RektCapital: Where Could The Next Bargain Bitcoin Buying Opportunity Be?

Bitcoin - Weekly Timeframe

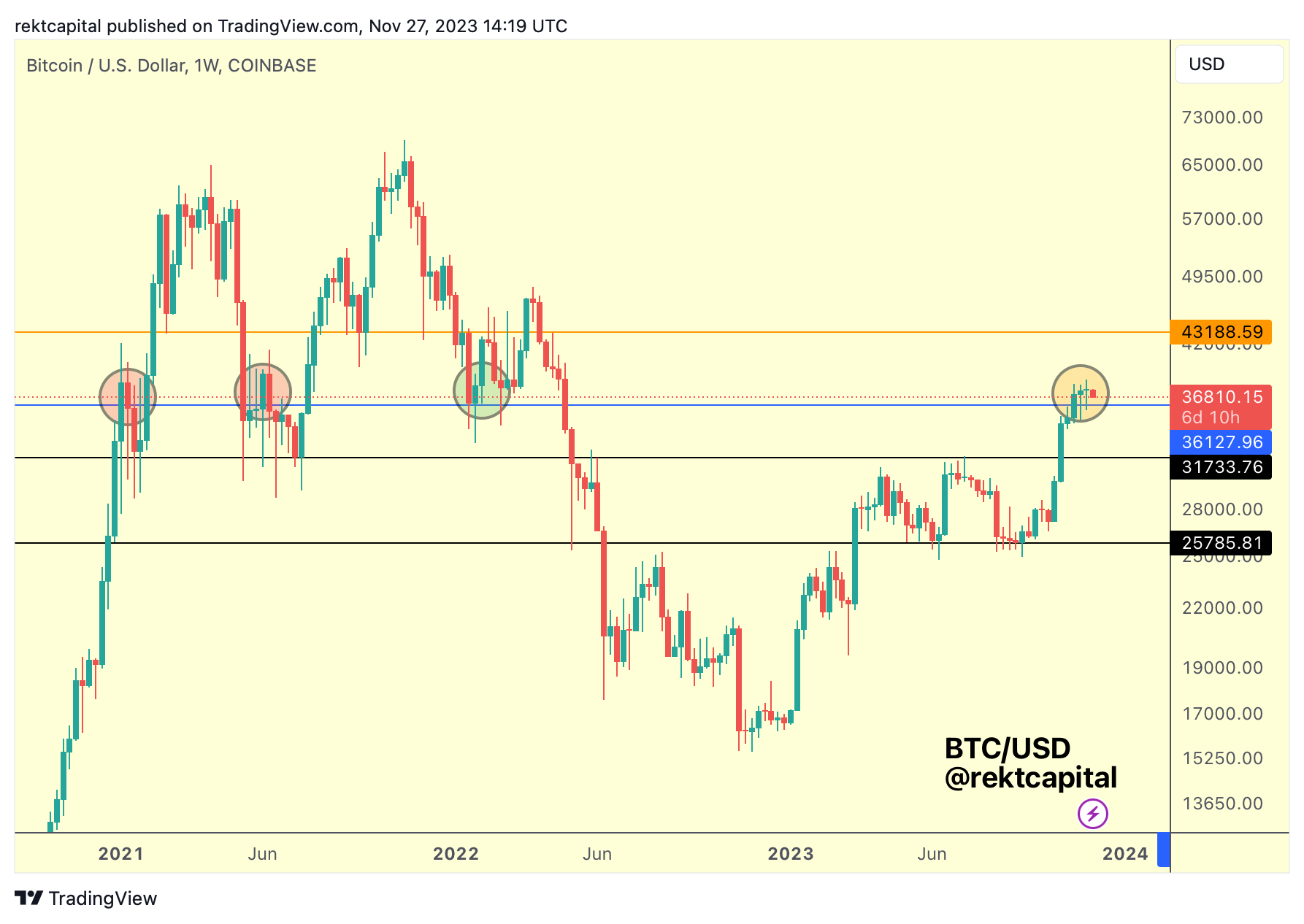

Over the past few weeks, we'd been talking about how Bitcoin was trying to reclaim a range.

