Economists: Decline in UK service sector inflation may help central bank cut interest rates in the summer

According to a report by Jin10, James Smith, an economist at ING International, said that the decline in service sector inflation is particularly helpful for the Bank of England as it hopes to bring the rate of price increases down to sustainable levels. The overall CPI growth rate in the UK decreased from 4.6% in October to 3.9% in November, and the service sector inflation rate dropped from 6.6% a month ago to 6.3%, which will be especially pleasing for the Bank of England. Sticky inflation in the service sector has been seen as a factor supporting core inflation due to high wage growth and increased demand for services such as holidays and hotels. Smith said that service prices may continue to rise at the same pace for some time but should ease from spring and could reach 4% by summer, which "increases the possibility of a summer interest rate cut by the central bank."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan launches its first tokenized money market fund

JPMorgan to launch its first tokenized money market fund on Ethereum, with a seed fund size of 100 millions

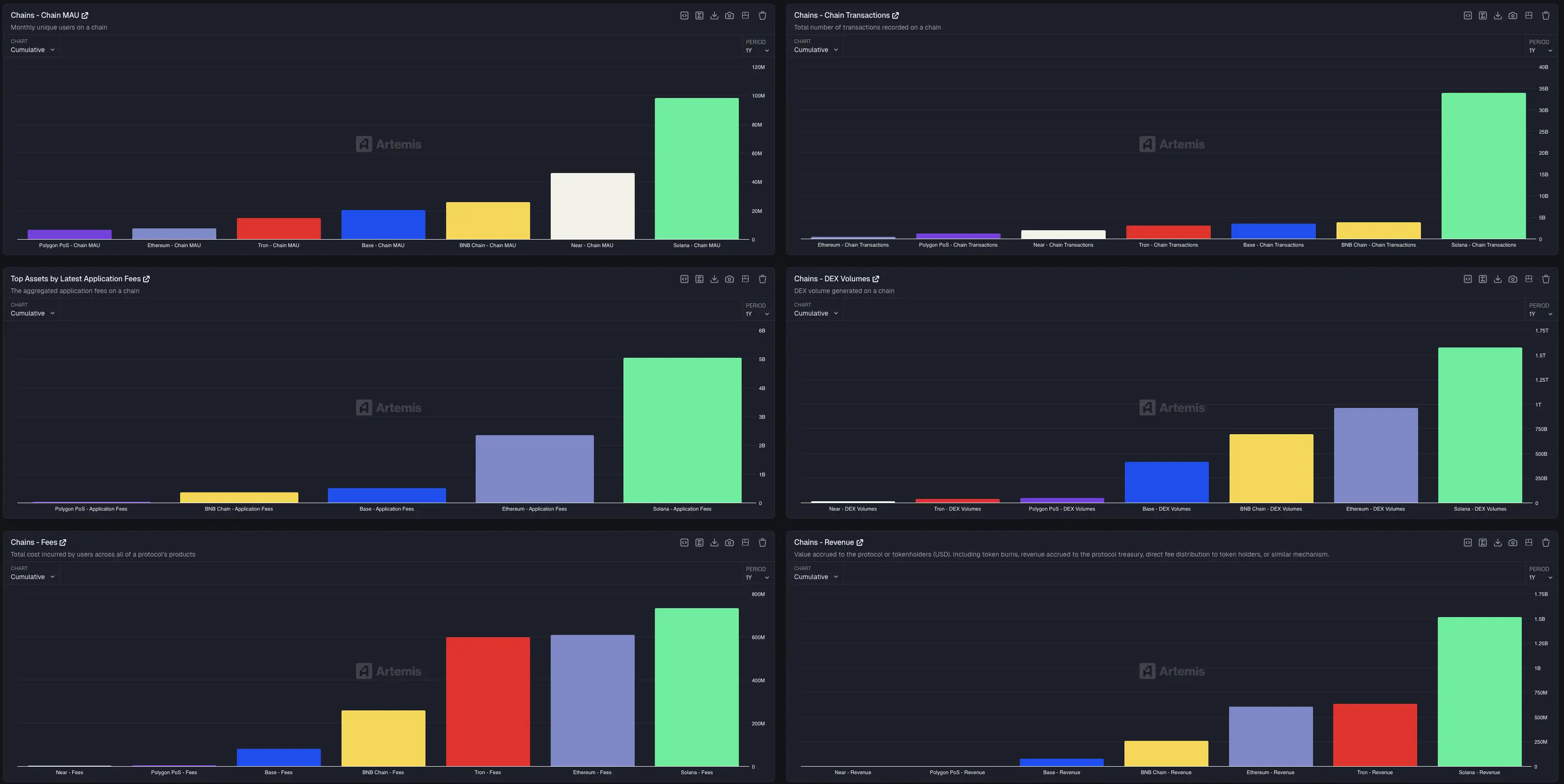

Artemis CEO: Solana leads the market in key on-chain metrics, with transaction volume 18 times that of BNB