Transparency for the Whales, Privacy for the Plebs

Identifying the owners of crypto wallets may level the playing field for retail traders. But if taken too far it could be weaponized against the weak.

Depending on your perspective, this week brought a double dose of for those who held out hope of salvaging cryptocurrency users’ privacy – or for those seeking greater transparency for a .

First, , a on-chain data analytics provider, opened an with the express purpose of unmasking the owners of crypto wallets.

This is an excerpt from The Node newsletter, a daily roundup of the most pivotal crypto news on CoinDesk and beyond. You can subscribe to get the full.

“Deanonymization is destiny,” the company declared in a “” (really a marketing brochure, printed in the same academic-looking font and layout as Satoshi Nakamoto’s for anonymous digital cash). “Eventually, everyone’s blockchain identity will be linked to their real-world identity.” (Emphasis mine.)

Descriptively and directionally, Arkham may be correct – but its project of accelerating that outcome understandably rubbed privacy advocates the wrong way. The subsequent that Arkham had inadvertently leaked its customers’ personal data offered comic relief.

Blockchains are one kind of fishbowl; regulated exchanges are another. The Arkham kerfuffle was followed by an illuminating about asset management giant BlackRock’s proposed spot bitcoin exchange-traded fund (ETF) from CoinDesk’s Ian Allison. He learned of an information-sharing agreement between BlackRock’s partners, the Nasdaq (which plans to list the ETF’s shares) and crypto exchange Coinbase. The arrangement would go further than (SSAs) in previous bitcoin ETF applications. Rather than Coinbase just pushing trade data to regulators, to BlackRock and to the Nasdaq, the latter parties would be allowed to pull data from the crypto exchange, “up to and including personally identifiable information (PII), such as the customer’s name and address.”

To be fair, there’s a reason the U.S. Securities and Exchange Commission (SEC) asks ETF applicants to obtain SSAs with regulated markets for the underlying assets, and it’s not some covert ambition to become another . The regulator aims to deter market manipulation.

Arkham’s intel exchange might serve a similarly salubrious purpose. “Transparency about what market players are doing is good for everyday traders and investors and helps to level the playing field,” the company noted in an . “This kind of widely available market transparency is missing in TradFi, which privileges bigger, well-resourced players at the expense of everyone else.”

So there’s a conceivable timeline where Arkham’s on-chain intel marketplace promotes , to borrow a formulation from WikiLeaks founder Julian Assange. There’s no in , after all; just want to know what the are up to. CoinDesk, it should be noted, has a dedicated analyzing on-chain trends to benefit the trader audience.

All this is well and good, as long as you think of cryptocurrency strictly as a trading asset, and not as, you know, a currency. Indeed, trading – put more bluntly, speculation – has historically been crypto’s main use case.

The danger is that blockchain identity bounties could be weaponized against the weak.

Two years ago, a data breach at a crowdfunding website exposed the identities of donors to a legal defense fund for a defendant who one side of the culture war had already found guilty without a trial. An international newspaper saw fit to amplify the names of several “” who donated, including a police sergeant who gave a whole $25 and a fire department paramedic who kicked in all of $10. Not to be outdone, a local television reporter and reported, with a whiff of incredulous disappointment, that the city had not placed this obscure individual, who was not accused of breaking any laws, on administrative leave. (The defendant, for the record, was acquitted by a jury of his peers.)

, decentralized networks into blocking transfers to politically disfavored recipients. There’s no “CEO of Bitcoin.” But you don’t need to “breach” a cryptocurrency network to see where the money is moving – it’s all out there in the open. Pseudonymous blockchain addresses are the only fig leaf available to participants.

Take those away for everyone, not just the high rollers, and you won’t just give retail traders a leg up; you’ll also arm the internet’s stalkers, sadists and scolds with a new set of “.”

Flashback:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes Shifts from ETH to High-Quality DeFi Stocks as Fiat Liquidity Improves

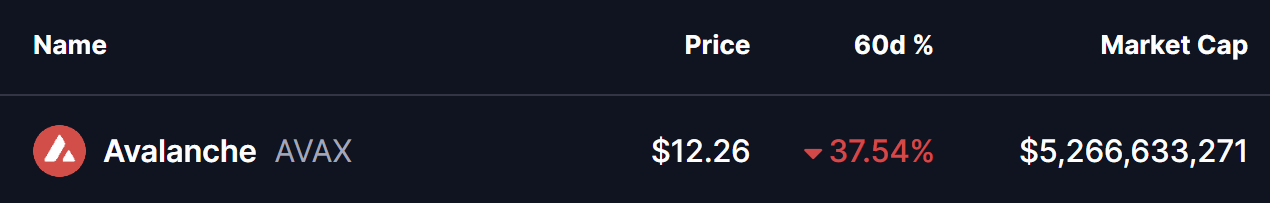

Avalanche (AVAX) Highlights Potential Reversal Setup – Will It Bounce Back?

Tom Lee’s Investment Firm Reveals Price Predictions for Bitcoin, Ethereum, and Solana: “First Bear, Then…”

Solana dips below $120 as activity cools – Yet THIS group leans in, why?