How low can the Bitcoin price go?

Bitcoin is down to one-month lows, and BTC price predictions are tending to assume worse is to come — how much lower can bears manage?

The price of Bitcoin () has fallen to one-month lows, and traders are increasingly betting on more downside to come.

BTC price performance has weakened in recent days, with BTC/USD hitting $28,850 on July 24, data from and confirms.

Despite a brief rebound, market participants remain unconvinced that the largest cryptocurrency has seen the worst of its losses.

Cointelegraph looks at current prognoses for crypto and risk assets during a major macroeconomic week.

BTC/USD 1-day chart. Source: TradingView

BTC/USD 1-day chart. Source: TradingView

For popular trader Crypto Ed, the prior dip to Bitcoin’s lowest since June 21 was entirely expected.

Now, he believes that a final break into buy liquidity should occur, taking BTC/USD to around $28,500. A relief bounce to $29,400 could come first.

“If we do get a move like this, then I’m looking for a setup for more downside and possibly $28,500 - 400, more or less,” he said in his latest YouTube .

Crypto Ed showed an additional target box covering prices as low as $27,800, but acknowledged that he was unconvinced that Bitcoin would make it there.

For fellow trader Crypto Chase, the downside could take Bitcoin toward $27,000 before last-minute long entries get suitably burned.

Speculators should end up bidding at major price points as BTC/USD moves down — at $29,200, $28,500 and $28,000, he predicted earlier in July.

In an on July 24, he maintained that this was the likely course of events.

“These are still mostly my thoughts. I can’t short now as strong R/R opportunities are behind us, decent entries were not offered based on my strategies,” he acknowledged to Twitter followers.

BTC/USD annotated chart. Source: Crypto Chase/Twitter

BTC/USD annotated chart. Source: Crypto Chase/Twitter

An accompanying chart showed relevant Fibonacci retracement levels for the daily chart.

Ahead of a series of crunch United States macro events, various traders are keeping out of Bitcoin until a more apparent trend emerges.

Related:

Nonetheless, as important lines in the sand, among them the 200-week and 21-week at $27,130 and $28,200, respectively.

“Bitcoin is testing support in a key zone of historical significance,” Keith Alan, co-founder of monitoring resource Material Indicators, on July 24.

BTC/USD 1-week chart with 21, 200 MAs. Source: TradingView

BTC/USD 1-week chart with 21, 200 MAs. Source: TradingView

As Cointelegraph reported, some worst-case scenarios include far deeper drawdowns, with not entirely off the table.

Magazine:

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

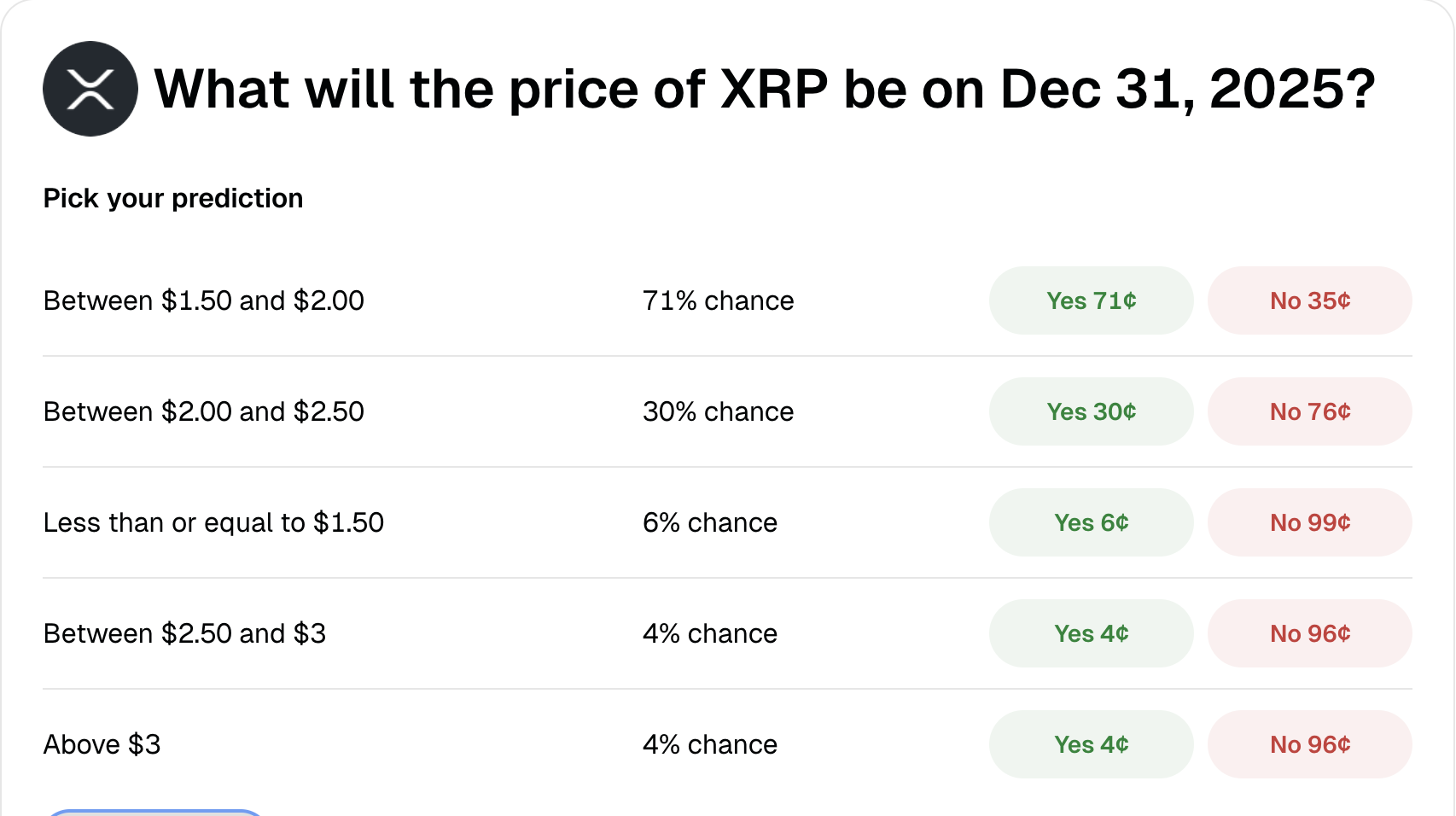

How Will XRP Close Out 2025? Here’s the Expected Price!

BNB price revisits $850 as token face bearish pressure