SOL, XRP Lead Slide in Crypto Majors as Bitcoin Slips Below $30K

Some selling pressure may have arisen from a revised U.S. bill that excludes a host of traditional securities from the "digital asset" category, which some say bodes ill for DeFi.

Profit taking in bitcoin (BTC) contributed to a broader market drop as tokens of some of the largest blockchains, such as solana's SOL fell as much as 8% in the past 24 hours, data shows.

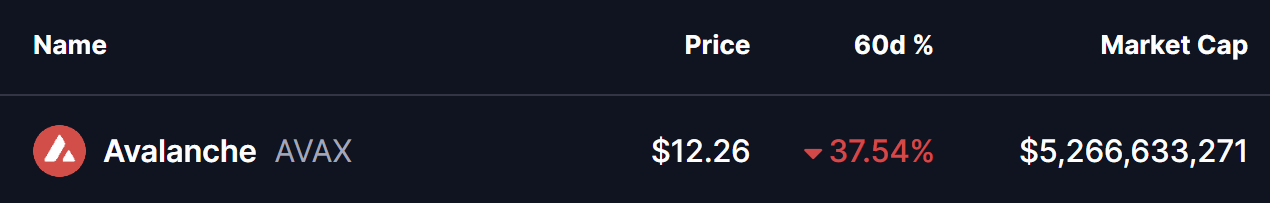

Bitcoin dipped under $30,000 during European hours on Friday, even as broader traditional markets remained relatively unchanged. Ether (ETH) shed over 3%. Among other large caps, XRP fell as much as 6% in the past 24 hours, while Cardano’s ADA and Avalanche’s AVAX fell 4% in the same period.

Elsewhere, stellar's XLM dropped 6.6% as traders likely took profits after a 10% rise over the past week. Chainlink’s LINK traded flat following a 15% rise on Thursday – buoyed by the introduction of its CCIP protocol earlier this week.

Some of the selling pressure may have arisen as U.S. House Republicans introduced a new digital assets oversight bill on Thursday that aims to establish a regulatory framework to protect investors in the crypto sector.

Analysts said parts of the revised bill exclude from the definition of "digital assets" a range of traditional securities such as stocks, bonds, "transferable share[s]," "certificate[s] of interest or participation in any profit-sharing agreement," and so on.

“All they have to do is argue that a token is a "transferable share" "a profit interest" etc,” Gabriel Shapiro, general counsel at crypto fund Delphi Digital, . “XRP and such will be fine but DeFi can still be persecuted at will... actually the regulators will have expanded authority to do so.”

The CoinDesk Market Index (CMI), a broad-based index designed to measure the market capitalization-weighted performance of the crypto market, fell 1.7%.

Meanwhile, the drop in prices caused over $66 million in liquidations in the past 24 hours, data from the analytics tool Coinglass shows. Slightly over 70% of these liquidations were on longs positions, or from traders betting on higher prices.

Liquidations occur when traders borrow funds from exchanges to bet on crypto prices using a relatively smaller initial capital, one that is forfeited when prices reach a predetermined liquidation level.

Edited by Parikshit Mishra.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes Shifts from ETH to High-Quality DeFi Stocks as Fiat Liquidity Improves

Avalanche (AVAX) Highlights Potential Reversal Setup – Will It Bounce Back?

Tom Lee’s Investment Firm Reveals Price Predictions for Bitcoin, Ethereum, and Solana: “First Bear, Then…”

Solana dips below $120 as activity cools – Yet THIS group leans in, why?