Head of Goldman Sachs Digital Assets Department: The future trading volume of blockchain-based assets will significantly increase

According to Reuters, Mathew McDermott, Global Head of Digital Assets at Goldman Sachs, said that the volume of blockchain-based asset transactions is expected to significantly increase in the next one to two years.

McDermott pointed out that as the market expects US securities regulators to soon approve applications for Bitcoin spot ETFs (Exchange-Traded Funds), customer interest in cryptocurrency derivatives trading is also increasing. In addition, he emphasized that besides cryptocurrencies, there is also "significant demand" for blockchain-based tokens representing traditional assets such as bonds. McDermott also mentioned that using blockchain to trade assets can improve operational and settlement efficiency and "de-risk" financial markets. He added that if securities are traded through blockchain, margin and liquidity can be transferred faster and more accurately between parties. Although widespread blockchain adoption in financial markets still has a long way to go, McDermott believes that we will see these markets gradually mature within the next three to five years. According to a survey conducted by Goldman Sachs' clients, 16% of respondents expect over 10% of financial markets to be "tokenized" within the next three to five years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

GAIB Final Spice officially launched, participants can enjoy a 10x points boost

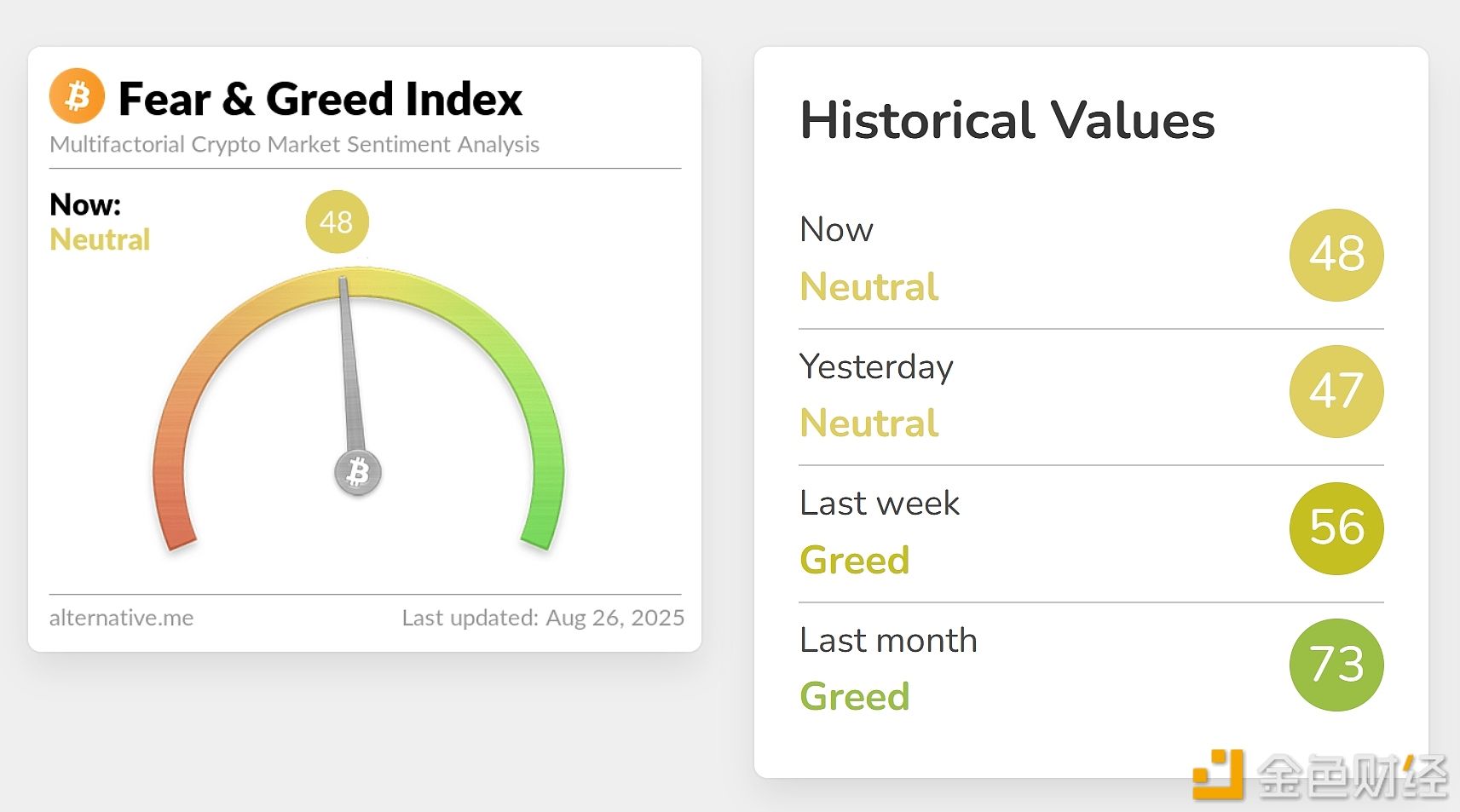

Today's Fear and Greed Index is 48, remaining at a neutral level

Limited Upside for the US Dollar as the Federal Reserve Faces Challenges