The Basel Committee proposes revising the standards to allow stablecoins to be considered as lower risk than unsecured cryptocurrencies

According to a report by CoinDesk, the Basel Committee on Banking Supervision (BCBS) proposed revising standards in a consultation paper released on Thursday, allowing stablecoins to be considered less risky than unsecured cryptocurrencies such as Bitcoin. As reported last week, BCBS is considering modifying its classification criteria for stablecoins, and the draft of the consultation paper published on Thursday provides detailed revision suggestions. So far, BCBS has taken a tough stance on cryptocurrencies, recommending a maximum risk weight of 1250% for freely floating digital assets like Bitcoin, which means banks must hold capital to match their risk exposure. Banks are also not allowed to allocate more than 2% of their core capital to these higher-risk assets. BCBS stated in a statement that it will not make any changes to these standards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

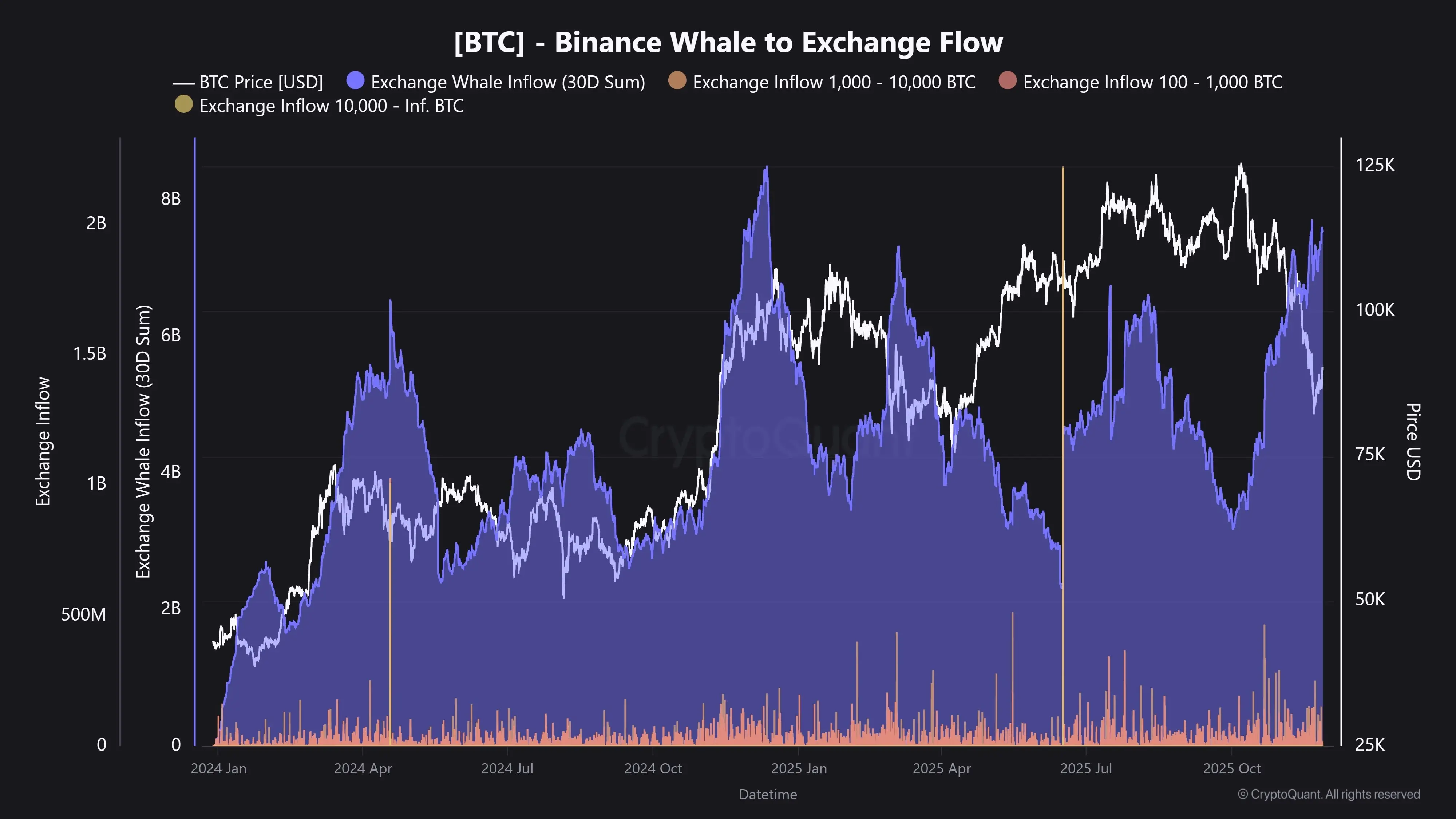

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month

Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.

CME Group: BrokerTec EU market is now open for trading, all other markets remain suspended