BitVol index dropped to 50.67, with a daily decline of 1.52%

On January 21st, the BitVol (Bitcoin Volatility) index launched by T3 Index and LedgerX, a Bitcoin options trading platform, dropped to 50.67 with a daily decline of 1.52%. The BitVol index measures the 30-day expected implied volatility derived from tradable Bitcoin options prices. Implied volatility represents market participants' views and expectations for the future market and is considered to be the closest approximation of the actual volatility at that time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

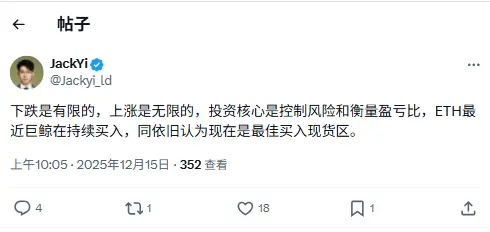

Yilihua: ETH whales are continuing to buy, and I still believe now is the best time to buy spot.

Eric Trump: Bitcoin Has No "Management," No Issues of Corruption, Fraud, or Abuse

Data: Hyperliquid platform whales currently hold $5.517 billions in positions, with a long-short ratio of 0.93.