (AVAX) Highlights Potential Reversal Setup – Will It Bounce Back?

Tom Lee’s Investment Firm Reveals Price Predictions for Bitcoin, Ethereum, and Solana: “First Bear, Then…”

Solana dips below $120 as activity cools – Yet THIS group leans in, why?