In late November, we discussed how Bitcoin was in the process of retesting the Range Low of ~$36130 as new support in an effort to revisit the Range High of ~$44000:

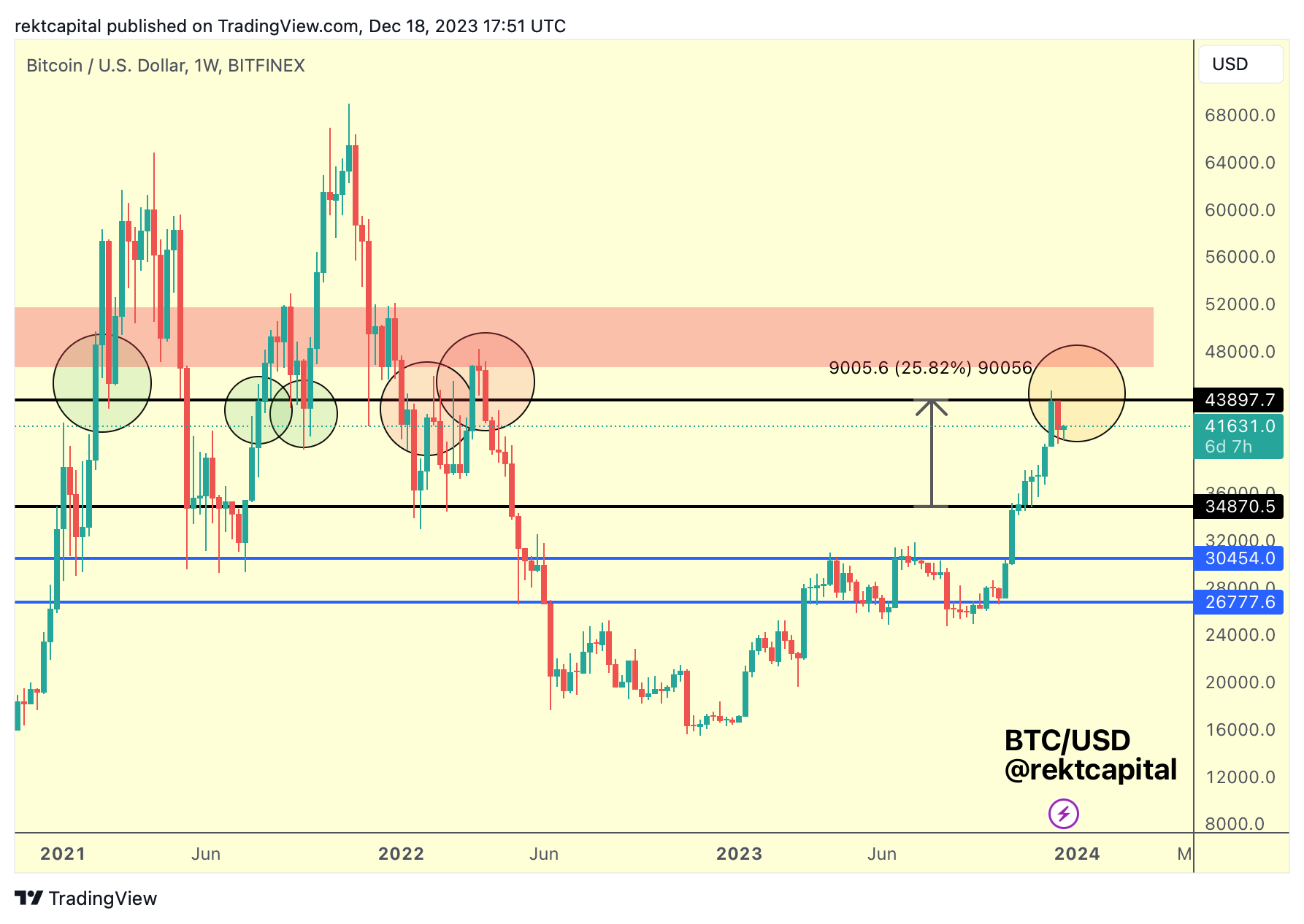

And Bitcoin finally revisited the Range High successfully for a +25% move in total:

Bitcoin has clearly rejected from the Range High resistance.

As a result, technically - Bitcoin still resides within the ~$35000-$44000 Macro Range.

And now the question is - will Bitcoin want to relief rally from here to form a Lower High of some sort before experiencing trend continuation to the downside to revisit the lower parts of this range?

As long as the Range High continues to act as resistance (and especially so if BTC decides to rally but fails to equals the highs so as to form a Lower High) then a drop into lower parts of the range may need to be considered.

