Crypto Investors Sour on Bitcoin Funds After Massive Inflows, Turn Instead to Ether and XRP

Digital asset investment products recorded outflows last week for the first time since mid-June, CoinShares reported.

Bitcoin () investment products suffered a $13 million outflow last week, bucking the trend of consecutive weeks of massive inflows as investors instead favored funds focusing on smaller cryptocurrencies such as ether () and Ripple’s , crypto asset manager CoinShares Monday.

Digital asset funds overall witnessed weekly outflows of $6.5 million after gaining $742 million of inflows through the previous four weeks.

The trend reversal came as BTC investors have seemingly run out of positive news to bid on after some major catalysts in recent weeks. Global asset management giant BlackRock for a long-coveted spot BTC exchange traded fund on June 15, followed by a swarm of competitors their applications. The BlackRock news spurred into BTC-focused investment funds over the next month at the fastest pace since October 2021.

XRP’s over the U.S. Securities and Exchange Commission () earlier this month sent BTC’s price to a fresh yearly high, before its price quickly reverted below $30,000. The ruling, however, improved investor confidence in altcoins – alternative crypto assets to BTC – which was underscored by positive fund flows through last week.

ETH-focused investment products enjoyed the largest inflows among all cryptocurrencies, totaling $6.6 million. The growth suggests that “sentiment, which has been poor this year, is beginning to turn around” for the second largest crypto asset, noted James Butterfill, head of research at CoinShares.

XRP funds experienced $2.6 million of inflows, totaling $6.8 million, or 8% of all assets under management inflows, over the last 11 weeks. “This implies investors are increasingly confident in the outlook for XRP,” Butterfill said.

Funds holding smaller altcoins such as Solana’s , UniSwap’s and Polygon’s witnessed positive flows of $1.1 million, $0.7 million and $0.7 million, respectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENDLE Slides After Polychain Sell-Off: Will Buyers Defend $2?

Arthur Hayes Shifts from ETH to High-Quality DeFi Stocks as Fiat Liquidity Improves

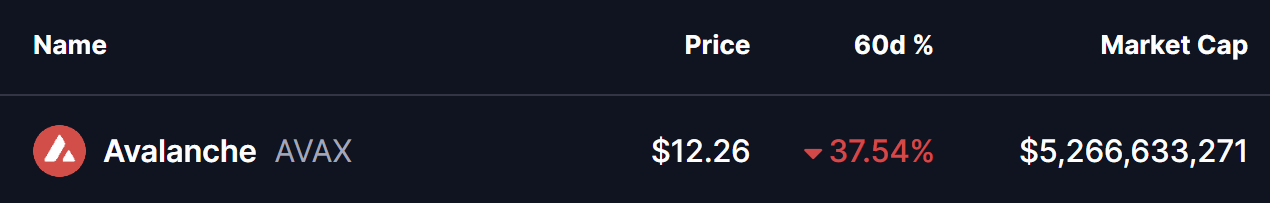

Avalanche (AVAX) Highlights Potential Reversal Setup – Will It Bounce Back?

Tom Lee’s Investment Firm Reveals Price Predictions for Bitcoin, Ethereum, and Solana: “First Bear, Then…”