Solana Takes the Lead in Daily Stablecoin Transfer Volume

Since the start of December, Solana’s daily stablecoin transfer volume has grown 600% to $16.6 billion and now outpaces major blockchain networks, according to Artemis, an institutional crypto data platform.

Solana's daily stablecoin transfer volume has risen 600% to $16.6 billion in the month of Dec. 2023.(Artemis)

Sage D. YoungPosted December 19, 2023 at 5:15 pm EST.

Solana has taken the lead in daily stablecoin transfer volume for the first time in the layer 1 blockchain’s history.

On Monday, daily stablecoin transfer volume on Solana had reached $16.6 billion, outpacing other major blockchain networks, including Ethereum, Tron, BNB Chain and Arbitrum, according to Artemis, an institutional crypto data platform. Solana’s stablecoin transfer volume has soared about 600% since the start of the month when it stood at nearly $2.4 billion.

Solana’s daily stablecoin transfer volume from June to Dec. 2023 grew dramatically compared to the volume of eight other major blockchains. (Artemis).

Solana’s daily stablecoin transfer volume in 2022 ranged from as little as $33 million to as high as $743 million, never exceeding $1 billion. During the bull market of 2021, Solana’s daily stablecoin transfer volume reached $7.1 billion, its previous highest level before this month.

Solana’s daily stablecoin transfer volume from Dec. 2020 to Dec. 2023 (Artemis).

The growth in Solana’s stablecoin transfer volume underscores heightened activity and liquidity in the layer 1 blockchain’s ecosystem over the past year. Circle, the issuer of the second-largest stablecoin USD Coin (USDC), announced yesterday that decentralized finance applications and digital wallets on Solana can now use Euro Coin (EURC) , a stablecoin pegged one-to-one with the euro.

Stablecoins are digital assets used on blockchains and pegged to fiat currencies like the U.S. dollar to bring stability to the crypto ecosystem, widely known for its price volatility.

“Growth was kickstarted by the JTO airdrop [on Dec. 7],” wrote Nirmal Krishnan, head of engineering at Artemis, in an email to Unchained. “SOL has flipped Ethereum on both [DEX NFT trading volume] in the last few days.”

He added: “Additionally, the growth of memecoins like BONK and WIF, which have historically never played out on Solana, has created room for more retail activity. Ultimately, I do think the combination of these factors has resulted in significantly more on-chain activity, with Solana reaching its highest daily active address numbers since summer of ’22.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tesla engaged in deceptive marketing for Autopilot and Full Self-Driving, judge rules

IBIT-Linked Structured Notes: Wall Street’s $530M Bet on Bitcoin Integration

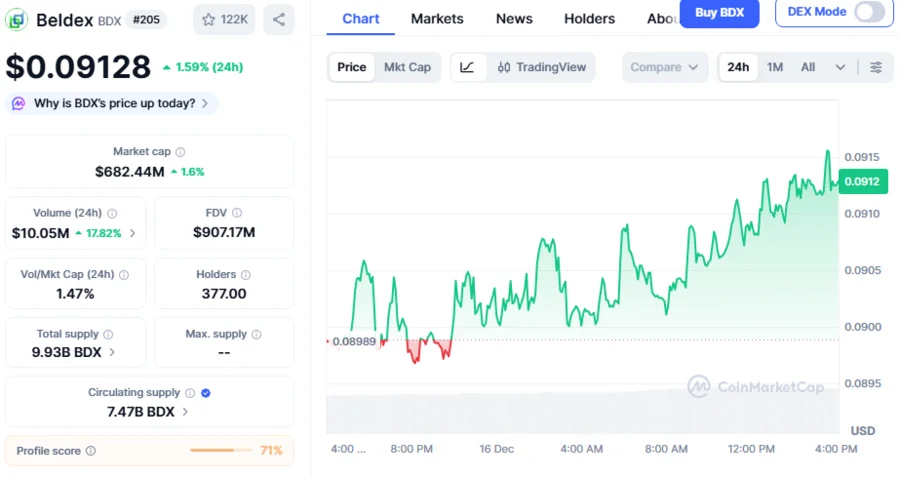

Beldex Price: BDX Token Gains Momentum with Stargate Integration via LayerZero’s OFT Standard

Altcoin Season Index Plummets: A Stark 4-Point Drop to 18 Signals Bitcoin’s Grip