But it's not just the Range High of ~$43900 that is the definitive resistance.

It's the ~$46000 area.

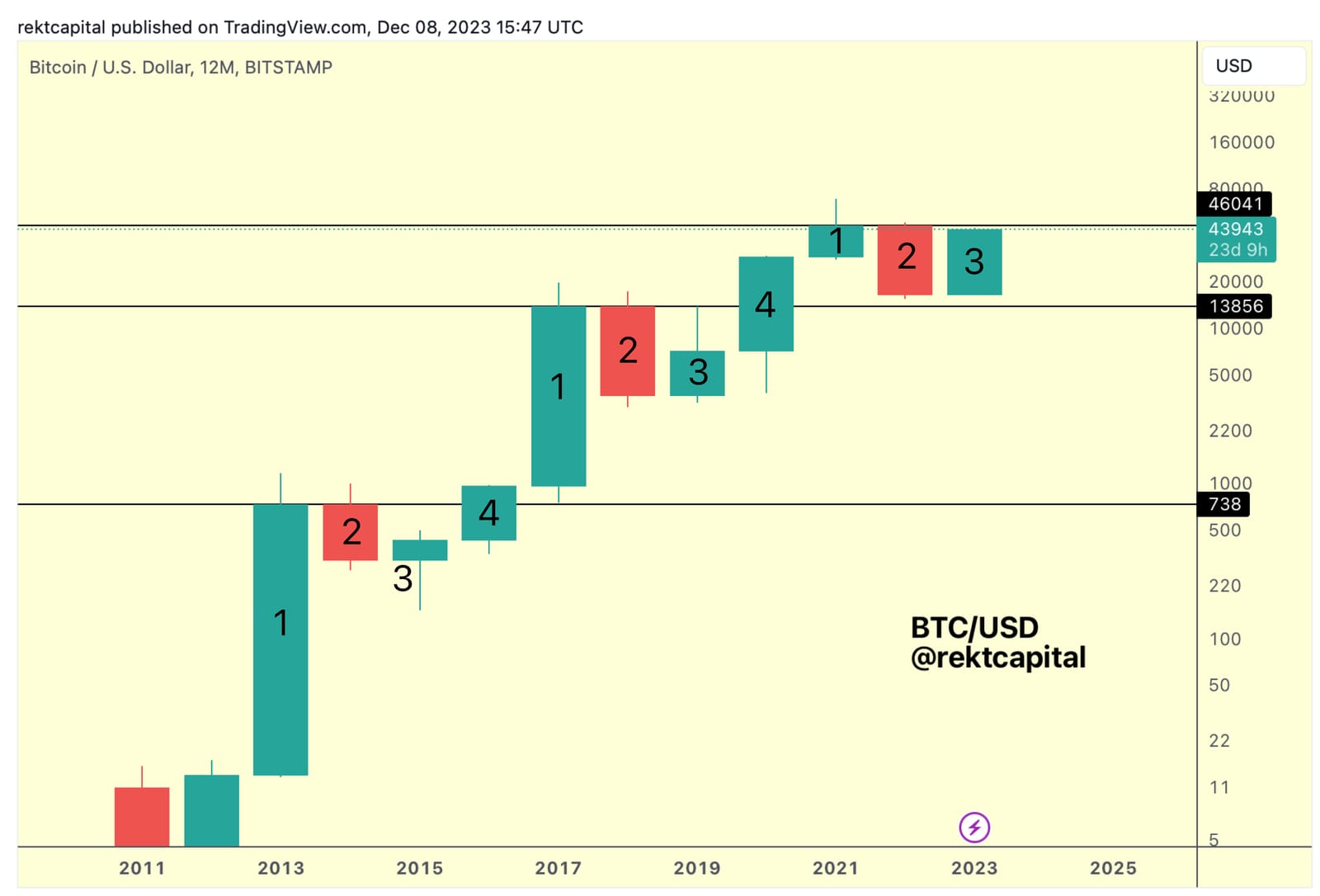

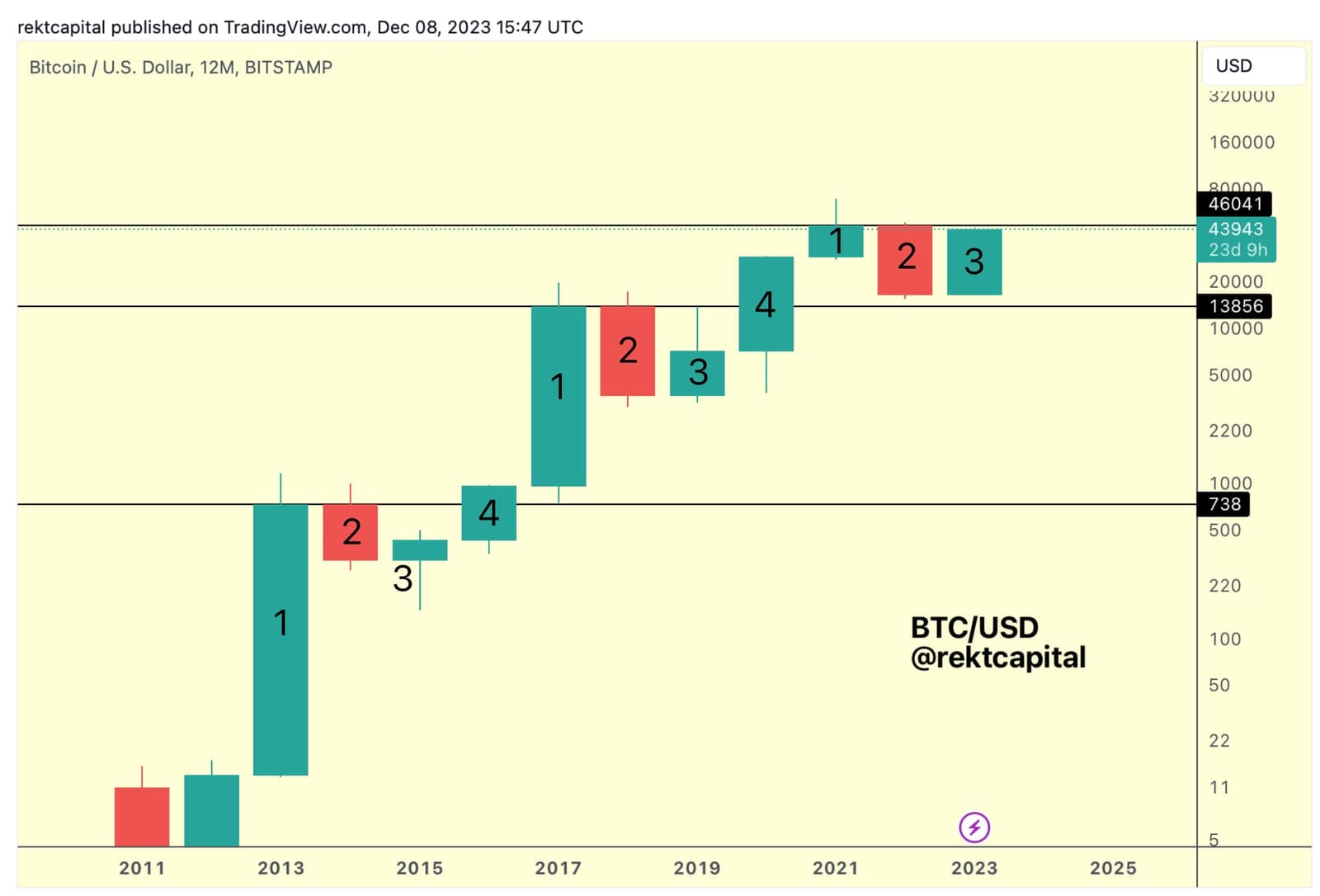

That's the Four Year Cycle resistance:

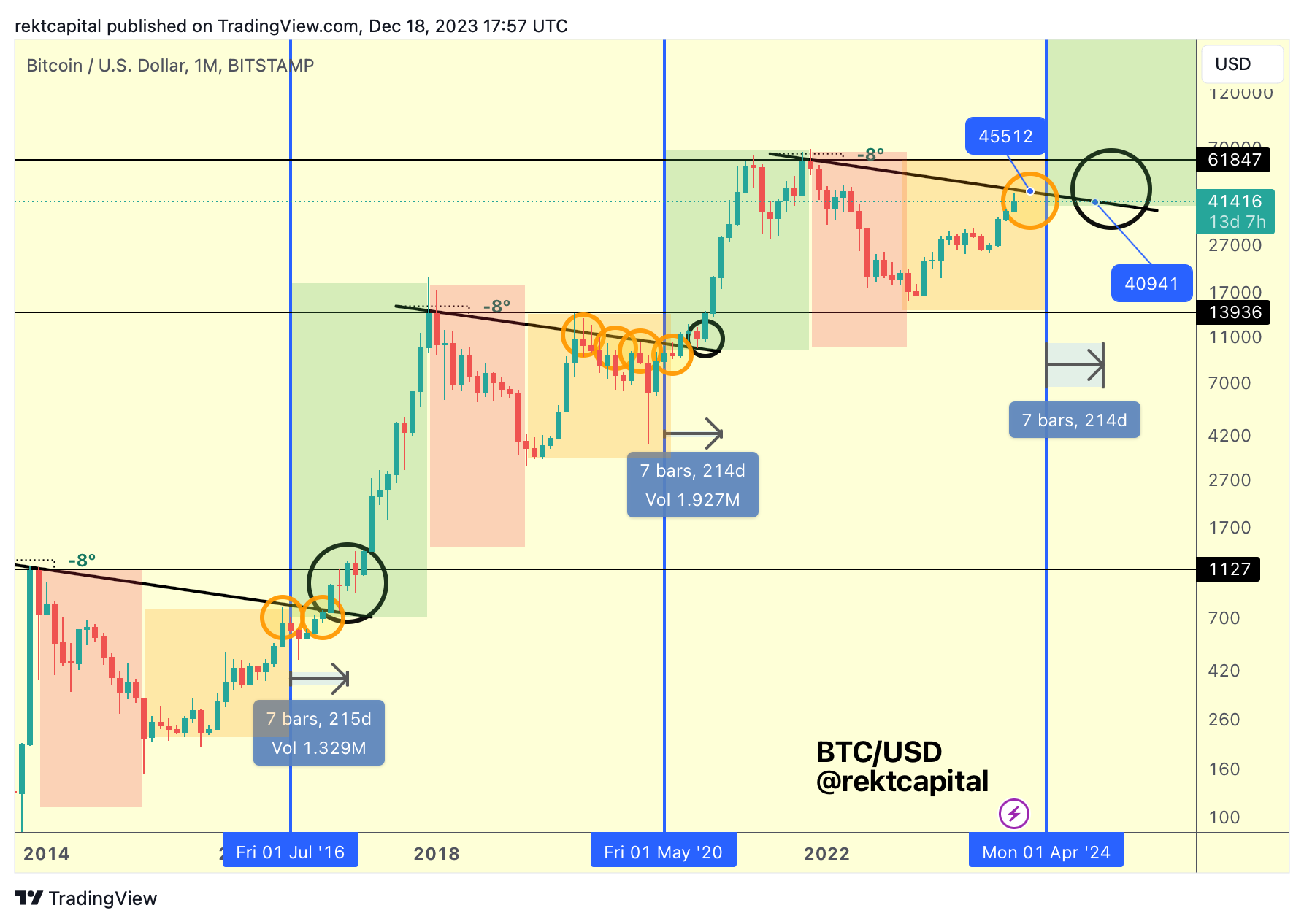

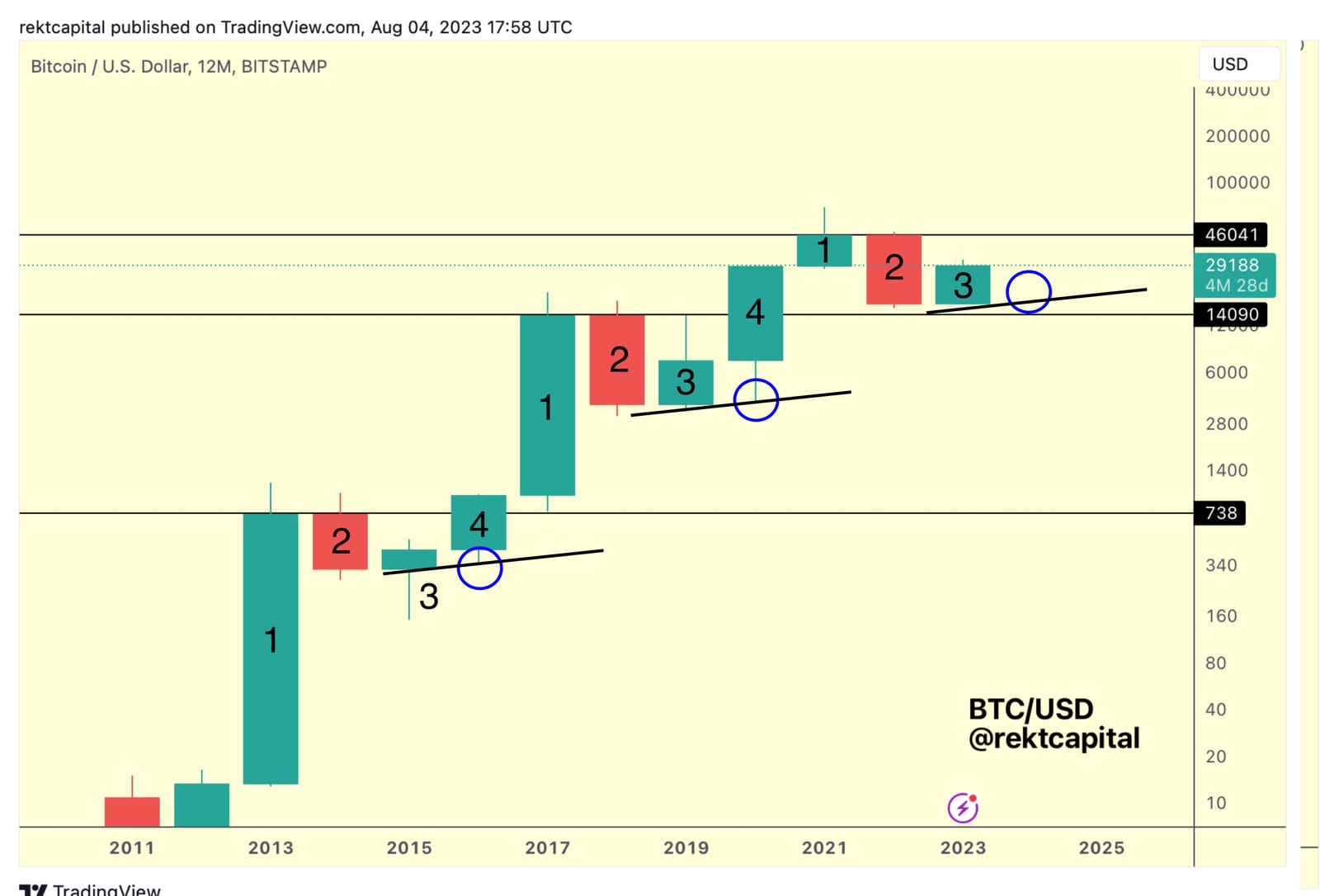

And curiously, it's also the price resistance area where the Macro Diagonal resides as well:

This Macro Diagonal showcases a few key points:

- Bitcoin may not break beyond the Macro Diagonal in the Pre-Halving period (orange)

- However, Bitcoin may upside wick beyond the Macro Diagonal in the Pre-Halving period.

- Nonetheless, as long as Bitcoin is not able to break the Macro Diagonal, some sort of retrace going into the Halving could occur.

So it's very likely that the Yearly Top is in.

And that makes sense - historically, Bitcoin has always failed to break its Four Year Cycle resistance (black) in a Pre-Halving Candle 3 year:

This Four Year Cycle resistance persists as a resistance for three years in a row.

However, this resistance then tends to break in the new Candle 4 which represents the Halving year. In this cycle, that means 2024.

That said, it's likely this Candle 4 breakout beyond the black Four Year Cycle resistance of $46000 will occur in the Post-Halving period, according to the Macro Diagonal chart mentioned above.

And if history does indeed repeat, we'd need to consider downside targets in the New Year of 2024 which will in all likelihood manifest themselves as a downside wick in the new Candle 4, as has historically been the case:

I don't anticipate a long downside wick like in 2020 (COVID) but something sensible like in 2016 I think is reasonable to at least consider (in which case the Macro Higher Low in this cycle would be steeper as a result).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dave Portnoy Reveals What He Would Do If XRP Crashes to $1.75

OpenSea Adds Beeple’s Regular Animals Memory 186 to Flagship Collection, Expanding Its Digital Art Reserve

CryptoQuant says bear market has started, sees bitcoin downside risk to $70,000

Bitcoin Poised to Rise to $1.4 Million by 2035, Analysts Say—Or Much Higher